Hillsborough Florida Withdrawal of Partner refers to the legal process of a partner exiting a business or dissolving a partnership within Hillsborough County, Florida. This procedure entails the formal termination of a partnership agreement between two or more individuals or entities operating a business together. This description will provide insights into the process and its key elements, including its forms and implications. In Hillsborough County, Florida, the Withdrawal of Partner can take different forms, depending on the circumstances and the type of partnership involved. Some common types of Withdrawal of Partner include: 1. General Partnership Withdrawal: In a general partnership, when a partner decides to withdraw from the business, they will need to adhere to the rules and provisions outlined in the partnership agreement. They must provide written notice to the other partners, specifying their intention to withdraw and the desired effective date of withdrawal. 2. Limited Partnership Withdrawal: In a limited partnership, the withdrawal process may be slightly more complex. Limited partners typically have restricted liability and may have limitations on their ability to withdraw. These limitations are typically defined in the partnership agreement. Limited partners may require unanimous consent from general partners or compliance with specific withdrawal procedures outlined in the agreement. 3. Limited Liability Partnership (LLP) Withdrawal: An LLP operates similarly to a general partnership but provides partners with limited personal liability. When a partner wishes to withdraw from an LLP, they must follow the procedures stipulated in the LLP agreement. This usually includes providing written notice to other partners and adhering to any specific timeframes or conditions outlined in the agreement. 4. Limited Liability Company (LLC) Member Withdrawal: In an LLC, members have flexibility in their withdrawal process as it can be defined by the operating agreement. Typically, a written notice to other members and adherence to the stated procedures in the operating agreement are required. LCS may also require buyout provisions or other terms for the withdrawal, which should be specified in the operating agreement. When a partner initiates the Withdrawal of Partner, it has several implications for the business and remaining partners. The departing partner may receive a payout for their share of the business's assets, profits, and liabilities, as outlined in the partnership agreement. It is advisable for the withdrawing partner to consult with an attorney to ensure a smooth separation and to clarify any doubts or disputes among the partners. In conclusion, Hillsborough Florida Withdrawal of Partner encompasses various forms depending on the type of partnership involved, such as general partnerships, limited partnerships, Laps, and LCS. The process typically requires written notice, adherence to established procedures, and consideration of financial implications. Seeking legal counsel is essential to safeguard the interests of all parties involved.

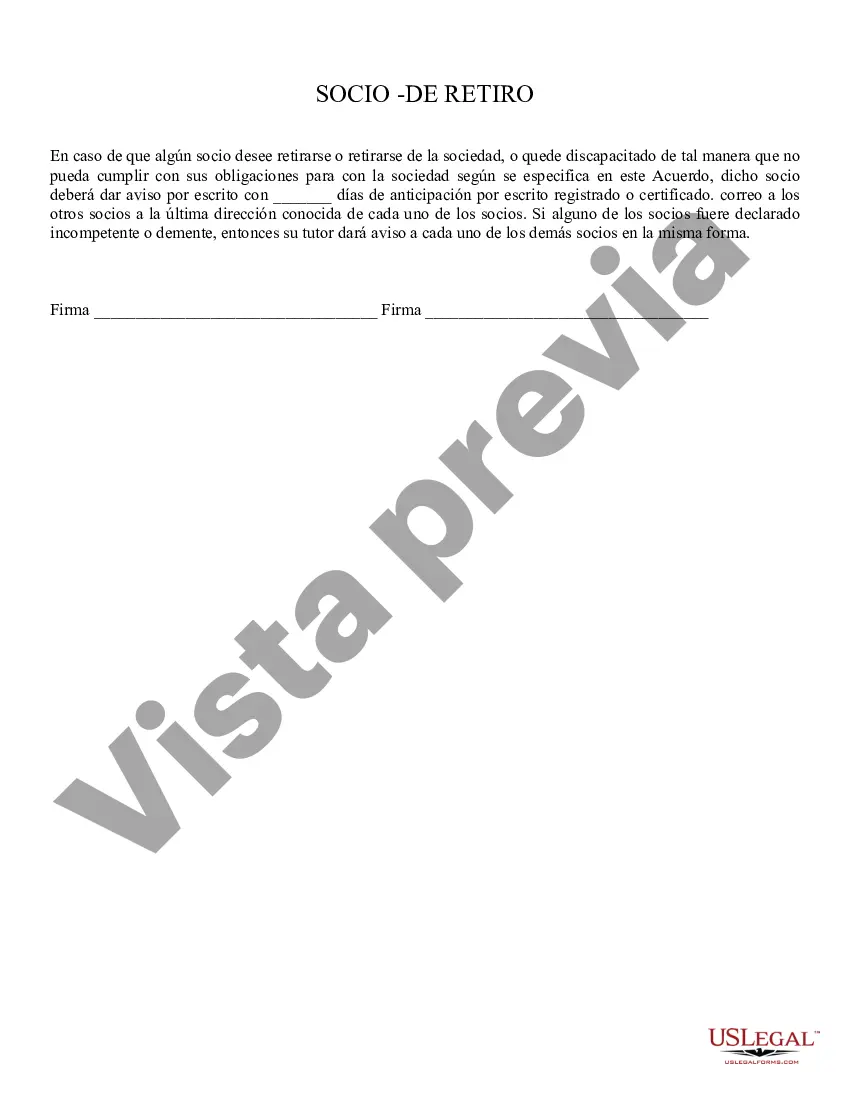

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Retiro de socio - Withdrawal of Partner

Description

How to fill out Hillsborough Florida Retiro De Socio?

Preparing papers for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Hillsborough Withdrawal of Partner without expert help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Hillsborough Withdrawal of Partner on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Hillsborough Withdrawal of Partner:

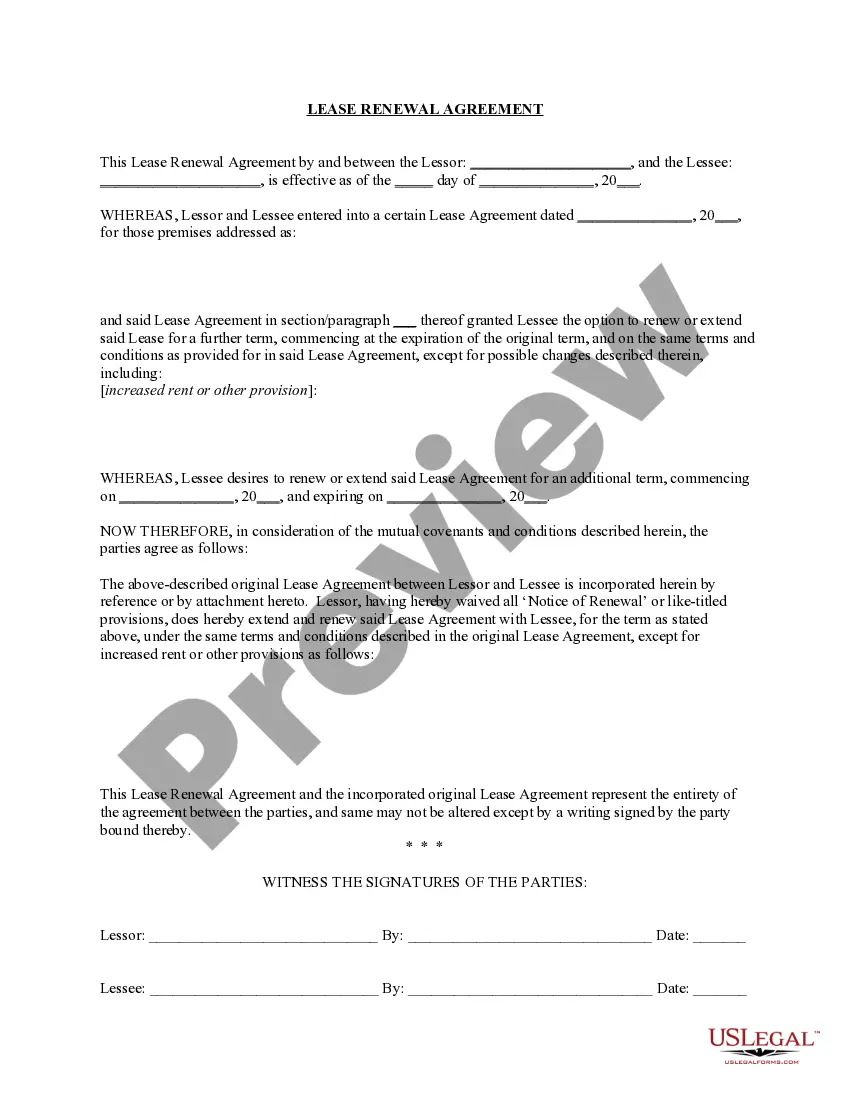

- Look through the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any scenario with just a couple of clicks!