This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

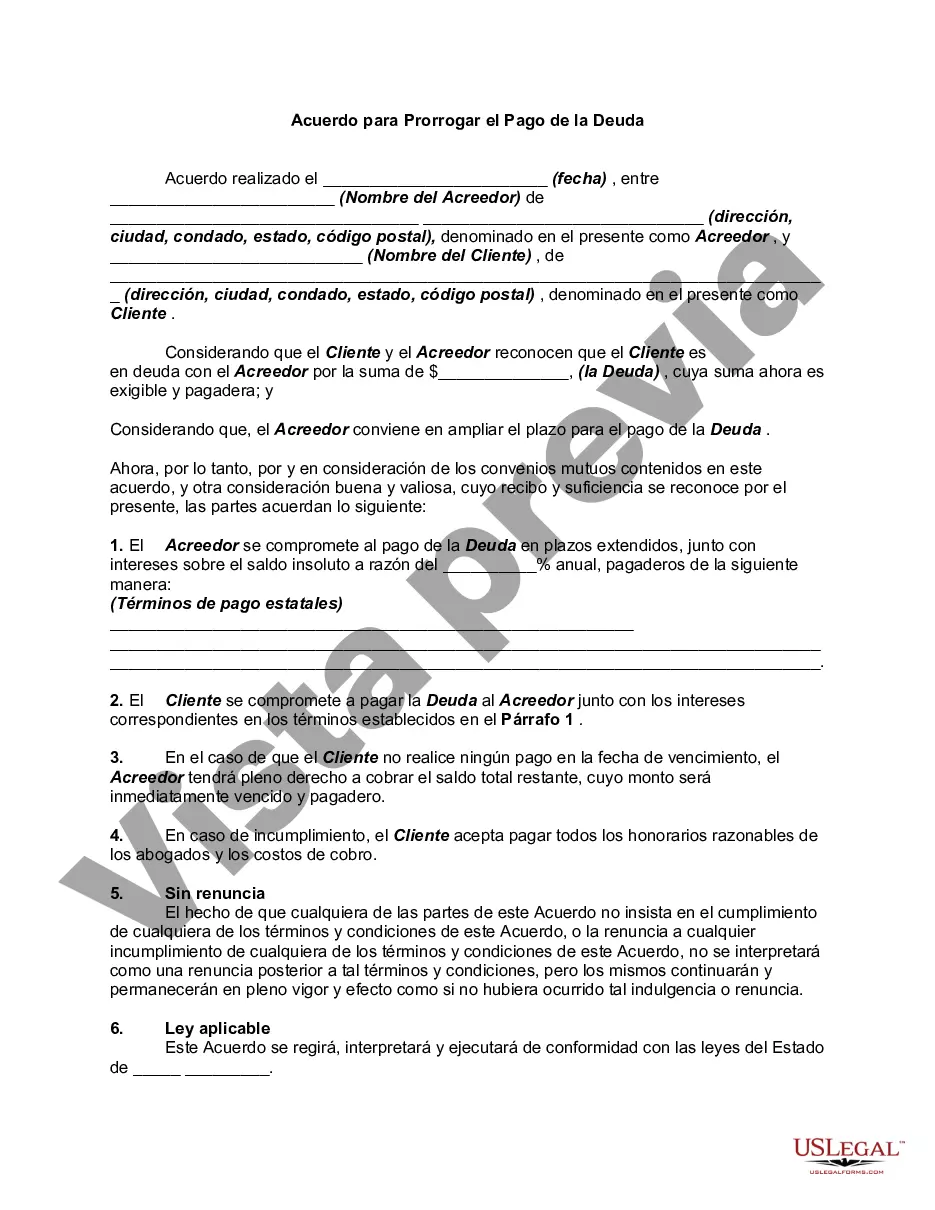

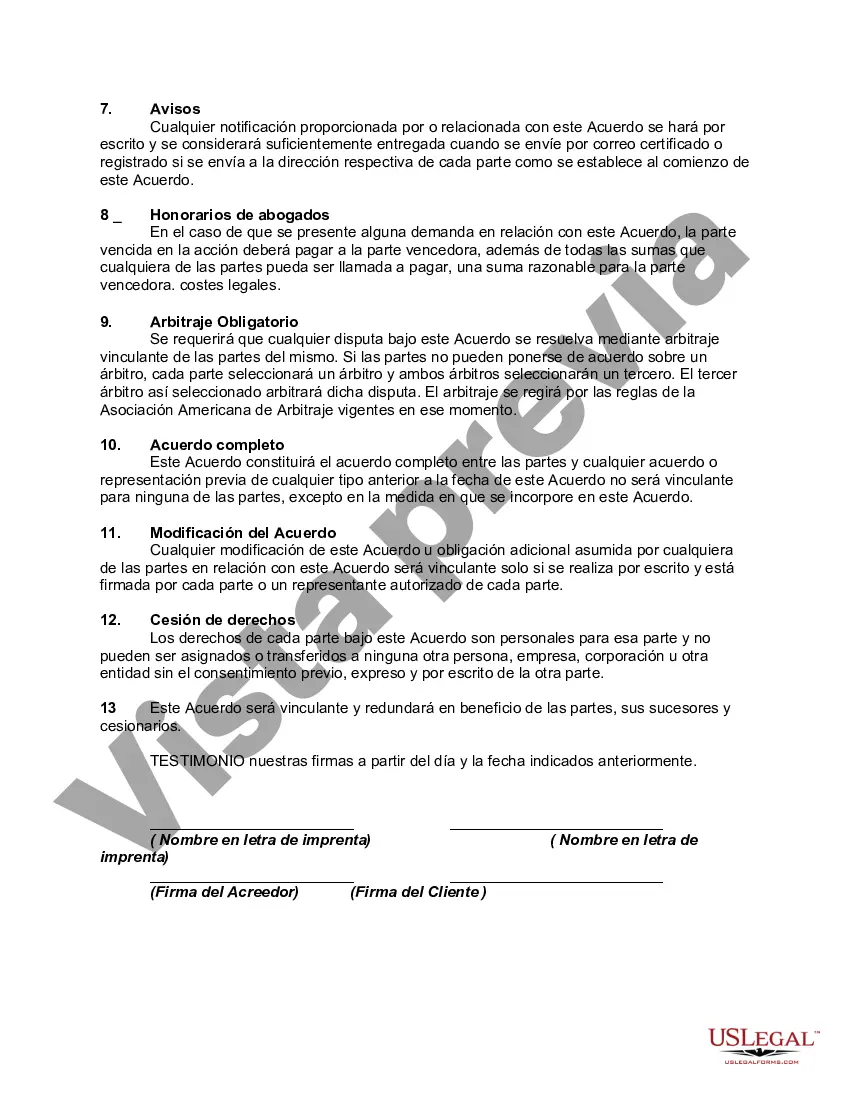

Title: Understanding the Maricopa, Arizona Agreement to Extend Debt Payment Keywords: Maricopa, Arizona, agreement, extend, debt payment, types, overview, benefits Introduction: The Maricopa, Arizona Agreement to Extend Debt Payment is a contract that allows individuals or entities to prolong the timeframe for repayment of their outstanding debts. This agreement serves as a viable solution for borrowers who are struggling to meet their financial obligations within the previously determined payment schedule. By opting for an agreement to extend debt payment, borrowers can alleviate immediate financial burdens, while still honoring their commitment to repay what they owe. Types of Maricopa Arizona Agreements to Extend Debt Payment: 1. Personal Debt Extended Payment Agreements: — When individuals face difficulty in repaying personal loans, credit card debts, or other forms of personal debts within the original repayment period, they can enter into a Maricopa Arizona Agreement to Extend Debt Payment with their creditors. This agreement outlines new terms for repayment, granting borrowers more time to settle their debts, often through adjusted monthly installments or additional interest charges. 2. Business Debt Extended Payment Agreements: — For businesses in Maricopa, Arizona, experiencing financial distress, an Agreement to Extend Debt Payment can be instrumental in avoiding default and bankruptcy. Such agreements can be formulated with lenders, suppliers, or other creditors to restructure payment terms, offer reduced interest rates, or permit an extended grace period. This helps businesses regain stability, maintain cash flow, and avoid severe financial repercussions. Overview of Maricopa Arizona Agreement to Extend Debt Payment: In a typical Maricopa Arizona Agreement to Extend Debt Payment, certain critical aspects are addressed to ensure transparency and fairness for both parties involved. Some key components that may be detailed within this agreement include: 1. Updated Payment Schedule: — The revised agreement stipulates a new payment schedule, accommodating the extended timeframe to meet debt obligations. This may occur through more manageable monthly installments, quarterly payments, or another agreed-upon payment frequency. 2. Interest and Penalties: — In certain cases, creditors may impose additional interest charges or penalties due to the extended payment duration. These terms are clearly outlined within the agreement to ensure complete understanding by the borrower. 3. Legal Validity: — The Maricopa Arizona Agreement to Extend Debt Payment holds legally-binding status, acknowledging the rights and responsibilities of both parties. This helps safeguard the interests of both the borrower and the creditor. Benefits of Maricopa Arizona Agreement to Extend Debt Payment: 1. Financial Relief: — By extending debt payment, borrowers can temporarily reduce their immediate financial burdens, allowing them breathing space to improve their financial situation. 2. Avoidance of Default: — Agreements to extend debt payment help borrowers stay on track and avoid default on their obligations, preserving their creditworthiness and avoiding potential legal consequences. 3. Improved Relations with Creditors: — Entering into such agreements demonstrates a borrower's commitment to fulfilling their repayment obligations. This willingness can foster positive relationships with creditors, potentially leading to future financial arrangements. Conclusion: Maricopa, Arizona Agreements to Extend Debt Payment provide a lifeline for individuals and businesses who require extra time to repay their debts. With various types available, borrowers can select agreements that align with their specific needs. These agreements mitigate immediate financial pressures, protect creditworthiness, and lay the groundwork for long-term financial stability.Title: Understanding the Maricopa, Arizona Agreement to Extend Debt Payment Keywords: Maricopa, Arizona, agreement, extend, debt payment, types, overview, benefits Introduction: The Maricopa, Arizona Agreement to Extend Debt Payment is a contract that allows individuals or entities to prolong the timeframe for repayment of their outstanding debts. This agreement serves as a viable solution for borrowers who are struggling to meet their financial obligations within the previously determined payment schedule. By opting for an agreement to extend debt payment, borrowers can alleviate immediate financial burdens, while still honoring their commitment to repay what they owe. Types of Maricopa Arizona Agreements to Extend Debt Payment: 1. Personal Debt Extended Payment Agreements: — When individuals face difficulty in repaying personal loans, credit card debts, or other forms of personal debts within the original repayment period, they can enter into a Maricopa Arizona Agreement to Extend Debt Payment with their creditors. This agreement outlines new terms for repayment, granting borrowers more time to settle their debts, often through adjusted monthly installments or additional interest charges. 2. Business Debt Extended Payment Agreements: — For businesses in Maricopa, Arizona, experiencing financial distress, an Agreement to Extend Debt Payment can be instrumental in avoiding default and bankruptcy. Such agreements can be formulated with lenders, suppliers, or other creditors to restructure payment terms, offer reduced interest rates, or permit an extended grace period. This helps businesses regain stability, maintain cash flow, and avoid severe financial repercussions. Overview of Maricopa Arizona Agreement to Extend Debt Payment: In a typical Maricopa Arizona Agreement to Extend Debt Payment, certain critical aspects are addressed to ensure transparency and fairness for both parties involved. Some key components that may be detailed within this agreement include: 1. Updated Payment Schedule: — The revised agreement stipulates a new payment schedule, accommodating the extended timeframe to meet debt obligations. This may occur through more manageable monthly installments, quarterly payments, or another agreed-upon payment frequency. 2. Interest and Penalties: — In certain cases, creditors may impose additional interest charges or penalties due to the extended payment duration. These terms are clearly outlined within the agreement to ensure complete understanding by the borrower. 3. Legal Validity: — The Maricopa Arizona Agreement to Extend Debt Payment holds legally-binding status, acknowledging the rights and responsibilities of both parties. This helps safeguard the interests of both the borrower and the creditor. Benefits of Maricopa Arizona Agreement to Extend Debt Payment: 1. Financial Relief: — By extending debt payment, borrowers can temporarily reduce their immediate financial burdens, allowing them breathing space to improve their financial situation. 2. Avoidance of Default: — Agreements to extend debt payment help borrowers stay on track and avoid default on their obligations, preserving their creditworthiness and avoiding potential legal consequences. 3. Improved Relations with Creditors: — Entering into such agreements demonstrates a borrower's commitment to fulfilling their repayment obligations. This willingness can foster positive relationships with creditors, potentially leading to future financial arrangements. Conclusion: Maricopa, Arizona Agreements to Extend Debt Payment provide a lifeline for individuals and businesses who require extra time to repay their debts. With various types available, borrowers can select agreements that align with their specific needs. These agreements mitigate immediate financial pressures, protect creditworthiness, and lay the groundwork for long-term financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.