A non-disclosure agreement (NDA) is a legally binding document that aims to protect sensitive information during a merger or acquisition process in Nassau, New York. Specifically tailored for this purpose, the Nassau New York Non-Disclosure Agreement for Merger or Acquisition outlines the terms and conditions that govern the confidentiality and non-disclosure obligations of the involved parties. This agreement serves as an essential tool to safeguard proprietary information, trade secrets, financial data, customer lists, intellectual property, and other confidential materials relating to the merger or acquisition. By signing this NDA, the parties involved commit to keeping such information confidential and preventing unauthorized disclosure or use. The Nassau New York Non-Disclosure Agreement for Merger or Acquisition can encompass various types, depending on the specific circumstances or needs of the involved parties. Some common types of NDAs for mergers or acquisitions include: 1. One-Way NDA: This type of agreement primarily benefits one party, typically the disclosing party, who shares confidential information with the receiving party while ensuring its protection. 2. Mutual NDA: In a mutual NDA, both parties may share sensitive information, and the agreement extends equal protection to both parties' confidential materials. 3. Stand-Alone NDA: A stand-alone NDA is a separate document that specifically addresses confidentiality concerns surrounding a merger or acquisition. It may be used alongside other legal agreements or contracts related to the transaction. 4. Brenda: A Brenda is sometimes used as a preliminary agreement before engaging in detailed discussions surrounding a merger or acquisition. While it may not cover the specifics of the transaction, it establishes a basic framework for confidentiality. 5. Letter of Intent (LOI) NDA: In some cases, an NDA may be included within a letter of intent, which outlines the preliminary terms and conditions of the merger or acquisition. The NDA within the LOI provides an additional layer of confidentiality protection during the negotiation phase. It is crucial for the parties involved in a merger or acquisition transaction in Nassau, New York, to consult with legal professionals to determine the most appropriate type of non-disclosure agreement for their specific needs. Adhering to a well-drafted NDA ensures the protection of confidential information throughout the merger or acquisition process, maintaining trust and maintaining a competitive advantage.

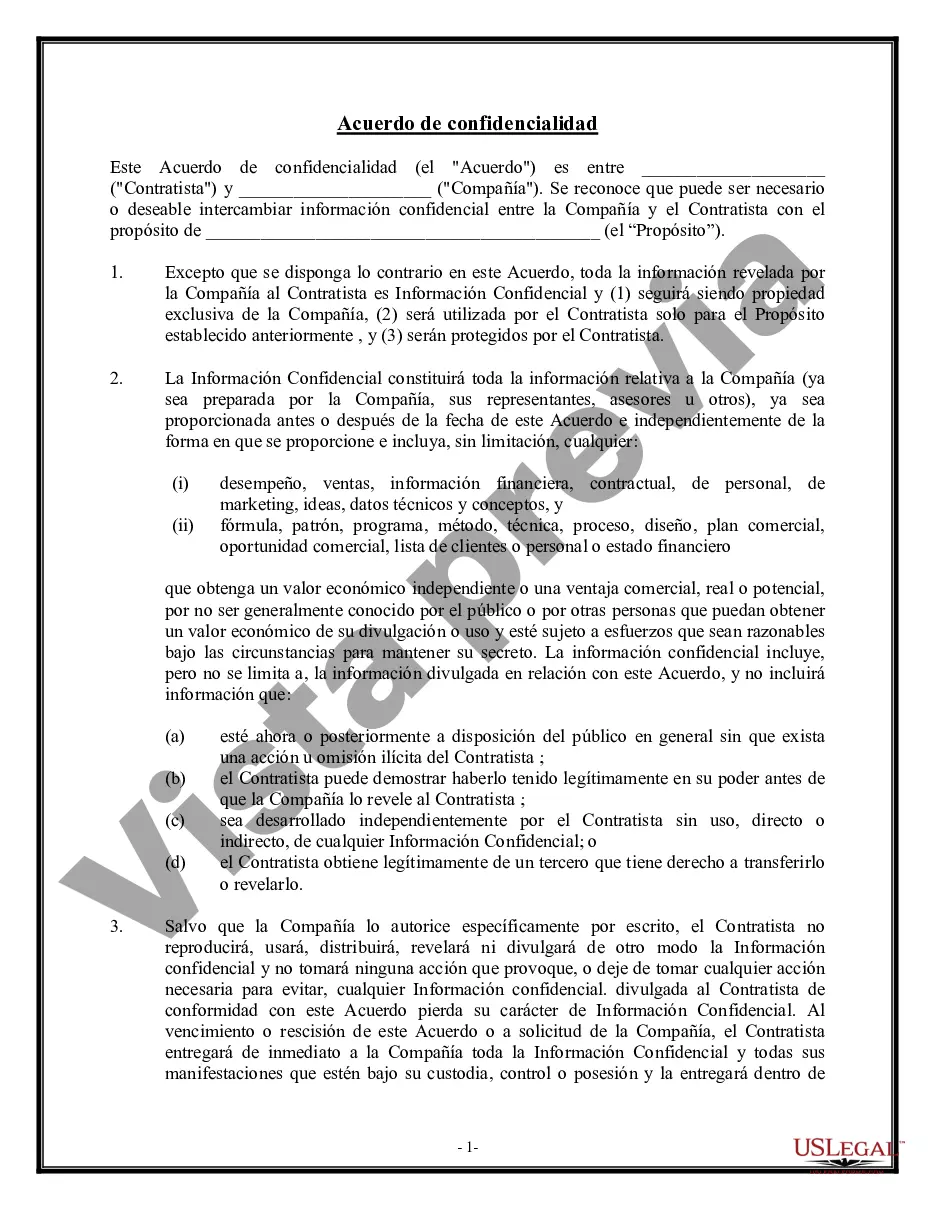

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Acuerdo de Confidencialidad para Fusión o Adquisición - Non-Disclosure Agreement for Merger or Acquisition

Description

How to fill out Nassau New York Acuerdo De Confidencialidad Para Fusión O Adquisición?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from the ground up, including Nassau Non-Disclosure Agreement for Merger or Acquisition, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any tasks related to paperwork execution straightforward.

Here's how you can find and download Nassau Non-Disclosure Agreement for Merger or Acquisition.

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the legality of some records.

- Check the similar forms or start the search over to find the right file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and purchase Nassau Non-Disclosure Agreement for Merger or Acquisition.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Nassau Non-Disclosure Agreement for Merger or Acquisition, log in to your account, and download it. Of course, our website can’t take the place of a legal professional completely. If you have to cope with an exceptionally challenging case, we advise using the services of an attorney to examine your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and get your state-compliant documents with ease!