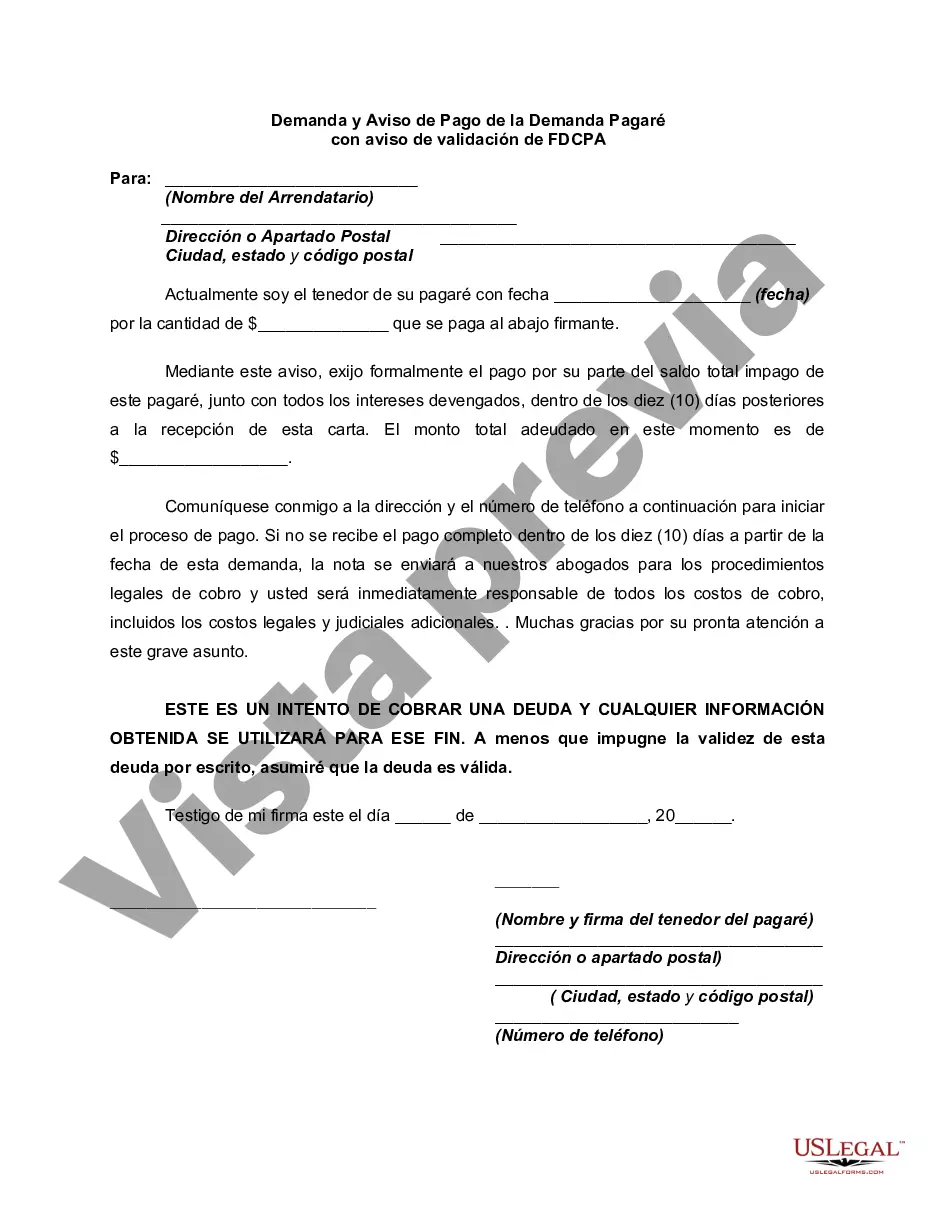

The following language is often referred to as the Fair Debt Collection Practices Act Validation Notice.

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. Unless you contest the validity of this indebtedness in writing, I will assume that the debt is valid.

The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors.

Orange, California Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legal document used to request payment for a promissory note in Orange, California. This document serves as a formal request for payment and includes important information about the debt and the rights of the debtor. The Demand and Notice for Payment of Demand Promissory Note is an essential tool for creditors to enforce their rights and encourage borrowers to fulfill their obligations. It provides a clear deadline for payment and outlines the consequences of non-compliance. The FD CPA Validation Notice, which stands for the Fair Debt Collection Practices Act, is a federal law designed to protect consumers from abusive debt collection practices. It requires debt collectors to provide certain information to the debtor, including the amount owed, the name of the creditor, and the rights of the debtor to dispute the debt. Different types of Orange, California Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may include variations, depending on the specific terms of the promissory note, loan agreement, or the nature of the debt. Some possible types include: 1. Unsecured Demand Promissory Note: This type of promissory note is not backed by collateral, meaning the creditor cannot seize specific assets if the debtor fails to repay the debt. 2. Secured Demand Promissory Note: This type of promissory note is secured by collateral, such as real estate or vehicles. In case of non-payment, the creditor has the right to seize the specified assets. 3. Demand Promissory Note with Interest: This type of promissory note includes an interest rate that accrues on the outstanding balance, increasing the total amount owed. 4. Demand Promissory Note without Interest: This type of promissory note does not include an interest rate, meaning the debtor only needs to repay the principal amount borrowed. It is crucial to consult with legal professionals or obtain the appropriate legal forms when drafting an Orange, California Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice. Accuracy and compliance with state and federal laws are essential to protect both the rights of the creditor and the debtor.Orange, California Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legal document used to request payment for a promissory note in Orange, California. This document serves as a formal request for payment and includes important information about the debt and the rights of the debtor. The Demand and Notice for Payment of Demand Promissory Note is an essential tool for creditors to enforce their rights and encourage borrowers to fulfill their obligations. It provides a clear deadline for payment and outlines the consequences of non-compliance. The FD CPA Validation Notice, which stands for the Fair Debt Collection Practices Act, is a federal law designed to protect consumers from abusive debt collection practices. It requires debt collectors to provide certain information to the debtor, including the amount owed, the name of the creditor, and the rights of the debtor to dispute the debt. Different types of Orange, California Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may include variations, depending on the specific terms of the promissory note, loan agreement, or the nature of the debt. Some possible types include: 1. Unsecured Demand Promissory Note: This type of promissory note is not backed by collateral, meaning the creditor cannot seize specific assets if the debtor fails to repay the debt. 2. Secured Demand Promissory Note: This type of promissory note is secured by collateral, such as real estate or vehicles. In case of non-payment, the creditor has the right to seize the specified assets. 3. Demand Promissory Note with Interest: This type of promissory note includes an interest rate that accrues on the outstanding balance, increasing the total amount owed. 4. Demand Promissory Note without Interest: This type of promissory note does not include an interest rate, meaning the debtor only needs to repay the principal amount borrowed. It is crucial to consult with legal professionals or obtain the appropriate legal forms when drafting an Orange, California Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice. Accuracy and compliance with state and federal laws are essential to protect both the rights of the creditor and the debtor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.