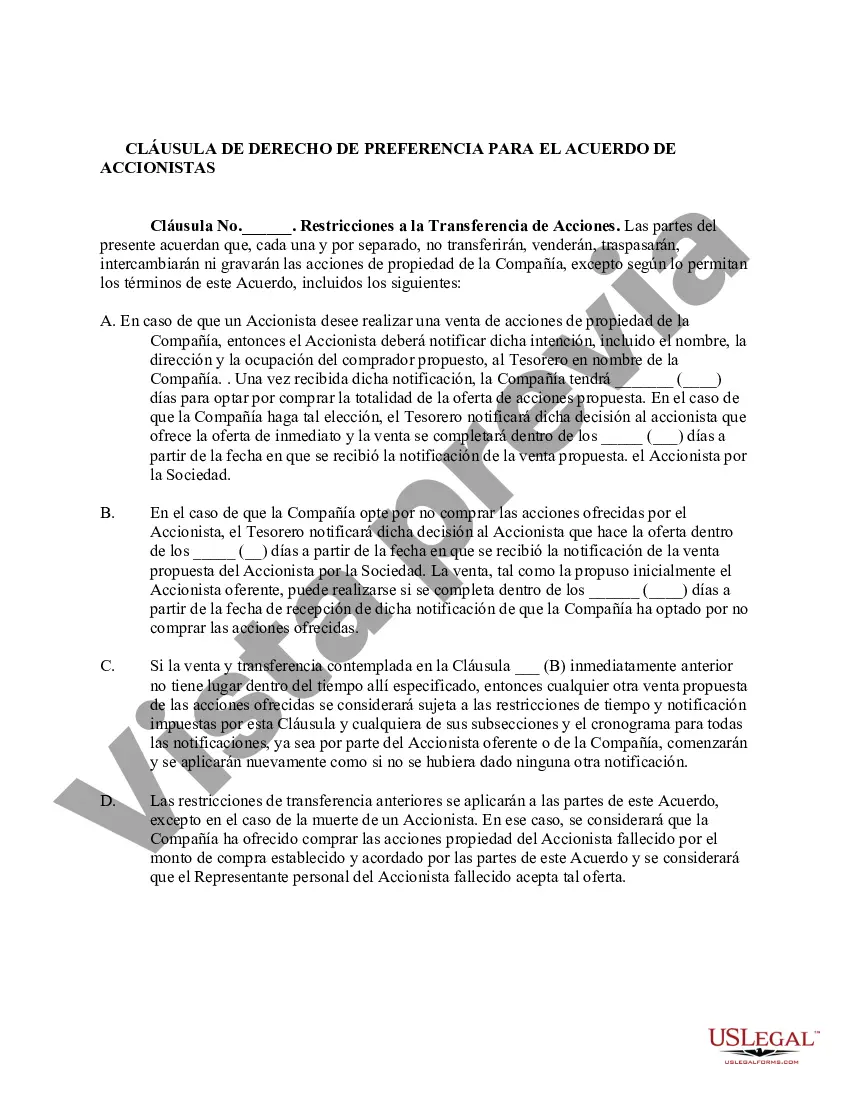

Montgomery, Maryland Right of First Refusal Clause for Shareholders' Agreement A Right of First Refusal (ROAR) Clause is a significant provision in a Shareholders' Agreement that governs the sale or transfer of shares in a company. In Montgomery, Maryland, there are various types of ROAR Clauses that aim to protect shareholders' interests and maintain company stability. These clauses set forth a framework for offering existing shareholders the opportunity to purchase shares before they are sold to external parties. One common type of ROAR Clause in Montgomery, Maryland is the Traditional Right of First Refusal. Under this clause, if a shareholder intends to sell their shares, they must first offer them to other existing shareholders at a price comparable to the offer they have received from an external party. Existing shareholders then have the right to accept or decline the offer within a specified timeframe, ensuring that they maintain control over their ownership stakes. Another type of ROAR Clause seen in Montgomery, Maryland is the Right of First Offer Clause. This clause provides existing shareholders with the first opportunity to purchase additional shares in proportion to their existing ownership percentages. Shareholders are given an exclusive period to accept or decline the offer before it can be presented to external parties, enabling them to maintain their relative ownership proportions and prevent dilution. Furthermore, the Right of First Negotiation Clause is employed in Montgomery, Maryland Shareholders' Agreements. This clause requires a shareholder planning to sell their shares to first negotiate with other existing shareholders in good faith, allowing them the opportunity to come to a mutually agreeable deal before considering any outside offers. It ensures that shareholders have the opportunity to actively participate in the negotiation process and potentially retain or increase their ownership in the company. In summary, Montgomery, Maryland's Right of First Refusal Clauses for Shareholders' Agreements are designed to protect shareholders' interests and maintain company stability. The Traditional Right of First Refusal Clause, Right of First Offer Clause, and Right of First Negotiation Clause are a few examples that outline the mechanisms by which existing shareholders can exercise their rights and opportunities, ensuring fair and orderly transactions of shares within the company.

Montgomery, Maryland Right of First Refusal Clause for Shareholders' Agreement A Right of First Refusal (ROAR) Clause is a significant provision in a Shareholders' Agreement that governs the sale or transfer of shares in a company. In Montgomery, Maryland, there are various types of ROAR Clauses that aim to protect shareholders' interests and maintain company stability. These clauses set forth a framework for offering existing shareholders the opportunity to purchase shares before they are sold to external parties. One common type of ROAR Clause in Montgomery, Maryland is the Traditional Right of First Refusal. Under this clause, if a shareholder intends to sell their shares, they must first offer them to other existing shareholders at a price comparable to the offer they have received from an external party. Existing shareholders then have the right to accept or decline the offer within a specified timeframe, ensuring that they maintain control over their ownership stakes. Another type of ROAR Clause seen in Montgomery, Maryland is the Right of First Offer Clause. This clause provides existing shareholders with the first opportunity to purchase additional shares in proportion to their existing ownership percentages. Shareholders are given an exclusive period to accept or decline the offer before it can be presented to external parties, enabling them to maintain their relative ownership proportions and prevent dilution. Furthermore, the Right of First Negotiation Clause is employed in Montgomery, Maryland Shareholders' Agreements. This clause requires a shareholder planning to sell their shares to first negotiate with other existing shareholders in good faith, allowing them the opportunity to come to a mutually agreeable deal before considering any outside offers. It ensures that shareholders have the opportunity to actively participate in the negotiation process and potentially retain or increase their ownership in the company. In summary, Montgomery, Maryland's Right of First Refusal Clauses for Shareholders' Agreements are designed to protect shareholders' interests and maintain company stability. The Traditional Right of First Refusal Clause, Right of First Offer Clause, and Right of First Negotiation Clause are a few examples that outline the mechanisms by which existing shareholders can exercise their rights and opportunities, ensuring fair and orderly transactions of shares within the company.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.