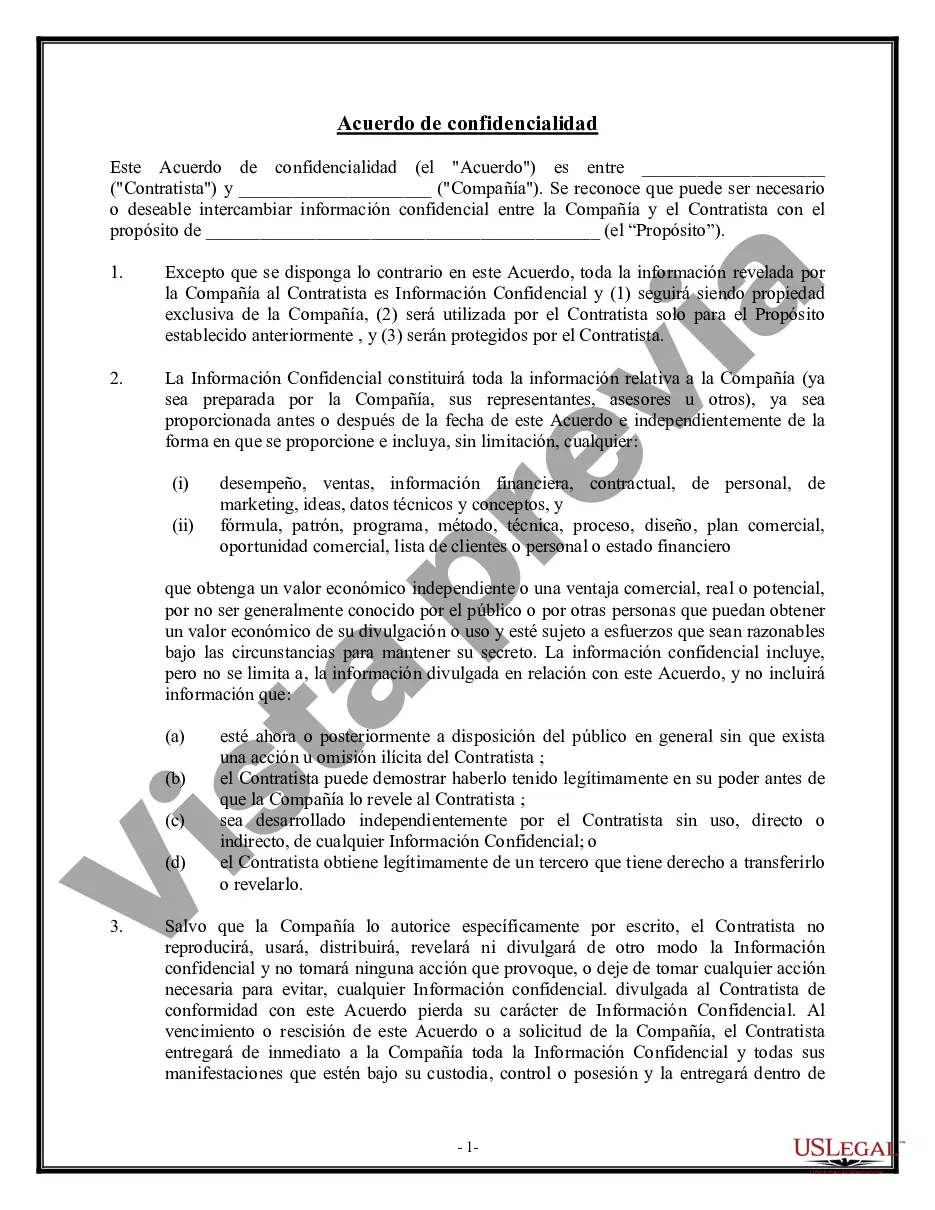

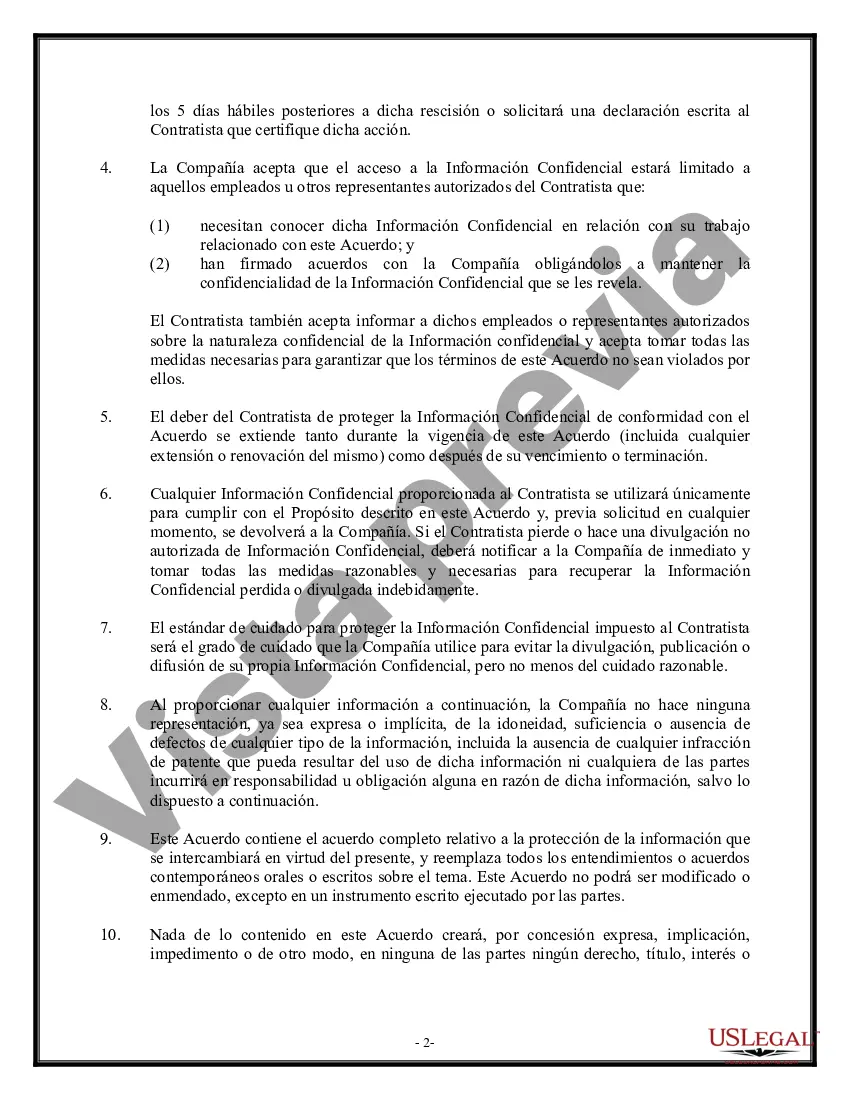

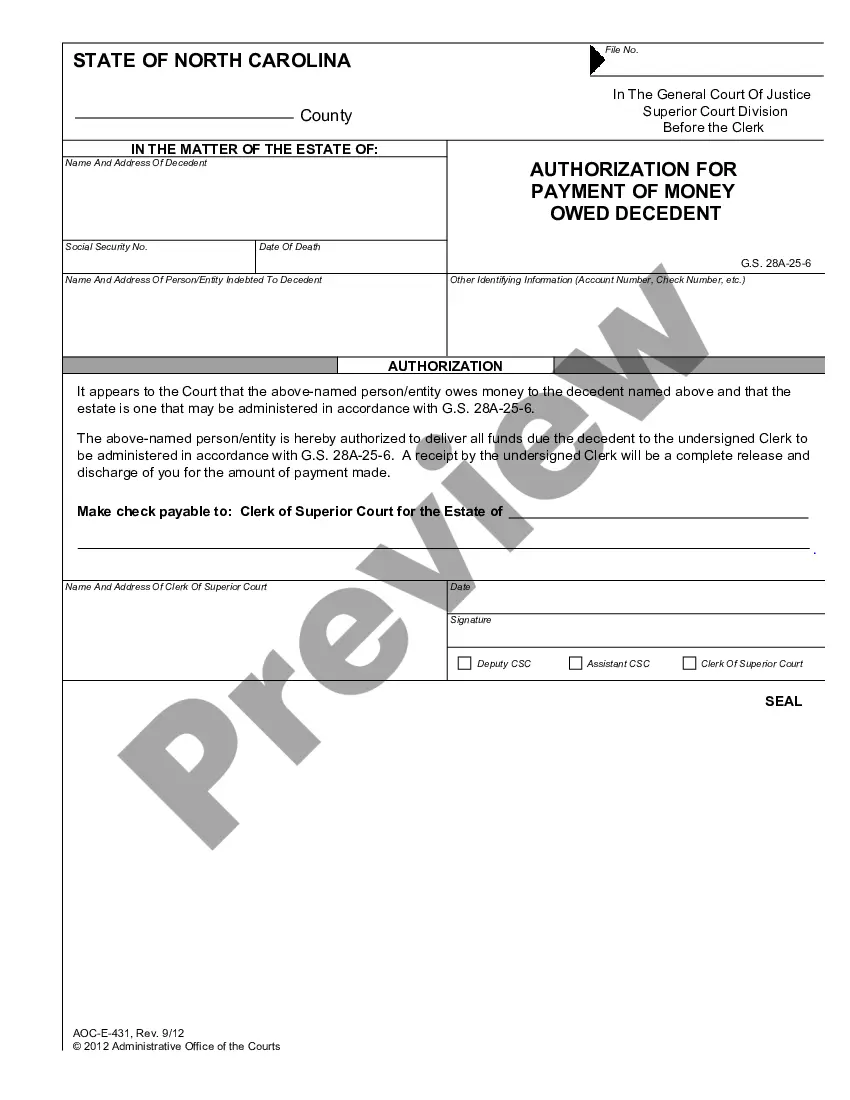

Maricopa Arizona Non-Disclosure Agreement for Potential Investors: A Comprehensive Guide In the realm of business, protecting sensitive information is of utmost importance. This is particularly true when it comes to potential investors who may be privy to critical data and confidential materials during the due diligence process. To safeguard intellectual property, trade secrets, and proprietary information, companies often require potential investors to sign a Non-Disclosure Agreement (NDA). In Maricopa, Arizona, these agreements play a vital role in maintaining the confidentiality and integrity of investment opportunities. A Maricopa Arizona Non-Disclosure Agreement for Potential Investors is a legal document that establishes a confidential relationship between the disclosing party (the company seeking investment) and the receiving party (the potential investor). Essentially, it outlines the terms and conditions under which any confidential information shared during negotiations, discussions, or presentations will be protected from disclosure or unauthorized use. Key Elements of a Maricopa Arizona Non-Disclosure Agreement for Potential Investors: 1. Definition of Confidential Information: The agreement clearly defines what information is considered confidential and subject to protection. This may include business strategies, financials, customer data, technological innovations, marketing plans, or any proprietary information unique to the company. 2. Obligations of the Receiving Party: The NDA details the obligations and responsibilities of the potential investor to maintain the confidentiality of the disclosed information. These provisions typically forbid the receiving party from disclosing, reproducing, or using the confidential information for any purpose other than evaluating and discussing the investment opportunity. 3. Exceptions: The agreement defines exceptions where the receiving party is not obligated to keep the information confidential. Common exceptions include information already in the public domain, received from a third party without restrictions, or information that must be disclosed due to legal obligations or court orders. 4. Duration of Confidentiality: The NDA specifies the duration of the confidentiality obligation, outlining the period during which the receiving party must maintain confidentiality. This period is typically defined as a certain number of years following the termination of negotiations or any formal agreement. 5. Remedies and Legal Recourse: The NDA establishes the remedies available to the disclosing party in the event of a breach. These remedies may include injunctive relief, monetary damages, or any other legally available recourse. Types of Maricopa Arizona Non-Disclosure Agreements for Potential Investors: 1. Unilateral NDA: This is the most common type of NDA and is used when only one party is disclosing confidential information to the potential investor. The investor agrees to keep the disclosed information confidential. 2. Mutual NDA: In some cases, both the disclosing party and the potential investor may have confidential information they wish to protect. A mutual NDA, also known as a two-way NDA, ensures that both parties agree to maintain each other's confidential information. It is important to understand that a Maricopa Arizona Non-Disclosure Agreement for Potential Investors is a legally binding document. Therefore, seeking professional legal advice is crucial when drafting or reviewing such agreements to ensure that all necessary provisions are included and enforceable under Arizona law. By implementing robust Non-Disclosure Agreements, companies in Maricopa, Arizona can securely share sensitive information with potential investors, fostering a climate of trust while safeguarding their competitive edge.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo de Confidencialidad para Inversores Potenciales - Non-Disclosure Agreement for Potential Investors

Description

How to fill out Maricopa Arizona Acuerdo De Confidencialidad Para Inversores Potenciales?

Draftwing documents, like Maricopa Non-Disclosure Agreement for Potential Investors, to take care of your legal matters is a challenging and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms crafted for various cases and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Maricopa Non-Disclosure Agreement for Potential Investors form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before downloading Maricopa Non-Disclosure Agreement for Potential Investors:

- Make sure that your template is specific to your state/county since the regulations for writing legal documents may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Maricopa Non-Disclosure Agreement for Potential Investors isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start utilizing our service and download the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your form is all set. You can go ahead and download it.

It’s an easy task to locate and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!