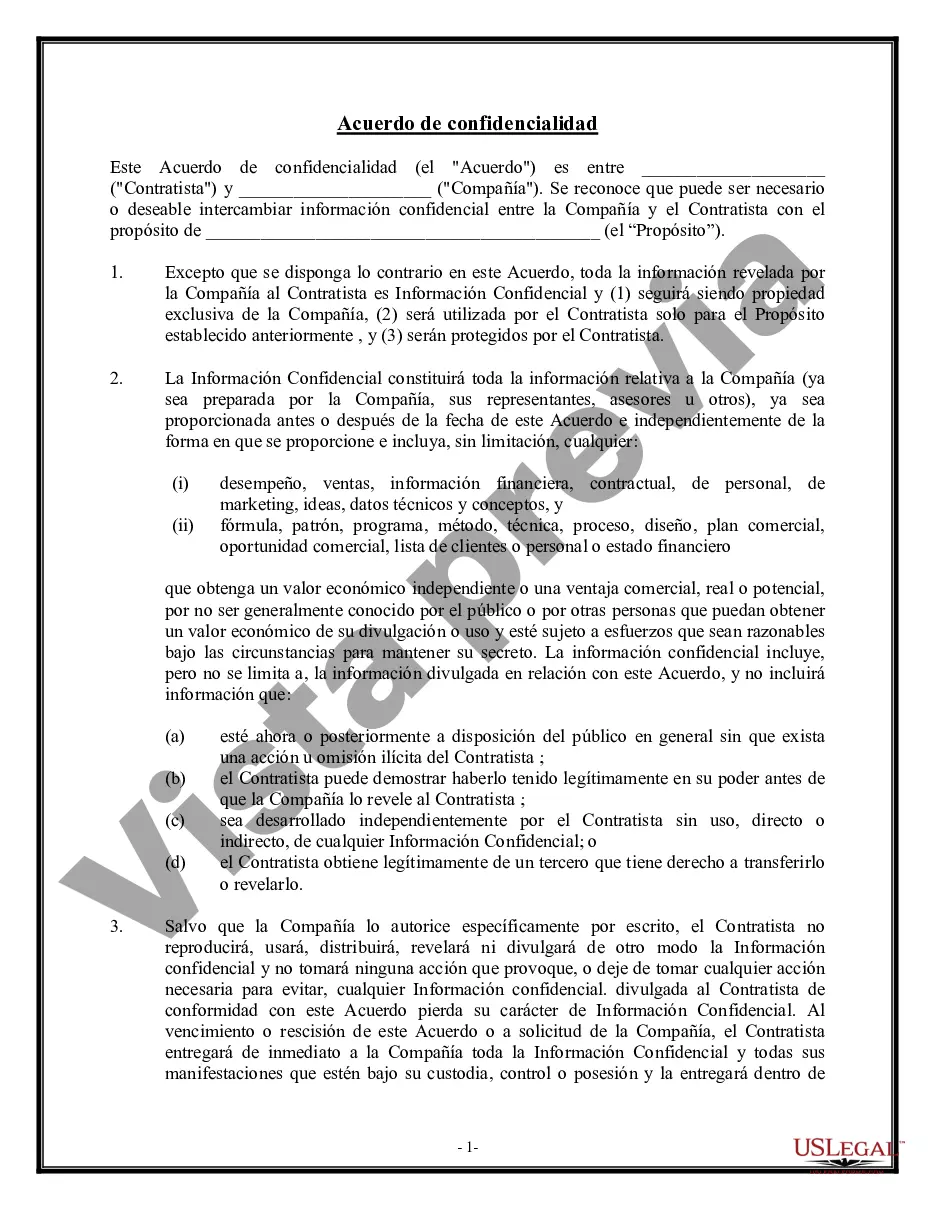

Maricopa, Arizona Non-Disclosure Agreement for Merger or Acquisition: A Detailed Overview A non-disclosure agreement (NDA) is an essential legal document that safeguards confidential information during potential merger or acquisition negotiations. In Maricopa, Arizona, businesses seeking to protect proprietary data and trade secrets during such transactions often employ various types of NDAs specifically catered to mergers and acquisitions. Let's explore the specifics and significance of the Maricopa Arizona Non-Disclosure Agreement for Merger or Acquisition. 1. Basic Non-Disclosure Agreement: The basic NDA serves as a starting point for businesses entering into merger or acquisition discussions in Maricopa, Arizona. This document establishes the framework for confidentiality between the parties involved, ensuring that sensitive information shared during the negotiation process remains protected. 2. Mutual Non-Disclosure Agreement: In certain merger or acquisition scenarios, both parties involved may have a reciprocal need to safeguard confidential information. The mutual NDA establishes a two-way confidentiality agreement, where each party commits to respecting and protecting the confidential information shared by the other party. 3. One-Way Non-Disclosure Agreement: While the mutual NDA emphasizes reciprocal confidentiality obligations, the one-way NDA primarily focuses on protecting the disclosing party's information. In some cases, the company seeking to sell or merge may require potential buyers or partners to sign a one-way NDA, obligating them to keep the shared information confidential and secure. 4. Non-Disclosure Agreement with Exclusivity: In an acquisition or merger, exclusivity refers to granting a specific buyer or partner an exclusive negotiating period, preventing the seller from entertaining offers from other parties. This type of NDA includes clauses that provide exclusivity to the party signing the agreement, ensuring they are the sole potential buyer or merger partner during the predetermined period. 5. Non-Disclosure Agreement with Non-Circumvention: Non-circumvention clauses aim to prevent one party from bypassing the other and directly approaching potential clients, customers, suppliers, or employees shared during the merger or acquisition negotiations. This type of NDA helps protect the disclosing party from being excluded after revealing valuable business contacts or resources. 6. Non-Disclosure Agreement with Non-Compete: A non-compete clause restricts one party from engaging in activities that directly compete with the other party. In the context of merger or acquisition negotiations, this type of NDA helps ensure that the receiving party will not exploit the disclosed information to gain a competitive advantage against the disclosing party. Maricopa, Arizona Non-Disclosure Agreement for Merger or Acquisition serves as an indispensable tool for businesses navigating complex deals in order to protect vital trade secrets and proprietary information. It offers a legally binding framework that guarantees confidentiality and boosts confidence between negotiating parties. By utilizing different types of NDAs, tailored specifically to various merger or acquisition scenarios, businesses safeguard their interests and maintain control over sensitive information throughout the negotiation process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo de Confidencialidad para Fusión o Adquisición - Non-Disclosure Agreement for Merger or Acquisition

Description

How to fill out Maricopa Arizona Acuerdo De Confidencialidad Para Fusión O Adquisición?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business case. All files are grouped by state and area of use, so picking a copy like Maricopa Non-Disclosure Agreement for Merger or Acquisition is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Maricopa Non-Disclosure Agreement for Merger or Acquisition. Follow the instructions below:

- Make certain the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Non-Disclosure Agreement for Merger or Acquisition in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!