The following language is often referred to as the Fair Debt Collection Practices Act Validation Notice.

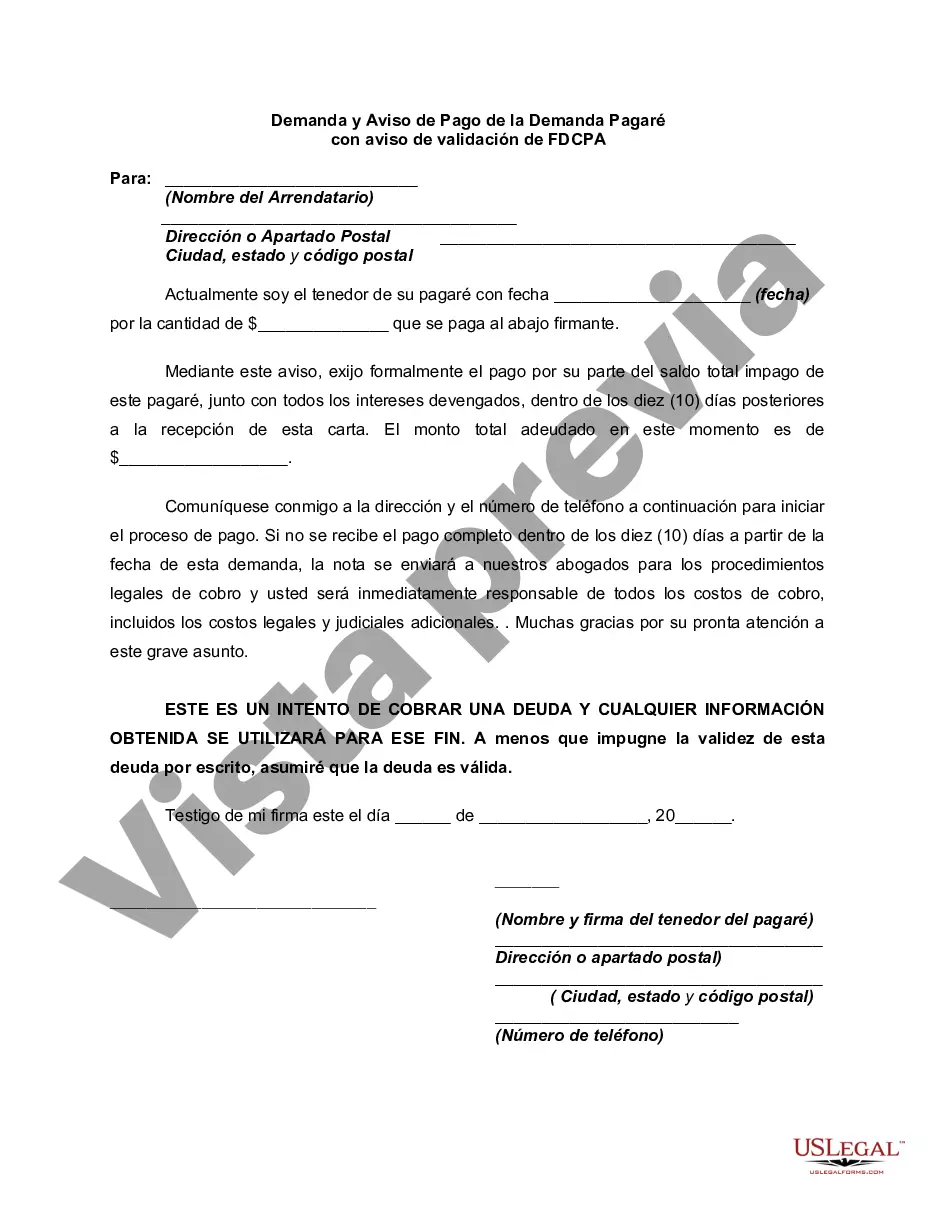

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. Unless you contest the validity of this indebtedness in writing, I will assume that the debt is valid.

The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors.

Salt Lake City, Utah, known for its stunning mountain views and vibrant city life, is a hub of economic activity and a center for the state's government and culture. The city offers a unique mix of urban amenities and outdoor recreational opportunities, making it a popular destination for residents and tourists alike. A Salt Lake Utah Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legal document that asserts a demand for payment on a promissory note and notifies the debtor of their obligations under the Fair Debt Collection Practices Act (FD CPA). It serves as a crucial instrument to ensure compliance and transparency in debt collection processes. Key elements of a Salt Lake Utah Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may include: 1. Identification: The document will include the names and contact information of both the creditor and debtor involved in the promissory note. 2. Promissory Note Details: It will outline the specifics of the promissory note, including the amount owed, interest rate, due dates, and any applicable penalties for late payments. 3. Payment Demand: The notice will assert the demand for immediate payment of the outstanding debt, emphasizing the consequences of non-payment or delay. 4. FD CPA Validation Notice: The document will inform the debtor of their rights under the FD CPA and their ability to request verification of the debt, challenging its legitimacy if necessary. 5. Consequences of Non-Payment: The notice will highlight the possible legal actions that may be taken if the debtor fails to satisfy the demand for payment, which can include litigation or reporting to credit bureaus. Different types of Salt Lake Utah Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may include variations based on specific contractual terms or unique circumstances. For instance, there might be different versions for commercial versus personal promissory notes, different interest rates, or varying grace periods for payment. However, the core purpose of the documents remains the same — to assert a demand for payment and ensure that debt collection practices adhere to the guidelines of the FD CPA. In conclusion, a Salt Lake Utah Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is an essential legal instrument used to assert payment demands on promissory notes while adhering to the requirements of the FD CPA. It plays a pivotal role in maintaining transparency and fairness in debt collection processes in Salt Lake City, Utah.Salt Lake City, Utah, known for its stunning mountain views and vibrant city life, is a hub of economic activity and a center for the state's government and culture. The city offers a unique mix of urban amenities and outdoor recreational opportunities, making it a popular destination for residents and tourists alike. A Salt Lake Utah Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legal document that asserts a demand for payment on a promissory note and notifies the debtor of their obligations under the Fair Debt Collection Practices Act (FD CPA). It serves as a crucial instrument to ensure compliance and transparency in debt collection processes. Key elements of a Salt Lake Utah Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may include: 1. Identification: The document will include the names and contact information of both the creditor and debtor involved in the promissory note. 2. Promissory Note Details: It will outline the specifics of the promissory note, including the amount owed, interest rate, due dates, and any applicable penalties for late payments. 3. Payment Demand: The notice will assert the demand for immediate payment of the outstanding debt, emphasizing the consequences of non-payment or delay. 4. FD CPA Validation Notice: The document will inform the debtor of their rights under the FD CPA and their ability to request verification of the debt, challenging its legitimacy if necessary. 5. Consequences of Non-Payment: The notice will highlight the possible legal actions that may be taken if the debtor fails to satisfy the demand for payment, which can include litigation or reporting to credit bureaus. Different types of Salt Lake Utah Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may include variations based on specific contractual terms or unique circumstances. For instance, there might be different versions for commercial versus personal promissory notes, different interest rates, or varying grace periods for payment. However, the core purpose of the documents remains the same — to assert a demand for payment and ensure that debt collection practices adhere to the guidelines of the FD CPA. In conclusion, a Salt Lake Utah Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is an essential legal instrument used to assert payment demands on promissory notes while adhering to the requirements of the FD CPA. It plays a pivotal role in maintaining transparency and fairness in debt collection processes in Salt Lake City, Utah.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.