This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding the Riverside California Agreement to Extend Debt Payment: Types and Implications Introduction: The Riverside California Agreement to Extend Debt Payment is a vital financial solution designed to assist individuals or entities facing difficulties in repaying their debts. This detailed description sheds light on the various types of agreements involved in extending debt payments within Riverside County, California, emphasizing their significance and potential benefits. 1. Riverside County Agreement to Extend Debt Payment: The Riverside County Agreement to Extend Debt Payment is a formal arrangement between a debtor and a creditor, offering the debtor an extended period to repay their debts. The agreement typically outlines customized terms and conditions to accommodate the debtor's financial circumstances while ensuring the creditor remains satisfied. 2. Personal Riverside County Agreement to Extend Debt Payment: A personal Riverside County Agreement to Extend Debt Payment is tailored for individuals who encounter challenges in meeting their financial obligations. This agreement allows for a revised repayment schedule, often spanning over an extended period, granting the debtor more time to settle their debts while avoiding default or bankruptcy. 3. Business Riverside County Agreement to Extend Debt Payment: The business Riverside County Agreement to Extend Debt Payment is specifically designed to assist struggling businesses or companies facing financial distress. It facilitates a restructuring of the debt repayment plan, granting the business additional time to stabilize their financial operations while making regular payments to creditors. 4. Key Benefits of Riverside County Agreement to Extend Debt Payment: — Improved cash flow management: The agreement enables debtors to better manage their finances by extending payment deadlines, reducing the strain on cash flow. — Increased likelihood of debt repayment: Debtors are more likely to fulfill their obligations when given a longer repayment period, reducing the risk of default. — Avoidance of legal actions: By proactively entering into an agreement to extend debt payment, debtors can prevent potential legal actions from creditors, such as lawsuits or asset seizure. — Preservation of credit score: Meeting extended debt payment terms helps debtors maintain a positive credit rating, thus ensuring future access to financial resources. 5. Process of Entering into a Riverside County Agreement to Extend Debt Payment: — Assessment of financial situation: Debtors must evaluate their financial capabilities and determine if they require an extension to repay their debts. — Communication with creditors: Contacting the creditor and discussing the possibility of an extended payment plan is crucial, allowing for negotiations and agreement establishment. — Drafting the agreement: Once both parties agree to extend debt payment, a formal agreement is drafted, highlighting the revised terms, new payment schedule, and any associated conditions. — Execution and compliance: The debtor and creditor must sign the agreement, demonstrating commitment, and adhering to the agreed-upon terms until the debt is fully settled. Conclusion: The Riverside California Agreement to Extend Debt Payment provides a lifeline for debtors facing challenging financial circumstances while promoting fairness and creditor satisfaction. Understanding the different types of agreements, such as personal and business arrangements, as well as their benefits, empowers individuals and entities within Riverside County to tackle their debt with improved financial stability.Title: Understanding the Riverside California Agreement to Extend Debt Payment: Types and Implications Introduction: The Riverside California Agreement to Extend Debt Payment is a vital financial solution designed to assist individuals or entities facing difficulties in repaying their debts. This detailed description sheds light on the various types of agreements involved in extending debt payments within Riverside County, California, emphasizing their significance and potential benefits. 1. Riverside County Agreement to Extend Debt Payment: The Riverside County Agreement to Extend Debt Payment is a formal arrangement between a debtor and a creditor, offering the debtor an extended period to repay their debts. The agreement typically outlines customized terms and conditions to accommodate the debtor's financial circumstances while ensuring the creditor remains satisfied. 2. Personal Riverside County Agreement to Extend Debt Payment: A personal Riverside County Agreement to Extend Debt Payment is tailored for individuals who encounter challenges in meeting their financial obligations. This agreement allows for a revised repayment schedule, often spanning over an extended period, granting the debtor more time to settle their debts while avoiding default or bankruptcy. 3. Business Riverside County Agreement to Extend Debt Payment: The business Riverside County Agreement to Extend Debt Payment is specifically designed to assist struggling businesses or companies facing financial distress. It facilitates a restructuring of the debt repayment plan, granting the business additional time to stabilize their financial operations while making regular payments to creditors. 4. Key Benefits of Riverside County Agreement to Extend Debt Payment: — Improved cash flow management: The agreement enables debtors to better manage their finances by extending payment deadlines, reducing the strain on cash flow. — Increased likelihood of debt repayment: Debtors are more likely to fulfill their obligations when given a longer repayment period, reducing the risk of default. — Avoidance of legal actions: By proactively entering into an agreement to extend debt payment, debtors can prevent potential legal actions from creditors, such as lawsuits or asset seizure. — Preservation of credit score: Meeting extended debt payment terms helps debtors maintain a positive credit rating, thus ensuring future access to financial resources. 5. Process of Entering into a Riverside County Agreement to Extend Debt Payment: — Assessment of financial situation: Debtors must evaluate their financial capabilities and determine if they require an extension to repay their debts. — Communication with creditors: Contacting the creditor and discussing the possibility of an extended payment plan is crucial, allowing for negotiations and agreement establishment. — Drafting the agreement: Once both parties agree to extend debt payment, a formal agreement is drafted, highlighting the revised terms, new payment schedule, and any associated conditions. — Execution and compliance: The debtor and creditor must sign the agreement, demonstrating commitment, and adhering to the agreed-upon terms until the debt is fully settled. Conclusion: The Riverside California Agreement to Extend Debt Payment provides a lifeline for debtors facing challenging financial circumstances while promoting fairness and creditor satisfaction. Understanding the different types of agreements, such as personal and business arrangements, as well as their benefits, empowers individuals and entities within Riverside County to tackle their debt with improved financial stability.

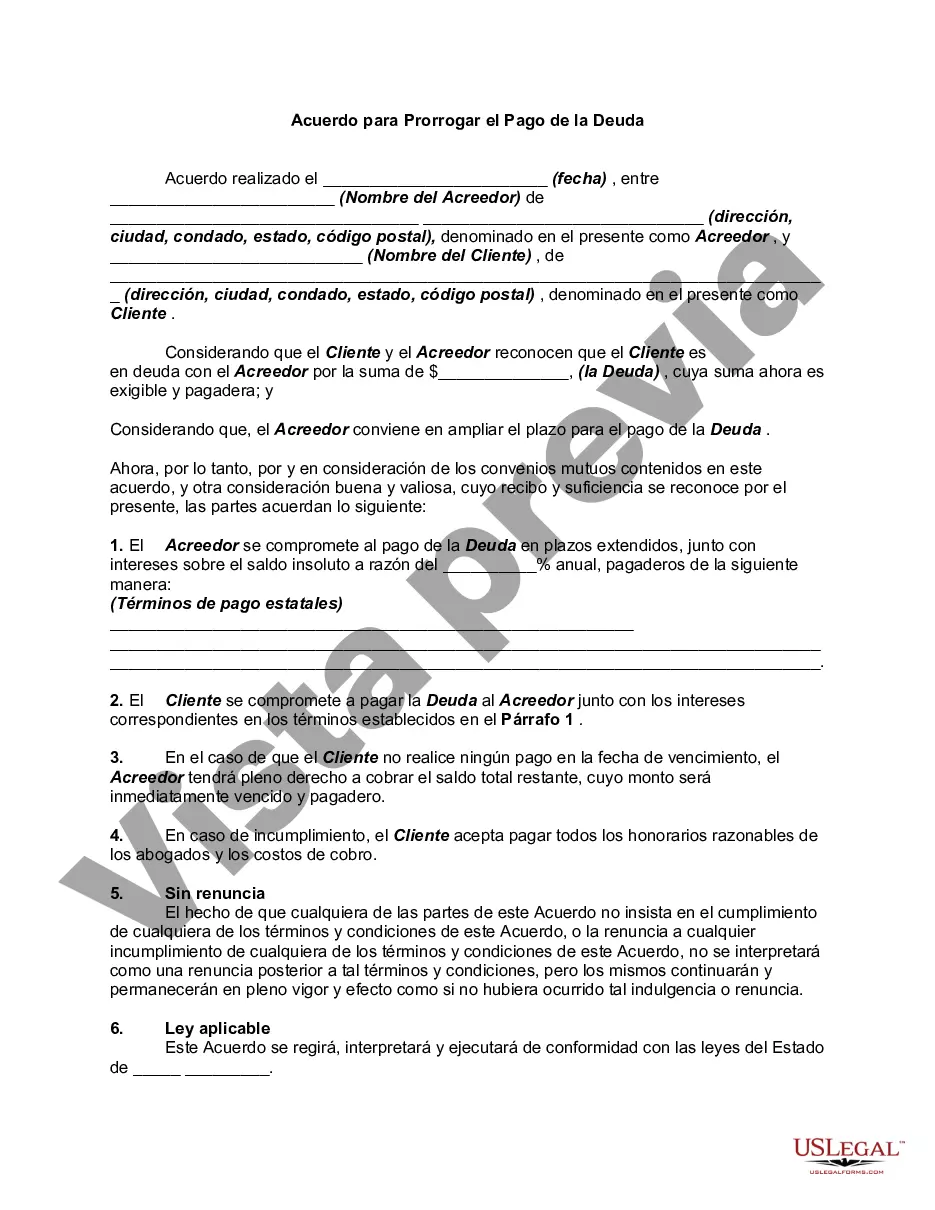

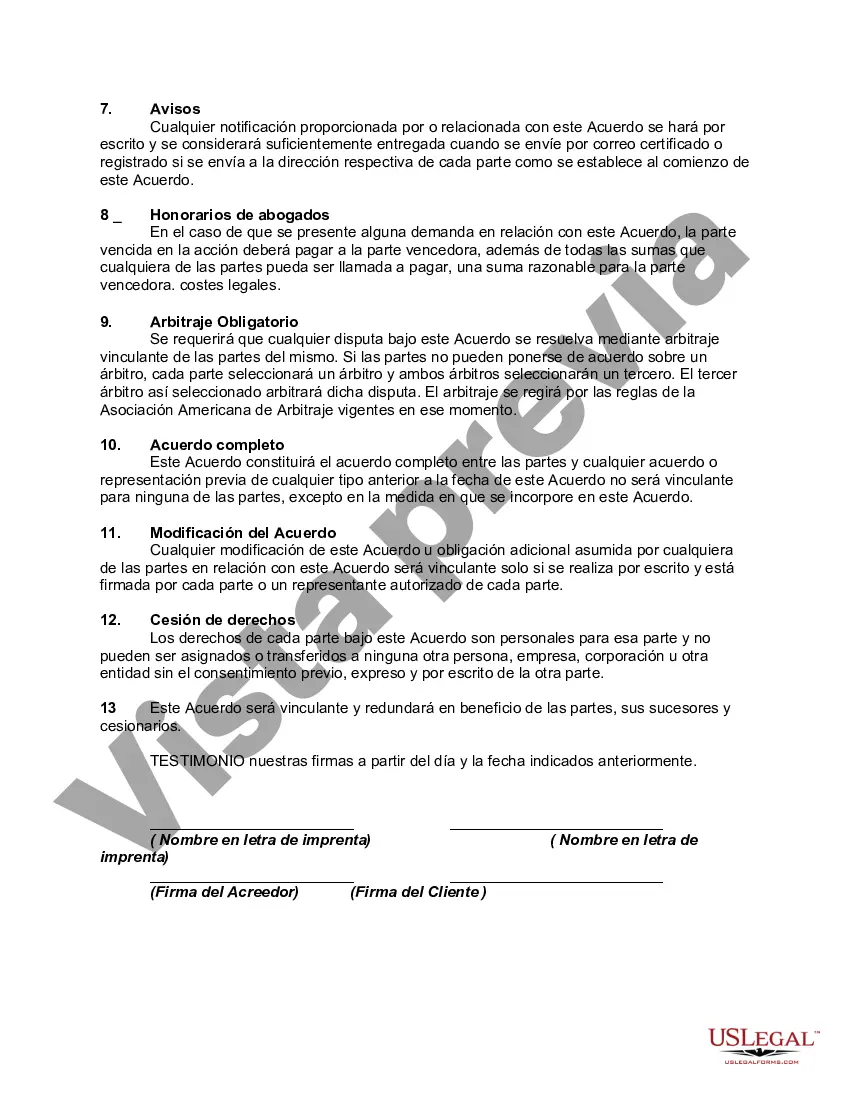

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.