In the context of a shareholders' agreement in Dallas, Texas, the Right of First Refusal (ROAR) clause is a legal provision that grants existing shareholders the opportunity to purchase additional shares of a company before those shares are offered to outside parties. This clause aims to protect the existing shareholders' interests and maintain ownership control within the company. Within the Dallas, Texas legal framework, there are several types of Right of First Refusal clauses that may be included in a shareholders' agreement: 1. Standard Right of First Refusal: This type of clause gives existing shareholders the first opportunity to purchase any shares being sold by another shareholder. If a shareholder intends to sell their shares, they must first offer them to the existing shareholders at a predetermined price or through a negotiated process. The existing shareholders have the option to accept or decline the offer. 2. Right of First Offer: This clause requires a shareholder who plans to sell their shares to first offer them to the existing shareholders at a predetermined price or on specified terms. However, unlike the standard Right of First Refusal, the existing shareholders are not obligated to accept the offer. Instead, they have the right to make a counteroffer or decline the opportunity to purchase the shares. 3. Co-sale Right: This clause is sometimes included in addition to the standard Right of First Refusal. It allows existing shareholders who are not directly offered the opportunity to purchase shares to join in the sale transaction proposed by another shareholder. These shareholders can sell a pro rata portion of their own shares on the same terms and conditions as the selling shareholder. 4. Tag-Along Right: Also known as "Piggyback Rights," this clause protects minority shareholders. If a majority shareholder intends to sell their shares to a third party, the minority shareholders have the right to include their shares in the transaction on the same terms and conditions as the majority shareholder. The purpose of these various Right of First Refusal clauses is to maintain the balance of ownership and protect the interests of existing shareholders in Dallas, Texas. By granting existing shareholders the right to purchase shares before they are offered to external parties, these clauses allow for more control over the company's ownership structure and help preserve the existing shareholder's influence.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Cláusula de Derecho de Preferencia para Acuerdo de Accionistas - Right of First Refusal Clause for Shareholders' Agreement

Description

How to fill out Dallas Texas Cláusula De Derecho De Preferencia Para Acuerdo De Accionistas?

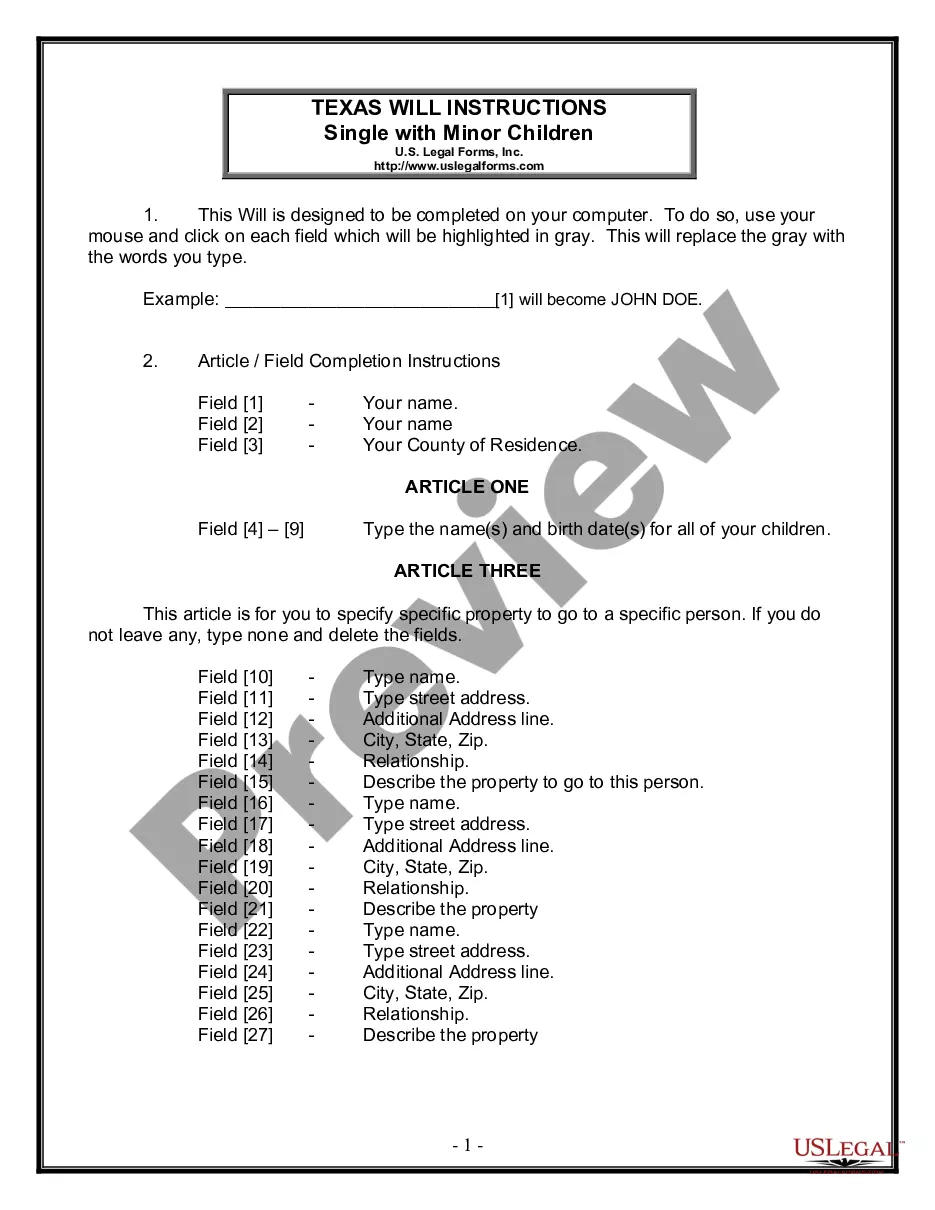

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Dallas Right of First Refusal Clause for Shareholders' Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different categories ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find detailed resources and tutorials on the website to make any tasks associated with paperwork execution simple.

Here's how you can locate and download Dallas Right of First Refusal Clause for Shareholders' Agreement.

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Check the similar forms or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment method, and buy Dallas Right of First Refusal Clause for Shareholders' Agreement.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Dallas Right of First Refusal Clause for Shareholders' Agreement, log in to your account, and download it. Of course, our platform can’t replace a legal professional entirely. If you need to cope with an exceptionally difficult situation, we recommend getting an attorney to check your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-specific paperwork effortlessly!