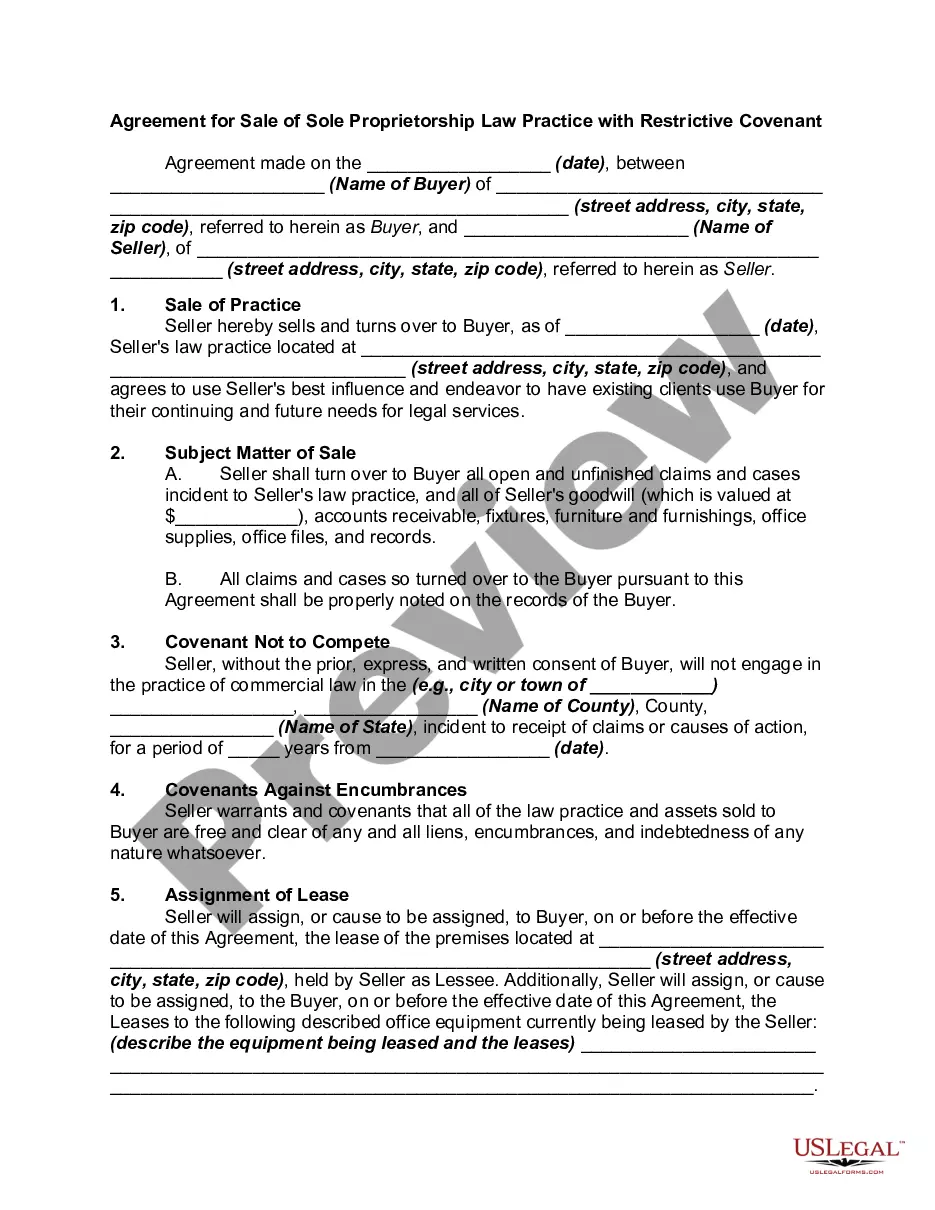

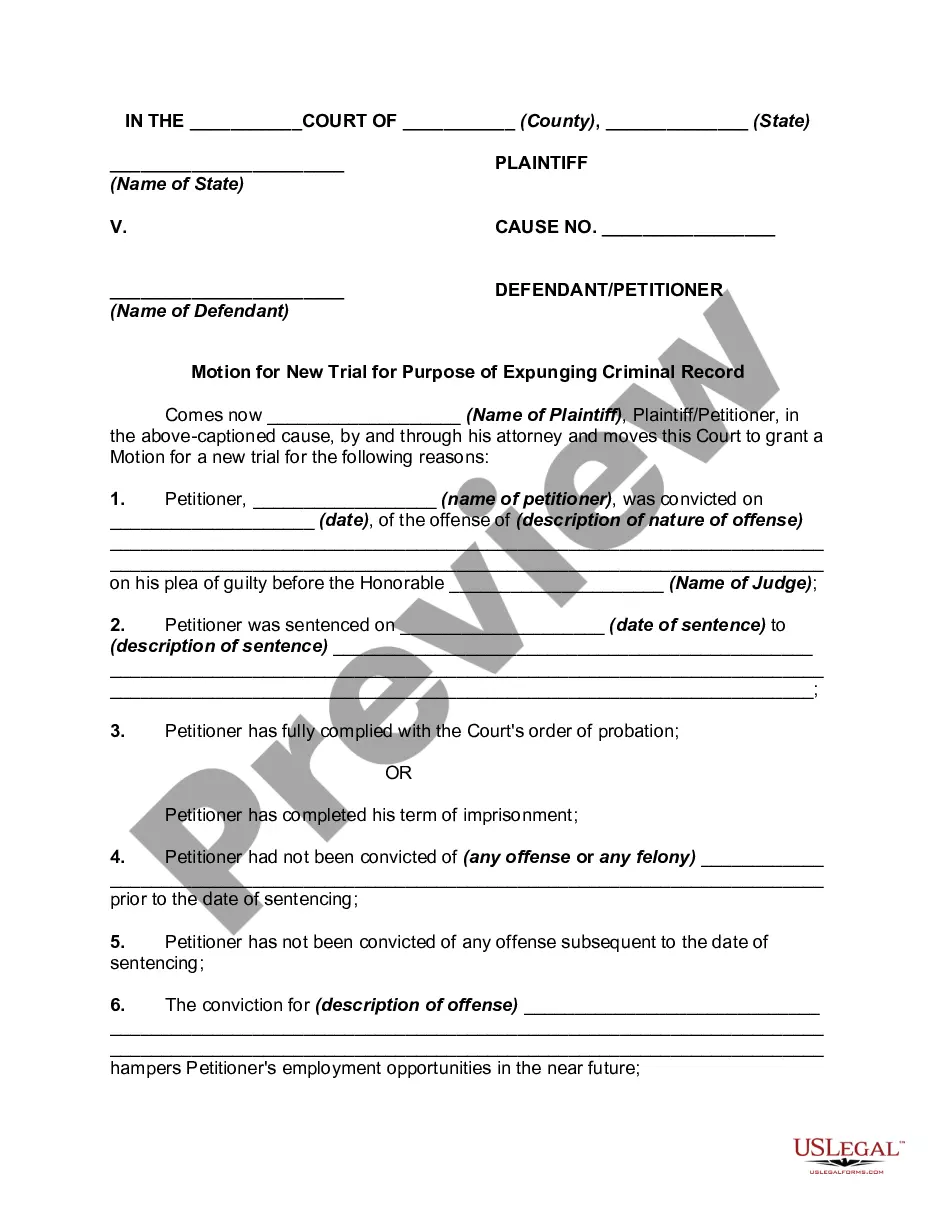

Broward Florida Sale of Partnership to Corporation can refer to the legal process of transferring ownership of a partnership business to a corporation in Broward County, Florida. This transaction involves several essential steps and may vary depending on the specific circumstances. Here is a detailed description and breakdown of the process: 1. Partnership Business Overview: In Broward County, Florida, a partnership is a type of business entity formed by two or more individuals or entities sharing profits, losses, and decision-making. Partnerships can be general partnerships (where all partners have equal liability) or limited partnerships (where there are both general and limited partners). 2. Advantages of Converting to a Corporation: There could be several reasons why a partnership in Broward Florida might choose to sell its assets or transfer ownership to a corporation, such as: — Limited liability: Shareholders in a corporation are generally shielded from personal liability for the entity's debts and obligations. — Access to capital: A corporation structure often provides more options for raising capital, including issuing stocks or attracting investments. — Continuity: A corporation can have indefinite existence, unlike partnerships that may face dissolution upon a partner's exit or death. — Tax considerations: Corporate tax rates and deductions may differ from partnership tax structures, which may offer potential advantages. 3. Legal Procedure: The sale of a partnership to a corporation in Broward County usually consists of the following steps: a) Preliminary Considerations: Partners should first consult with legal and financial professionals to understand the implications, tax consequences, and feasibility of the transaction. They should also review the partnership agreement for any provisions relating to the sale of partnership interests. b) Valuation of Partnership Assets: Partners must determine the fair market value of the partnership's assets and liabilities. This assessment helps in negotiating the terms of the sale, including the purchase price and allocation of assets. c) Drafting Agreements: Partners must prepare legal agreements outlining the terms of the sale, including a purchase agreement, transfer agreement, and any required corporate bylaws or articles of incorporation. d) Necessary Approvals: Depending on the partnership structure and agreement, partners may need to obtain the consent of all partners or a majority vote. Additionally, any required governmental permits, licenses, or authorizations must be acquired. e) Execution of the Sale: Once all necessary approvals are received, partners can proceed with the formal transfer of partnership assets to the corporation. This may involve the sale of partnership interests or the transfer of specific assets to the corporation. 4. Types of Broward Florida Sale of Partnership to Corporation: Some variations of Sale of Partnership to Corporation in Broward County, Florida could include: — Complete Sale: The partnership is fully sold, and all partners' interests are transferred to the corporation. — Partial Sale: Only a portion of the partnership's assets or interests are sold to the corporation, allowing some partners to retain their ownership. In conclusion, Broward Florida Sale of Partnership to Corporation refers to the legal process of transferring ownership of a partnership business to a corporation within Broward County, Florida. This transaction requires careful planning, financial assessment, legal agreements, and necessary approvals from partners and relevant authorities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Venta de Sociedad a Corporación - Sale of Partnership to Corporation

Description

How to fill out Broward Florida Venta De Sociedad A Corporación?

Draftwing paperwork, like Broward Sale of Partnership to Corporation, to manage your legal affairs is a difficult and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms intended for different scenarios and life circumstances. We make sure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Broward Sale of Partnership to Corporation template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before getting Broward Sale of Partnership to Corporation:

- Make sure that your template is compliant with your state/county since the rules for creating legal papers may differ from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Broward Sale of Partnership to Corporation isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to start utilizing our service and download the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!