The following language is often referred to as the Fair Debt Collection Practices Act Validation Notice.

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. Unless you contest the validity of this indebtedness in writing, I will assume that the debt is valid.

The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors.

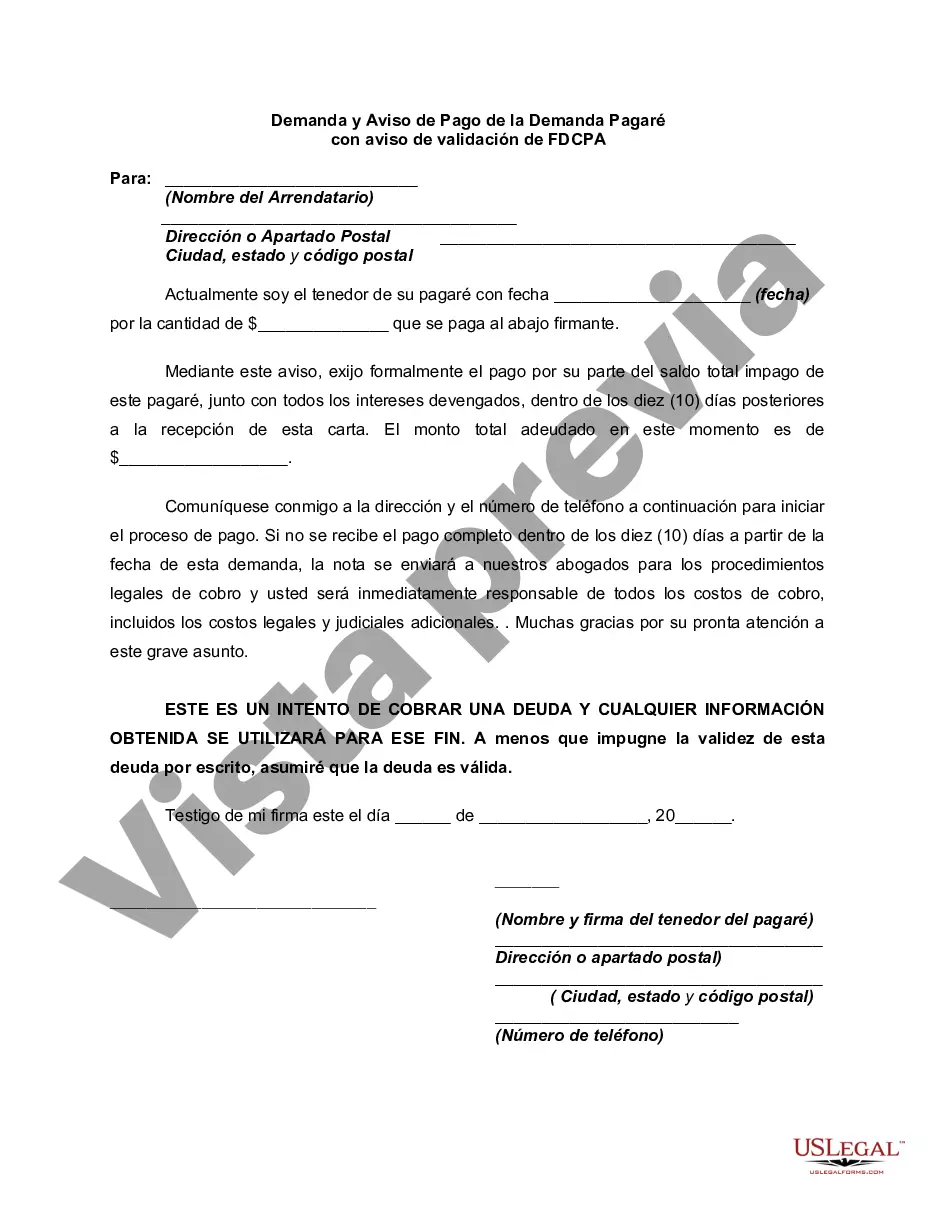

San Bernardino, California Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legal document used in the state of California to formally demand payment on a promissory note. It is designed to notify the borrower that they are in default and must satisfy their obligations according to the terms of the promissory note. The San Bernardino Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice includes various essential details such as: 1. Identification: The document will clearly state the name and contact information of the lender or party demanding payment (demanded). It will also include the details of the borrower (debtor) involved in the transaction. 2. Promissory Note Details: The demand and notice will provide a comprehensive description of the promissory note, including the principal amount borrowed, interest rate, due date, and any other relevant terms agreed upon between the parties. 3. Default Notification: The document will explicitly state the default condition, specifying that the borrower has failed to make the payments or fulfill their obligations as outlined in the promissory note, thus triggering the demand for payment. 4. Demand for Payment: The demand and notice will clearly articulate the demanded's request for immediate payment of the outstanding balance on the promissory note, including any accrued interest and applicable fees. 5. Consequences of Non-Payment: It is common for the document to outline the potential legal actions or consequences that may arise if the borrower fails to comply with the demand, such as the initiation of a lawsuit or the pursuit of collections through other legal means. 6. FD CPA Validation Notice: The San Bernardino Demand and Notice for Payment of Demand Promissory Note may also incorporate a Fair Debt Collection Practices Act (FD CPA) validation notice, which informs the borrower of their rights to request verification of the debt within a specified timeframe. Other possible variations or types of Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice in San Bernardino, California may include specific templates for commercial promissory notes, personal loans, real estate transactions, or other specialized loan agreements. It is crucial to select the appropriate type based on the specific circumstances and nature of the promissory note in question.San Bernardino, California Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legal document used in the state of California to formally demand payment on a promissory note. It is designed to notify the borrower that they are in default and must satisfy their obligations according to the terms of the promissory note. The San Bernardino Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice includes various essential details such as: 1. Identification: The document will clearly state the name and contact information of the lender or party demanding payment (demanded). It will also include the details of the borrower (debtor) involved in the transaction. 2. Promissory Note Details: The demand and notice will provide a comprehensive description of the promissory note, including the principal amount borrowed, interest rate, due date, and any other relevant terms agreed upon between the parties. 3. Default Notification: The document will explicitly state the default condition, specifying that the borrower has failed to make the payments or fulfill their obligations as outlined in the promissory note, thus triggering the demand for payment. 4. Demand for Payment: The demand and notice will clearly articulate the demanded's request for immediate payment of the outstanding balance on the promissory note, including any accrued interest and applicable fees. 5. Consequences of Non-Payment: It is common for the document to outline the potential legal actions or consequences that may arise if the borrower fails to comply with the demand, such as the initiation of a lawsuit or the pursuit of collections through other legal means. 6. FD CPA Validation Notice: The San Bernardino Demand and Notice for Payment of Demand Promissory Note may also incorporate a Fair Debt Collection Practices Act (FD CPA) validation notice, which informs the borrower of their rights to request verification of the debt within a specified timeframe. Other possible variations or types of Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice in San Bernardino, California may include specific templates for commercial promissory notes, personal loans, real estate transactions, or other specialized loan agreements. It is crucial to select the appropriate type based on the specific circumstances and nature of the promissory note in question.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.