Fairfax Virginia Right of First Refusal Clause for Shareholders' Agreement In Fairfax, Virginia, the Right of First Refusal (ROAR) clause is a vital provision included in shareholders' agreements. This clause grants existing shareholders the opportunity to purchase shares of a company before they are sold to third parties. It ensures that existing shareholders have the right to maintain their ownership percentage and protect their investment in the company. There are different types of ROAR clauses that can be customized based on the specific needs of shareholders in Fairfax, Virginia. Here are some notable variations: 1. Standard Right of First Refusal: This type of clause provides existing shareholders with the first opportunity to purchase any shares being sold by another shareholder. If a shareholder receives an offer from a third party to purchase their shares, they must first offer those shares to existing shareholders on the same terms. The existing shareholders have a limited time, typically specified in the agreement, to accept or decline the offer. 2. Right of First Offer: This clause requires the shareholder who wishes to sell their shares to first offer them to existing shareholders before considering offers from third parties. However, unlike the standard ROAR, existing shareholders have the option to either accept or decline the offer. If declined, the shareholder is then free to explore other options. 3. Co-Sale Right: This clause is often used when multiple shareholders collectively hold a significant stake in a company. It allows minority shareholders to sell their shares alongside a majority shareholder if the latter receives an offer from a third party. This grants minority shareholders the opportunity to exit their investment alongside the majority shareholder, providing them with more liquidity options. 4. Tag-Along Right: The tag-along or "piggyback" right ensures that minority shareholders have the option to sell their shares in a company if a majority shareholder receives an offer from a third party. Without this clause, it might be difficult for minority shareholders to find buyers for their shares on the same terms as the majority shareholder. These variations of the ROAR clause aim to protect the interests of Fairfax, Virginia shareholders by providing them with the ability to maintain their ownership position, regulate share transfers, and ensure fair treatment. Each type of clause serves a specific purpose and can be tailored to meet the requirements and preferences of involved parties. It is important for shareholders and companies in Fairfax, Virginia to consult legal professionals specializing in corporate law to draft and include the appropriate ROAR clause in their shareholders' agreement. This will help establish clear guidelines and avoid potential disputes or challenges related to share transfers.

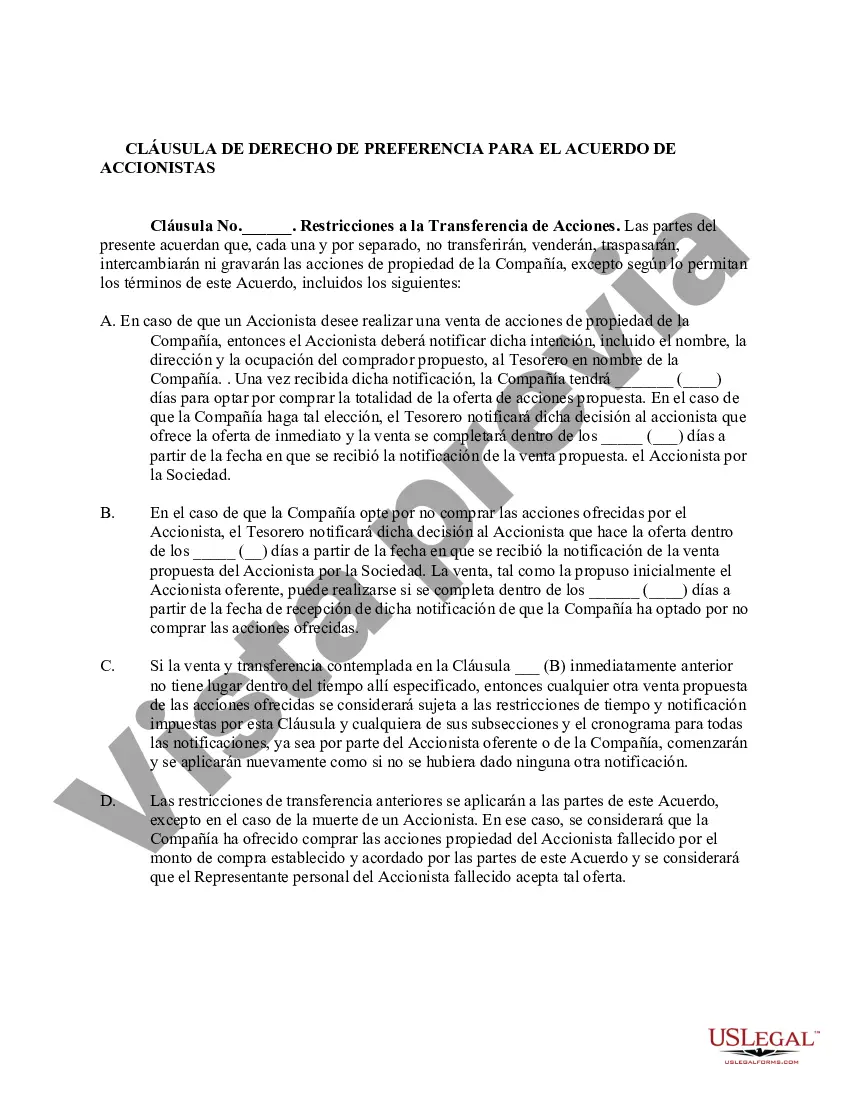

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Cláusula de Derecho de Preferencia para Acuerdo de Accionistas - Right of First Refusal Clause for Shareholders' Agreement

Description

How to fill out Fairfax Virginia Cláusula De Derecho De Preferencia Para Acuerdo De Accionistas?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Fairfax Right of First Refusal Clause for Shareholders' Agreement, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Consequently, if you need the recent version of the Fairfax Right of First Refusal Clause for Shareholders' Agreement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Fairfax Right of First Refusal Clause for Shareholders' Agreement:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Fairfax Right of First Refusal Clause for Shareholders' Agreement and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!