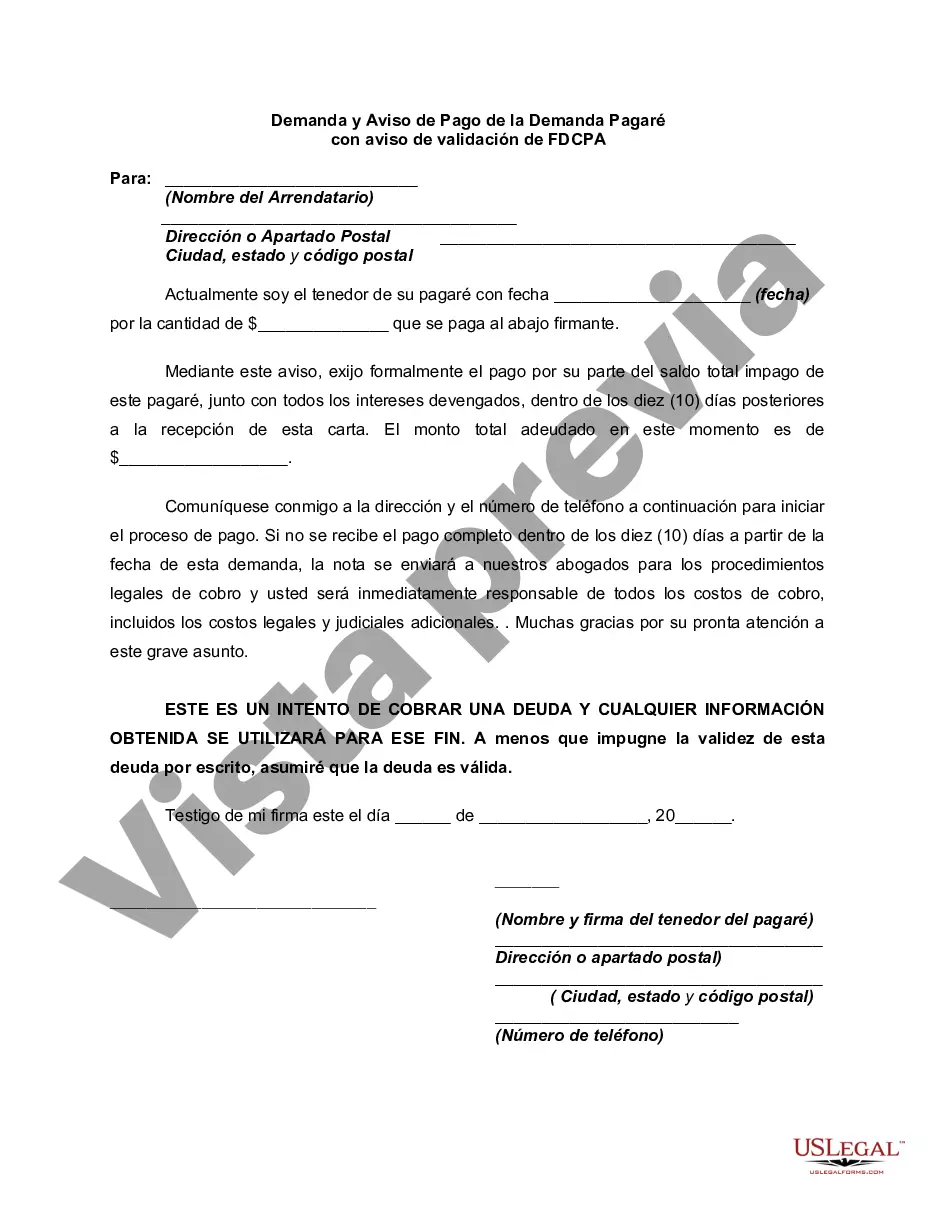

The following language is often referred to as the Fair Debt Collection Practices Act Validation Notice.

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. Unless you contest the validity of this indebtedness in writing, I will assume that the debt is valid.

The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors.

San Jose, California, known as the "Capital of Silicon Valley," is a vibrant city located in the heart of Northern California's Santa Clara County. Home to numerous high-tech companies, world-class universities, and a diverse population, San Jose offers a unique blend of opportunities and attractions. In terms of demand and notice for payment of a demand promissory note, San Jose California follows a specific legal framework governed by the state's laws. The purpose of this demand is to formally request payment from a borrower who has failed to meet their financial obligations as outlined in the promissory note agreement. A San Jose Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice adheres to the guidelines set forth by the Fair Debt Collection Practices Act (FD CPA). The FD CPA ensures fair treatment for consumers, protecting them from abusive debt collection practices. Types of San Jose California Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may include: 1. Standard Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: This is the most common type of demand notice. It clearly states the amount owed, the due date, and provides legal information and remedies available to both the lender and the borrower. 2. Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice for Mortgage Loans: This type of demand notice is specific to mortgage loans. It includes additional details regarding the property, the mortgage agreement, and any applicable foreclosure procedures. 3. Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice for Business Loans: Designed for business loans, this notice incorporates elements tailored to commercial lending. It may include provisions related to personal guarantees, collateral, or corporate entities. 4. Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice for Student Loans: This type of notice specifically addresses student loan debt. It outlines the borrower's responsibilities, repayment options, and any government programs available for loan relief. In summary, a San Jose California Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legally binding document used to request payment from a borrower who has defaulted on their promissory note obligations. The notice follows the guidelines of the FD CPA and can vary depending on the type of loan involved, such as mortgage loans, business loans, or student loans. It's essential for both lenders and borrowers to understand their rights and obligations outlined in these demand notices to ensure a fair resolution.San Jose, California, known as the "Capital of Silicon Valley," is a vibrant city located in the heart of Northern California's Santa Clara County. Home to numerous high-tech companies, world-class universities, and a diverse population, San Jose offers a unique blend of opportunities and attractions. In terms of demand and notice for payment of a demand promissory note, San Jose California follows a specific legal framework governed by the state's laws. The purpose of this demand is to formally request payment from a borrower who has failed to meet their financial obligations as outlined in the promissory note agreement. A San Jose Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice adheres to the guidelines set forth by the Fair Debt Collection Practices Act (FD CPA). The FD CPA ensures fair treatment for consumers, protecting them from abusive debt collection practices. Types of San Jose California Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice may include: 1. Standard Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: This is the most common type of demand notice. It clearly states the amount owed, the due date, and provides legal information and remedies available to both the lender and the borrower. 2. Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice for Mortgage Loans: This type of demand notice is specific to mortgage loans. It includes additional details regarding the property, the mortgage agreement, and any applicable foreclosure procedures. 3. Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice for Business Loans: Designed for business loans, this notice incorporates elements tailored to commercial lending. It may include provisions related to personal guarantees, collateral, or corporate entities. 4. Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice for Student Loans: This type of notice specifically addresses student loan debt. It outlines the borrower's responsibilities, repayment options, and any government programs available for loan relief. In summary, a San Jose California Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legally binding document used to request payment from a borrower who has defaulted on their promissory note obligations. The notice follows the guidelines of the FD CPA and can vary depending on the type of loan involved, such as mortgage loans, business loans, or student loans. It's essential for both lenders and borrowers to understand their rights and obligations outlined in these demand notices to ensure a fair resolution.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.