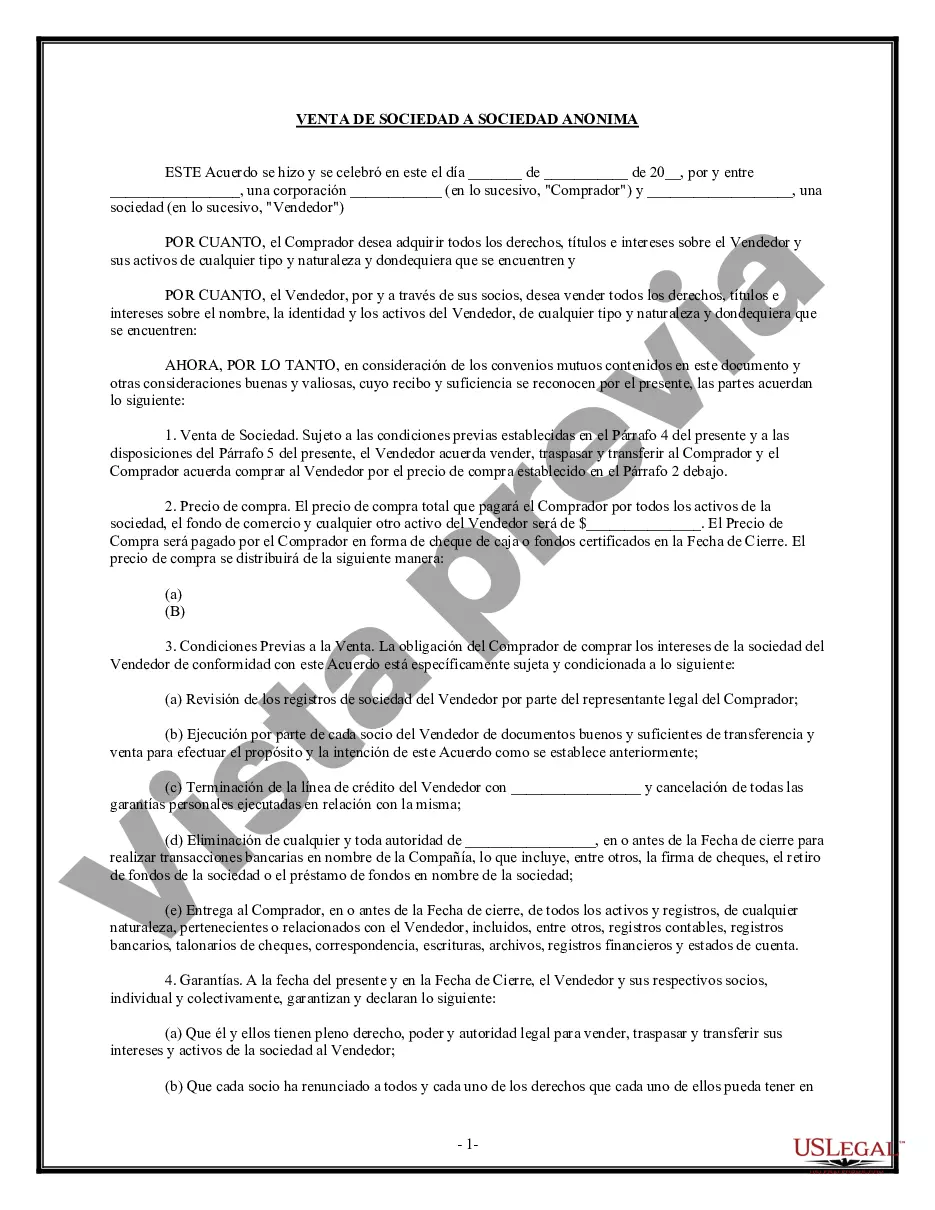

The possibility of a Montgomery Maryland Sale of Partnership to Corporation entails the process of converting a partnership business structure into a corporation in Montgomery County, Maryland. This transition involves legal and financial steps to ensure a smooth transfer of ownership and business operations. Various factors such as taxation benefits and growth opportunities may drive partners to pursue this conversion. One type of Montgomery Maryland Sale of Partnership to Corporation can be referred to as a general partnership conversion. In this scenario, all partners agree to transform their partnership business into a corporation. This transformation requires compliance with legal formalities, including filing the necessary documents with the Maryland Secretary of State's office and drafting new company bylaws. Another type of Montgomery Maryland Sale of Partnership to Corporation is known as a limited partnership conversion. This type involves the conversion of a limited partnership, which typically consists of general partners who manage the business operations and limited partners who are passive investors. By converting to a corporation, the limited partners can enjoy liability protection and potential tax advantages. During the Montgomery Maryland Sale of Partnership to Corporation, the partners should consider several significant aspects. Firstly, they must draft articles of incorporation that outline the new corporation's structure, purpose, and shareholder rights. Additionally, partners may need to negotiate ownership shares and determine the value of their contributions to the new corporation. Tax implications are crucial considerations in this conversion process. Partners should consult with tax professionals to analyze the potential tax consequences of converting from a partnership to a corporation. Factors such as capital gains tax, future tax obligations, and deductible expenses should be thoroughly evaluated to ensure an advantageous outcome for all parties involved. Furthermore, partners should create a detailed plan for the transfer of assets, contracts, and liabilities from the partnership to the corporation. Proper due diligence should be conducted to assess any risks or legal obligations associated with the conversion. In conclusion, the Montgomery Maryland Sale of Partnership to Corporation involves the transformation of a partnership business into a corporation, allowing partners to benefit from legal protections, tax advantages, and enhanced growth opportunities. Whether it's a general partnership or limited partnership, careful planning and legal compliance are crucial for a successful conversion. Professional guidance and support from business attorneys, tax experts, and financial advisors can greatly assist partners in navigating this complex process effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Venta de Sociedad a Corporación - Sale of Partnership to Corporation

Description

How to fill out Montgomery Maryland Venta De Sociedad A Corporación?

Creating forms, like Montgomery Sale of Partnership to Corporation, to take care of your legal matters is a tough and time-consumming task. Many situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can get your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms created for various scenarios and life circumstances. We make sure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Montgomery Sale of Partnership to Corporation template. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting Montgomery Sale of Partnership to Corporation:

- Make sure that your form is compliant with your state/county since the rules for writing legal documents may vary from one state another.

- Find out more about the form by previewing it or going through a quick intro. If the Montgomery Sale of Partnership to Corporation isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start using our service and get the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is all set. You can try and download it.

It’s easy to find and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!