Nassau New York Sale of Partnership to Corporation: A Detailed Description If you are in Nassau, New York, and considering the sale of a partnership to a corporation, it is important to understand the process, implications, and potential variations involved. This transaction typically involves the transfer of ownership interests or assets from a partnership to a corporation. Let's dive into the details of this process and explore any different types that may exist. The sale of a partnership to a corporation in Nassau, New York, often begins with an evaluation of the partnership's current structure, value, and potential benefits that incorporation can bring. This could include factors such as tax implications, liability protection, succession planning, and the ability to attract additional investors or capital. Key Considerations: 1. Legal Structure: As partnership structures differ, it is vital to consider whether the sale will involve a general partnership, limited partnership, or limited liability partnership (LLP), among others. 2. Valuation and Negotiations: Determining the value of the partnership is crucial in negotiating a fair deal. Assessment methods may involve assessing the partnership's assets, intellectual property, goodwill, and future revenue potential. 3. Agreement Terms: The sale should be clearly outlined in a comprehensive agreement, addressing the transfer of ownership interests, assets, liabilities, employee agreements, intellectual property rights, and any specific conditions or contingencies. 4. Legal Compliance: It is essential to comply with all federal, state, and local laws and regulations relevant to the sale of a partnership to a corporation. Seek legal counsel to ensure adherence to the necessary requirements for a smooth transition. Types of Nassau New York Sale of Partnership to Corporation: 1. Complete Buyout: This type of sale involves the partnership selling or transferring all its assets, including ownership interests, rights, and liabilities, to the acquiring corporation. This is often a preferred method when winding down the partnership. 2. Partial Buyout: In cases where the partnership intends to continue operating, a partial buyout may occur. This allows the selling partners to retain a percentage of ownership while transferring a portion to the corporation. 3. Merger or Acquisition: Instead of a straightforward sale, a partnership might choose to merge with or be acquired by a corporation. This involves combining operations, assets, and often results in the dissolution of the partnership entity. 4. Conversion: In certain instances, a partnership may decide to convert its structure into the form of a corporation, transitioning from a partnership to a corporation without a sale. This method allows the partnership's existing partners to become shareholders in the newly formed corporation. Please note that the specific terms and details of a Nassau, New York sale of partnership to a corporation may vary based on the unique circumstances of each business involved. Seeking professional advice from lawyers, accountants, and business consultants experienced in partnership and corporate transactions is essential to understand the intricacies and ensure a successful conversion or sale process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Venta de Sociedad a Corporación - Sale of Partnership to Corporation

Description

How to fill out Nassau New York Venta De Sociedad A Corporación?

Preparing documents for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Nassau Sale of Partnership to Corporation without expert assistance.

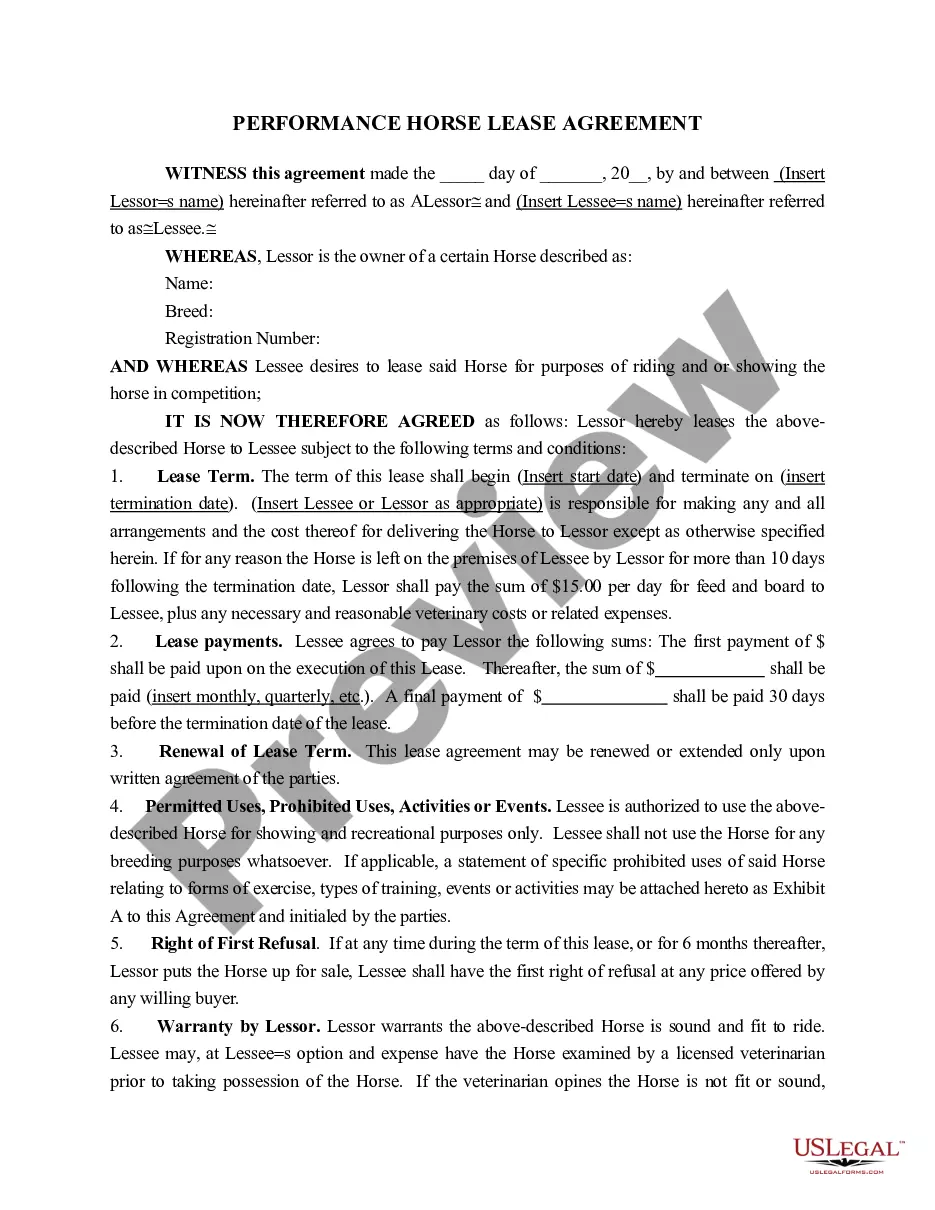

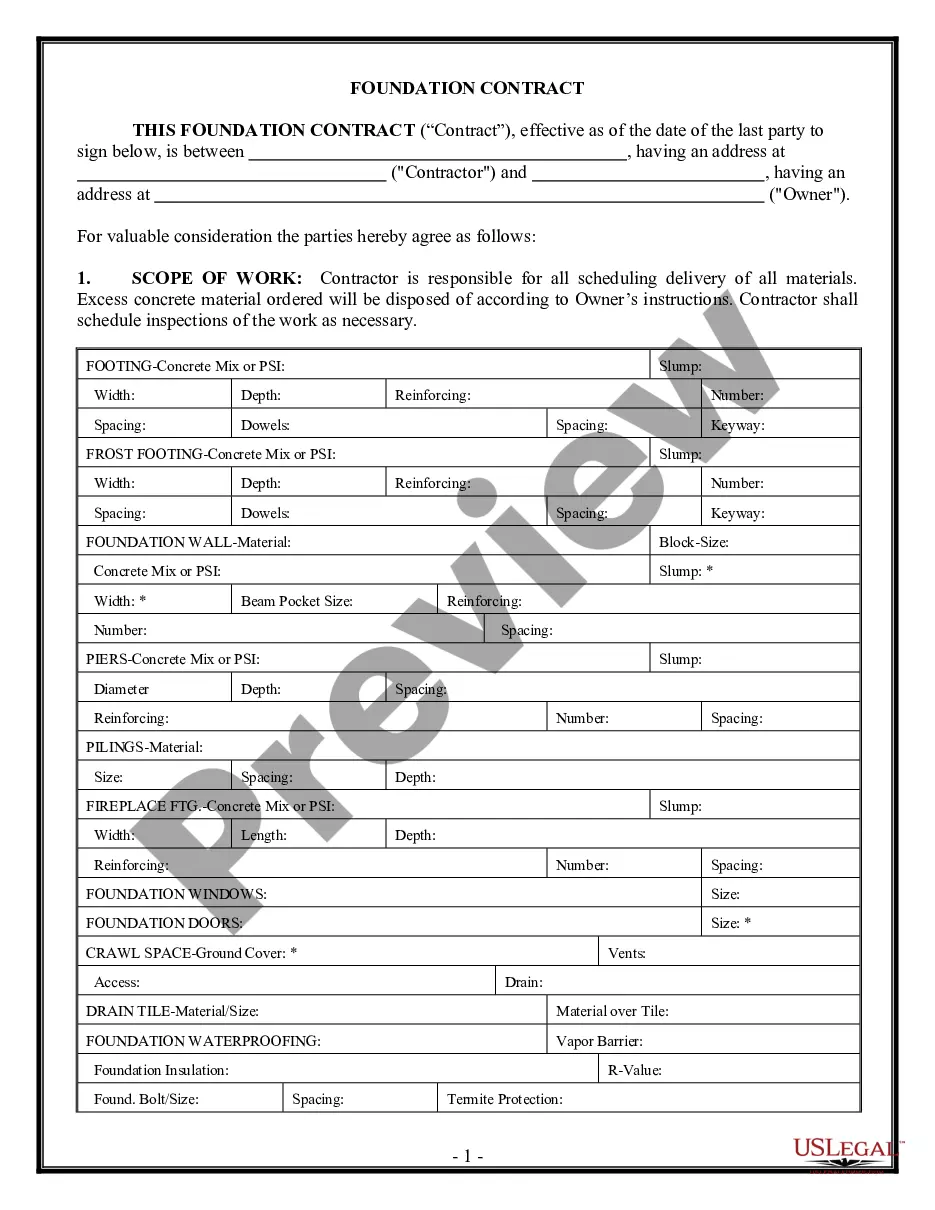

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Nassau Sale of Partnership to Corporation by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Nassau Sale of Partnership to Corporation:

- Look through the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that meets your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any situation with just a few clicks!