The following language is often referred to as the Fair Debt Collection Practices Act Validation Notice.

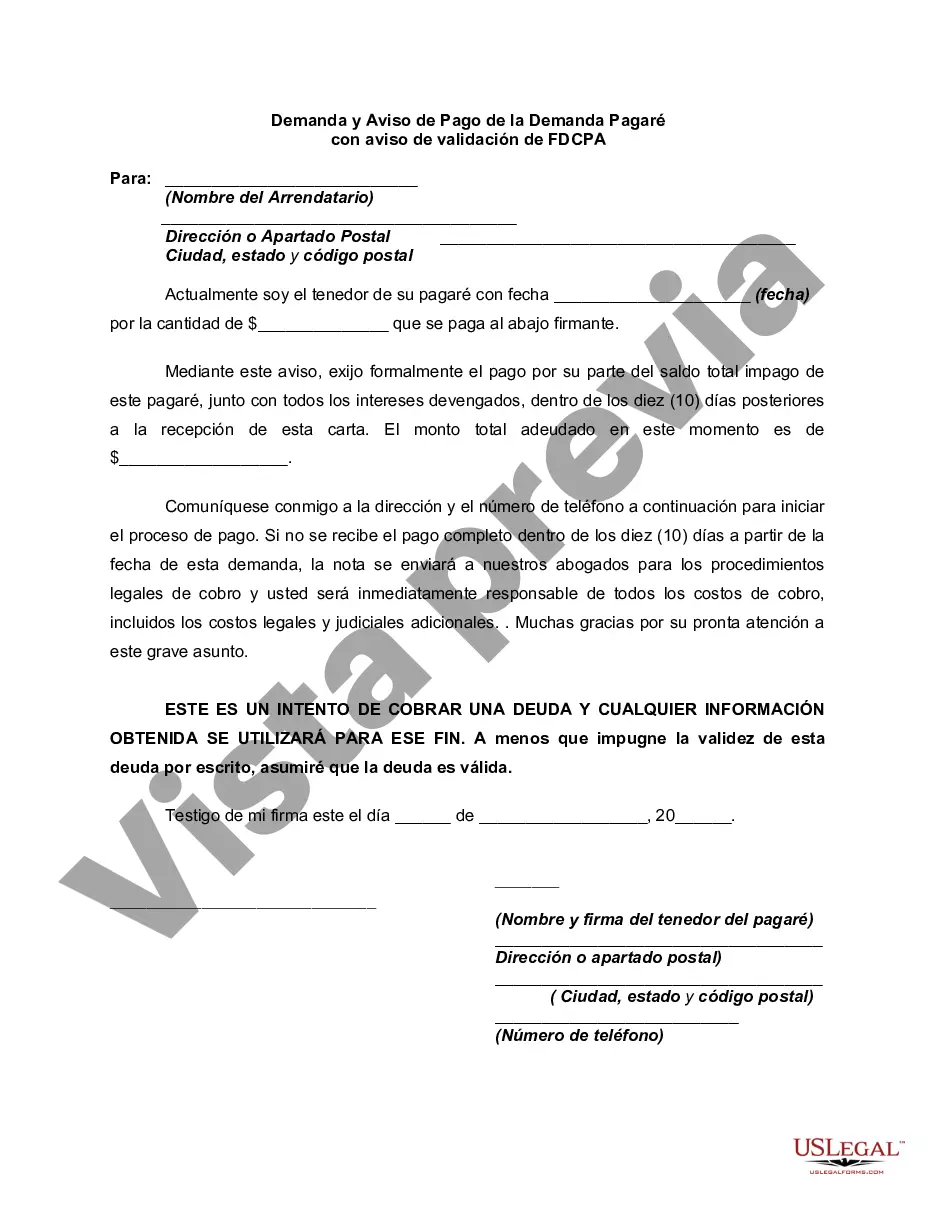

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. Unless you contest the validity of this indebtedness in writing, I will assume that the debt is valid.

The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors.

The Hennepin Minnesota Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is an important legal document used in financial transactions. This document serves as a formal request for payment of a promissory note and provides a notice of demand to the debtor. It also includes an FD CPA (Fair Debt Collection Practices Act) validation notice to ensure that the debt collection process follows the appropriate legal guidelines. In Hennepin County, Minnesota, there may be different circumstances under which this document is utilized. Some specific types of Hennepin Minnesota Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may include: 1. Default Notice: This type of notice is issued when the debtor fails to make the agreed-upon payments on the promissory note, breaching the terms and conditions of the agreement. The demand and notice for payment of demand promissory note is sent to the debtor, reminding them of their obligation and demanding immediate repayment. 2. Acceleration Notice: In cases where the debtor is in default on the promissory note, an acceleration notice may be issued. This notice demands immediate payment of the remaining balance on the note, as the creditor can accelerate the due date and demand full repayment. 3. Extension Request: Sometimes, the debtor may face unforeseen circumstances preventing them from making timely payments. In such cases, a request for an extension may be made using the Hennepin Minnesota Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice. This document would outline the reasons for the extension request and propose a new payment schedule. 4. Settlement Offer Notice: In certain situations, the creditor may decide to negotiate a settlement with the debtor rather than pursuing full repayment. A settlement offer notice would be drafted using the same demand and notice template, but instead of demanding full payment, it would outline the proposed settlement terms for the debtor's consideration. It is important to remember that each situation may have unique circumstances, and the specific type of Hennepin Minnesota Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice will largely depend on the nature of the transaction and the debtor's actions. It is advisable to consult with a legal professional to ensure that the document is tailored to the specific case accurately.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.