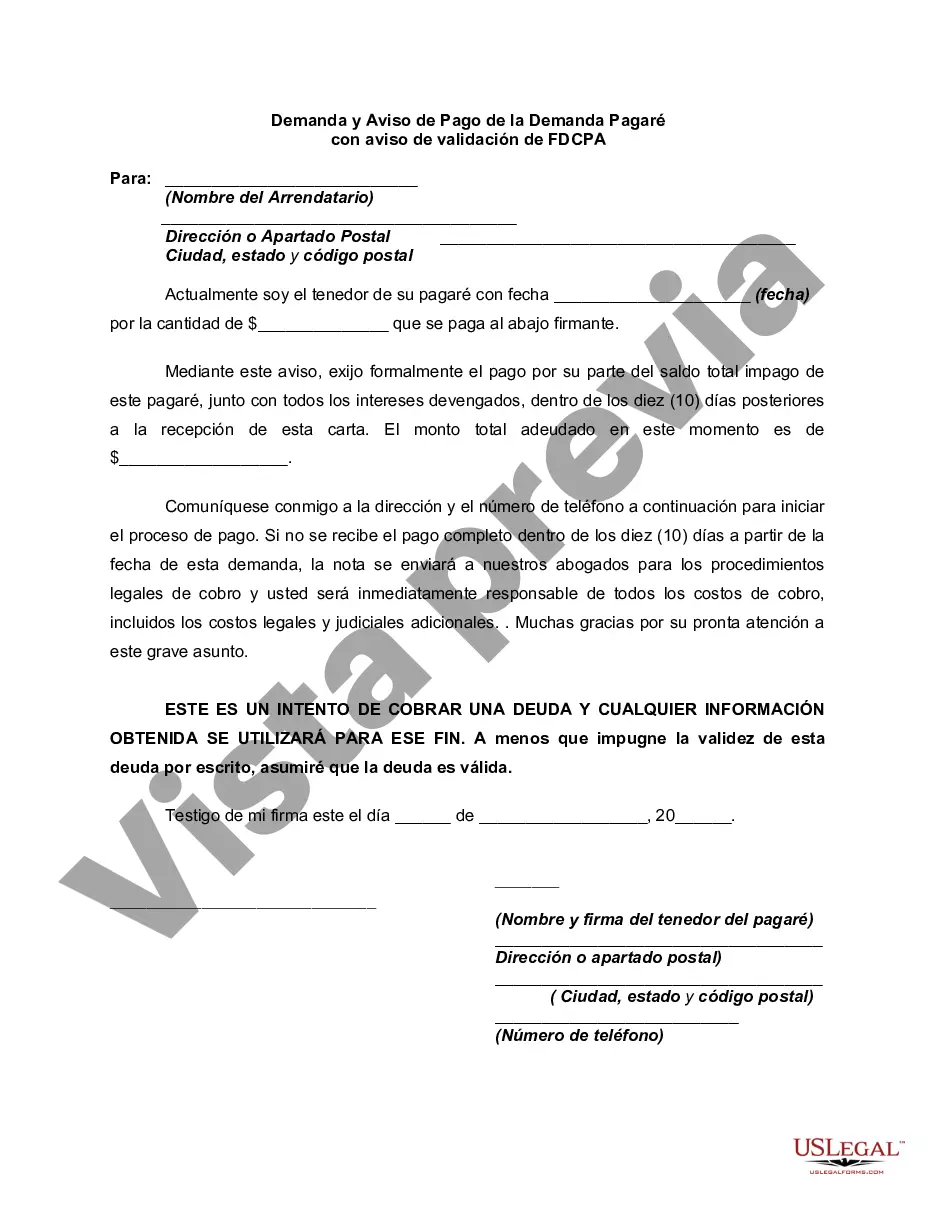

The following language is often referred to as the Fair Debt Collection Practices Act Validation Notice.

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. Unless you contest the validity of this indebtedness in writing, I will assume that the debt is valid.

The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors.

Chicago Illinois Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is an important legal document used in the state of Illinois to demand payment on a demand promissory note. This document includes certain specific elements and should comply with the requirements of the Fair Debt Collection Practices Act (FD CPA). Let's explore its components and different types below. 1. Purpose: The Chicago Illinois Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is used to formally demand payment from a debtor on a demand promissory note. This notice serves as an official request for payment and also provides an opportunity for the debtor to validate the debt under the FD CPA. 2. Content: The document includes various key elements to ensure its effectiveness and compliance: — Date: The date when the notice is issued. — Creditor Information: Full details of the creditor, including name, address, and contact information. — Debtor Information: Complete details of the debtor, including name, address, and contact information. — Demand for Payment: A clear statement demanding immediate payment of the outstanding debt specified in the demand promissory note. — Amount Due: The exact amount owed by the debtor, including principal, interest, and any other applicable charges. — Payment Deadline: A specific date provided to the debtor to make the payment before further legal actions may be taken. FD CPAPA Validation Notice: A paragraph explaining the debtor's rights to dispute, request verification, and validation of the alleged debt under the Fair Debt Collection Practices Act (FD CPA). This ensures that the debtor is aware of their rights and can take appropriate actions if needed. 3. Types: There are no specifics named types of Chicago Illinois Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice. However, variations may exist based on specific circumstances, such as: — Corporate Demand Notice: If the debtor is a corporate entity, the notice can be tailored accordingly, including the debtor's corporate name, registered agent information, and any relevant corporate identifiers. — Joint Debtor Notice: In cases where multiple debtors are involved, a joint debtor notice may be necessary, outlining the responsibility of each debtor and their obligations to fulfill the payment demand. In conclusion, the Chicago Illinois Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a crucial legal document used to demand payment on a demand promissory note in the state of Illinois. Its content includes creditor and debtor information, a clear demand for payment, the exact amount due, a payment deadline, and an FD CPA validation notice. While there are no specific named types, variations may exist based on the debtor's nature (e.g., corporate) or the involvement of multiple debtors.Chicago Illinois Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is an important legal document used in the state of Illinois to demand payment on a demand promissory note. This document includes certain specific elements and should comply with the requirements of the Fair Debt Collection Practices Act (FD CPA). Let's explore its components and different types below. 1. Purpose: The Chicago Illinois Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is used to formally demand payment from a debtor on a demand promissory note. This notice serves as an official request for payment and also provides an opportunity for the debtor to validate the debt under the FD CPA. 2. Content: The document includes various key elements to ensure its effectiveness and compliance: — Date: The date when the notice is issued. — Creditor Information: Full details of the creditor, including name, address, and contact information. — Debtor Information: Complete details of the debtor, including name, address, and contact information. — Demand for Payment: A clear statement demanding immediate payment of the outstanding debt specified in the demand promissory note. — Amount Due: The exact amount owed by the debtor, including principal, interest, and any other applicable charges. — Payment Deadline: A specific date provided to the debtor to make the payment before further legal actions may be taken. FD CPAPA Validation Notice: A paragraph explaining the debtor's rights to dispute, request verification, and validation of the alleged debt under the Fair Debt Collection Practices Act (FD CPA). This ensures that the debtor is aware of their rights and can take appropriate actions if needed. 3. Types: There are no specifics named types of Chicago Illinois Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice. However, variations may exist based on specific circumstances, such as: — Corporate Demand Notice: If the debtor is a corporate entity, the notice can be tailored accordingly, including the debtor's corporate name, registered agent information, and any relevant corporate identifiers. — Joint Debtor Notice: In cases where multiple debtors are involved, a joint debtor notice may be necessary, outlining the responsibility of each debtor and their obligations to fulfill the payment demand. In conclusion, the Chicago Illinois Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a crucial legal document used to demand payment on a demand promissory note in the state of Illinois. Its content includes creditor and debtor information, a clear demand for payment, the exact amount due, a payment deadline, and an FD CPA validation notice. While there are no specific named types, variations may exist based on the debtor's nature (e.g., corporate) or the involvement of multiple debtors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.