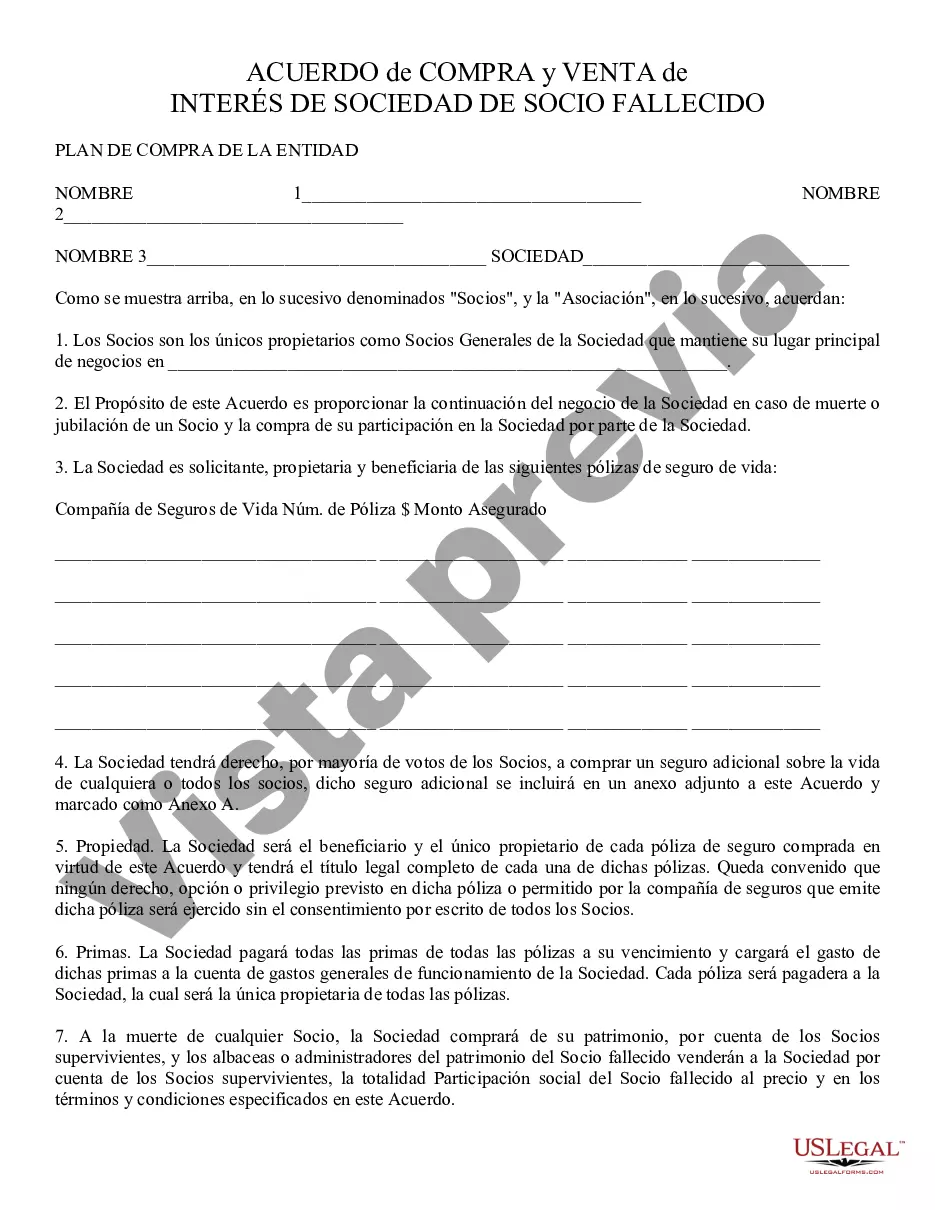

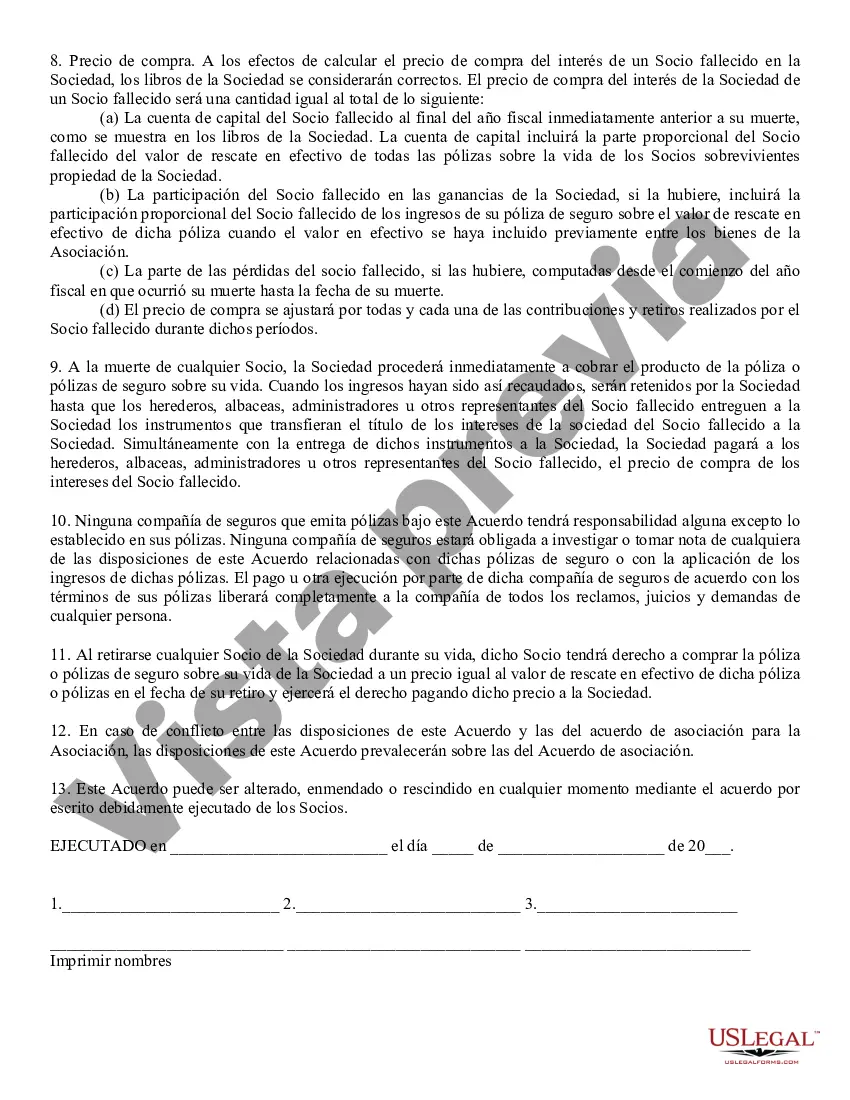

San Jose, California is a vibrant city located in the heart of Silicon Valley. It is known for its sprawling tech industry, diverse culture, and beautiful surroundings. When it comes to the sale of a deceased partner's interest in San Jose, various options and processes need to be considered. One type of sale in San Jose is the sale of a deceased partner's interest in a business or partnership. This involves transferring ownership rights and financial stake from the deceased partner to another individual or entity. It can be a complex process, and legal and financial expertise is often required to navigate through the intricacies involved. In cases where the deceased partner had a will or trust in place, the sale of their interest can be conducted according to their predetermined wishes. The executor or personal representative of the deceased partner's estate will oversee the sale and ensure that it is carried out in compliance with applicable laws and regulations. Another type of sale is the sale of a deceased partner's interest in real estate properties. San Jose's real estate market is highly competitive and dynamic, making it crucial to follow the proper legal procedures when selling a deceased partner's interest in a property. This may involve filing necessary documents with the county recorder's office, obtaining a probate court's approval, and ensuring fair distribution of proceeds among the deceased partner's beneficiaries. Additionally, depending on the circumstances, the sale of a deceased partner's interest may also involve the dissolution of a business or partnership. This occurs when the surviving partners or beneficiaries decide to wind up the affairs of the partnership and distribute its assets. The sale of the deceased partner's interest in such cases often involves liquidating business assets, settling outstanding obligations, and allocating profits or losses as per the partnership agreement or applicable laws. To successfully navigate the sale of a deceased partner's interest in San Jose, it is crucial to consult with professionals specializing in estate planning, probate law, and business transfers. They can provide invaluable guidance and assistance throughout the process, ensuring that all legal and financial requirements are met while safeguarding the rights and interests of all parties involved. In summary, when dealing with the sale of a deceased partner's interest in San Jose, there are several considerations to keep in mind. Whether it involves business assets, real estate properties, or the dissolution of a partnership, seeking professional advice is essential to handle the complex legal and financial aspects of the process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Venta de Interés de Socio Fallecido - Sale of Deceased Partner's Interest

Description

How to fill out San Jose California Venta De Interés De Socio Fallecido?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the San Jose Sale of Deceased Partner's Interest, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the San Jose Sale of Deceased Partner's Interest from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the San Jose Sale of Deceased Partner's Interest:

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!