The following language is often referred to as the Fair Debt Collection Practices Act Validation Notice.

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. Unless you contest the validity of this indebtedness in writing, I will assume that the debt is valid.

The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors.

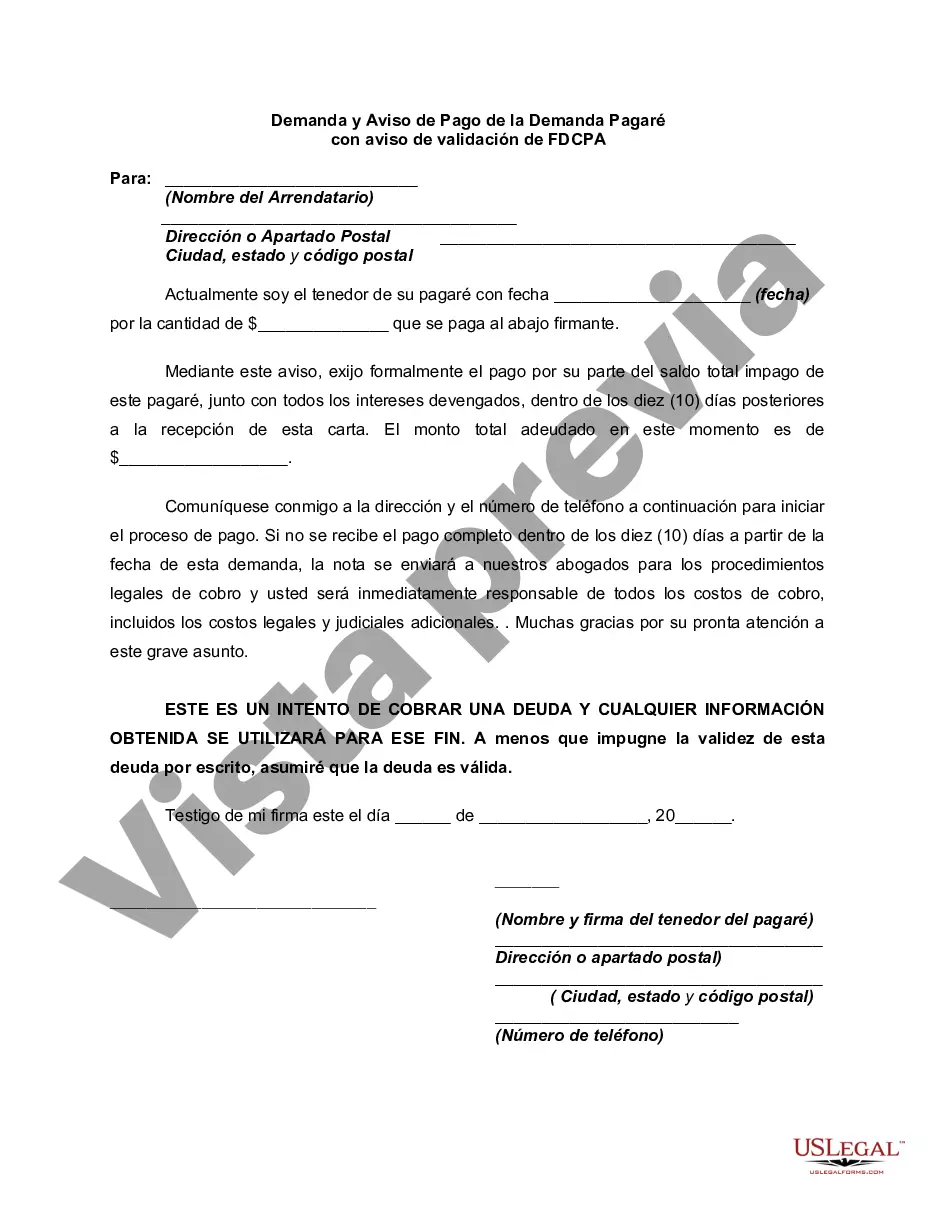

Collin County, located in Texas, follows a specific process for filing a Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice. This legal procedure serves as a means for a lender to request the payment of an outstanding debt from the borrower. It is essential to understand the steps involved to ensure compliance with the law. The Demand and Notice for Payment includes several key elements. First, it should clearly state the outstanding amount owed, the promissory note terms, and the date when the debt becomes due. It is crucial to reference the specific promissory note in question, providing all the necessary information to identify the loan. Additionally, the Notice should define the consequences of non-payment, such as legal action or additional fees and interest that may be incurred. Stating the potential outcomes emphasizes the seriousness of the situation and encourages prompt payment. The FD CPA (Fair Debt Collection Practices Act) Validation Notice is an integral part of the process. It ensures that the debtor is aware of their rights under the act and how they can request validation of the debt within a specific timeframe. The FD CPA Validation Notice must include the debt amount, the creditor's contact information, and a statement informing the debtor of their right to dispute the debt. Different types or variations of the Collin Texas Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may include: 1. Basic Demand and Notice for Payment with FD CPA Validation Notice: This is the standard form used to demand payment for a promissory note debt. It includes all the necessary elements mentioned above. 2. Notice for Payment with Intent to Accelerate: In cases where the debtor has failed to make timely payments or is in default, this notice may be used to inform the borrower that the lender intends to accelerate the debt and demand full payment. 3. Notice for Payment with Final Demand: If previous attempts to collect the debt have been unsuccessful, this notice serves as a final demand for payment. It usually includes a more assertive tone and emphasizes the consequences of continued non-payment, such as legal action or damage to the borrower's credit. It is crucial to consult with legal professionals to ensure the Demand and Notice for Payment of a Demand Promissory Note with FD CPA Validation Notice accurately adheres to the specific regulations and requirements of Collin County, Texas.Collin County, located in Texas, follows a specific process for filing a Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice. This legal procedure serves as a means for a lender to request the payment of an outstanding debt from the borrower. It is essential to understand the steps involved to ensure compliance with the law. The Demand and Notice for Payment includes several key elements. First, it should clearly state the outstanding amount owed, the promissory note terms, and the date when the debt becomes due. It is crucial to reference the specific promissory note in question, providing all the necessary information to identify the loan. Additionally, the Notice should define the consequences of non-payment, such as legal action or additional fees and interest that may be incurred. Stating the potential outcomes emphasizes the seriousness of the situation and encourages prompt payment. The FD CPA (Fair Debt Collection Practices Act) Validation Notice is an integral part of the process. It ensures that the debtor is aware of their rights under the act and how they can request validation of the debt within a specific timeframe. The FD CPA Validation Notice must include the debt amount, the creditor's contact information, and a statement informing the debtor of their right to dispute the debt. Different types or variations of the Collin Texas Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may include: 1. Basic Demand and Notice for Payment with FD CPA Validation Notice: This is the standard form used to demand payment for a promissory note debt. It includes all the necessary elements mentioned above. 2. Notice for Payment with Intent to Accelerate: In cases where the debtor has failed to make timely payments or is in default, this notice may be used to inform the borrower that the lender intends to accelerate the debt and demand full payment. 3. Notice for Payment with Final Demand: If previous attempts to collect the debt have been unsuccessful, this notice serves as a final demand for payment. It usually includes a more assertive tone and emphasizes the consequences of continued non-payment, such as legal action or damage to the borrower's credit. It is crucial to consult with legal professionals to ensure the Demand and Notice for Payment of a Demand Promissory Note with FD CPA Validation Notice accurately adheres to the specific regulations and requirements of Collin County, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.