This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

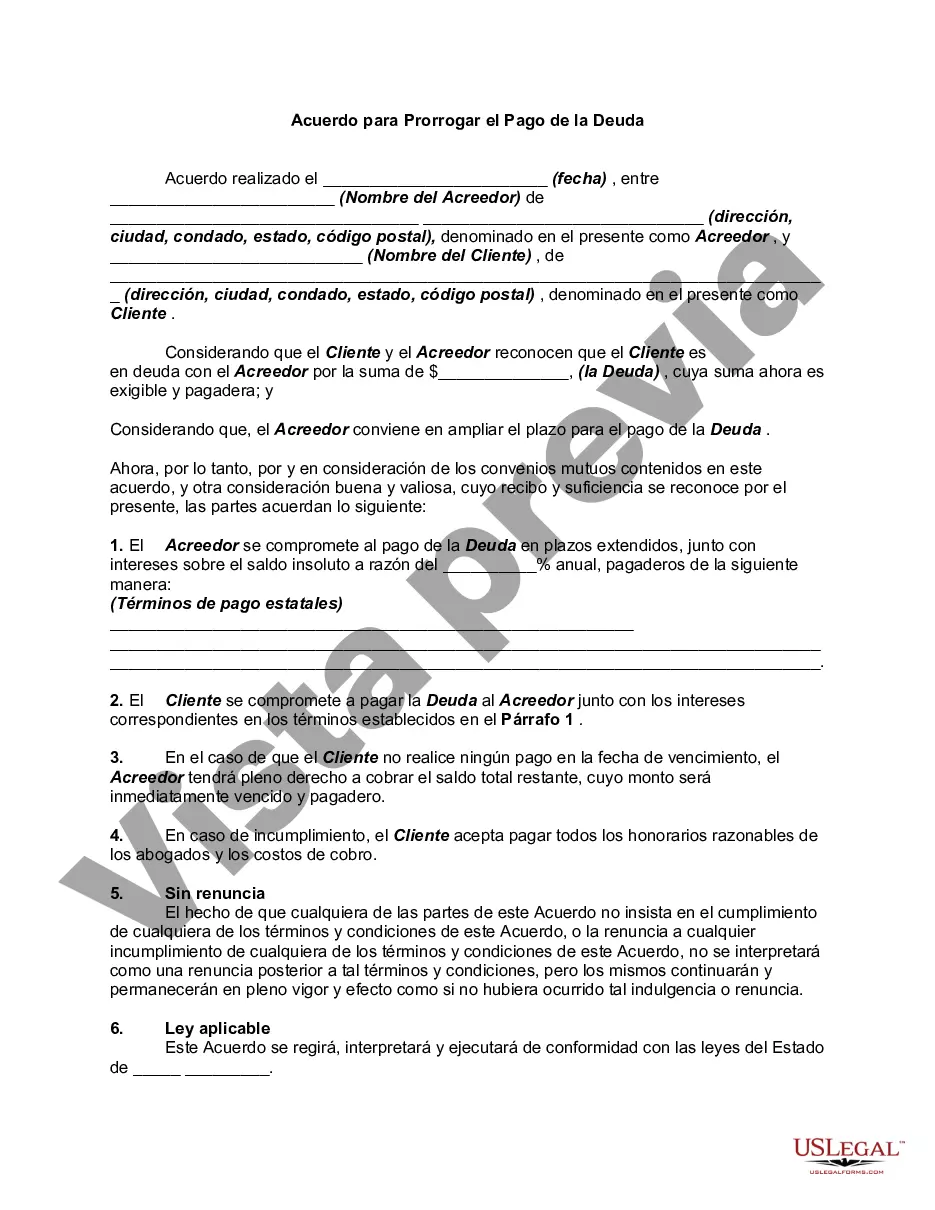

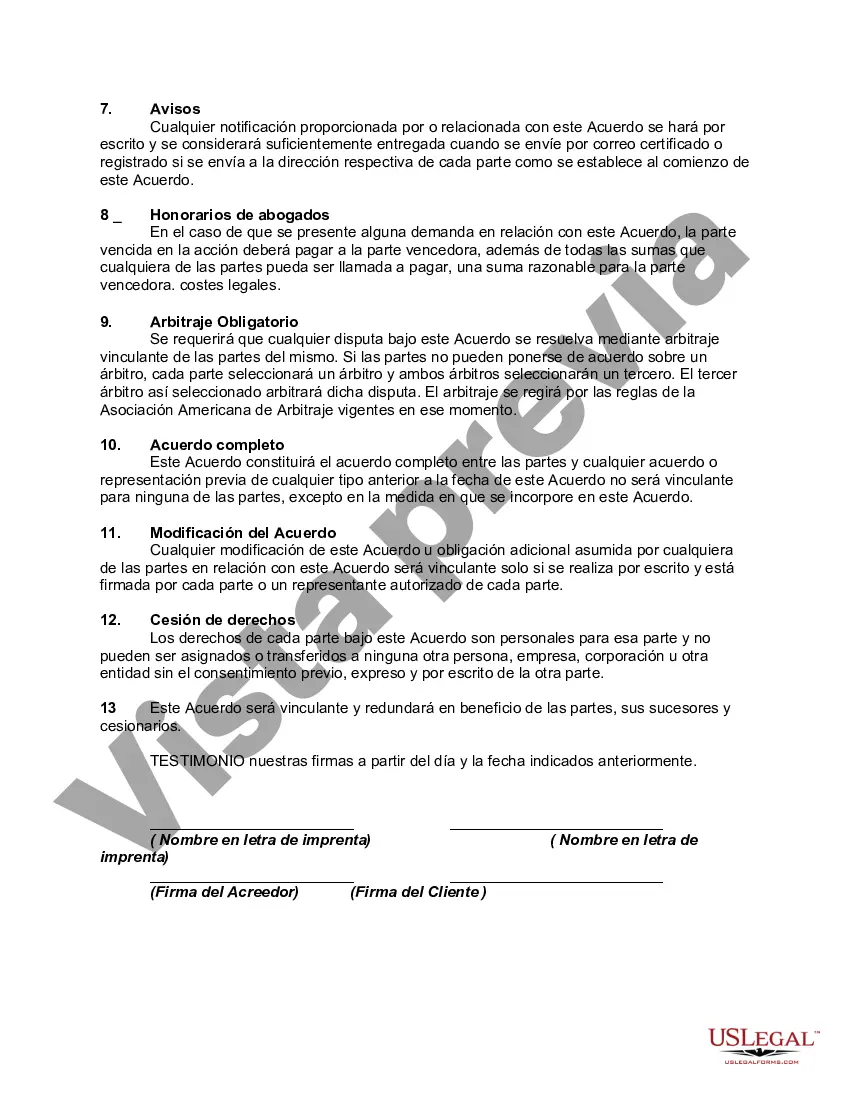

The Santa Clara California Agreement to Extend Debt Payment refers to a contractual arrangement aimed at extending the timeline for debt payment in the region of Santa Clara, California. This agreement allows individuals, businesses, or organizations to negotiate an extension period for settling their outstanding debts with creditors or lenders. It offers a mechanism to prevent default, bankruptcy, or serious financial consequences for debtors who might be facing temporary financial difficulties. This type of agreement helps create a more favorable and manageable financial situation for debtors, offering them flexibility and breathing room to effectively address their financial obligations. By extending the repayment term, debtors can alleviate immediate financial strain and potentially avoid severe consequences, including foreclosure, repossession, or legal actions initiated by creditors. There are various types of Santa Clara California Agreements to Extend Debt Payment designed to meet the specific needs and circumstances of individuals or businesses, including: 1. Personal/agreement: This type of agreement is tailored to individuals seeking financial relief for personal debts such as credit card bills, medical expenses, or student loans. It allows them to negotiate with creditors to extend the repayment period, potentially reducing monthly payments or interest rates. 2. Business/agreement: Businesses facing financial hardships and struggling to meet their debt obligations can opt for this type of agreement. It enables businesses to restructure their debts, renegotiate payment terms, or obtain additional funding to alleviate financial strain and maintain ongoing operations. 3. Mortgage/agreement: Homeowners in Santa Clara, California, encountering difficulties in making their mortgage payments can utilize this agreement to negotiate an extended repayment term with their lenders. By doing so, they can avoid foreclosure and potential eviction while working towards financial stability. 4. Loan/agreement: Borrowers with outstanding loans who are unable to make timely payments can opt for a loan extension agreement. This arrangement allows for a reevaluation of the loan terms, such as interest rates, repayment period, or monthly installments, thereby providing temporary relief during financial hardships. The Santa Clara California Agreement to Extend Debt Payment grants debtors an opportunity to regain control of their financial situation without resorting to drastic measures like bankruptcy. It enables debtors and creditors to work collaboratively to find mutually beneficial solutions, benefiting both parties in the long run. By providing debtors the chance to restructure their repayment plans, this agreement promotes financial stability, protects credit scores, and helps avoid the disruptive consequences of default.The Santa Clara California Agreement to Extend Debt Payment refers to a contractual arrangement aimed at extending the timeline for debt payment in the region of Santa Clara, California. This agreement allows individuals, businesses, or organizations to negotiate an extension period for settling their outstanding debts with creditors or lenders. It offers a mechanism to prevent default, bankruptcy, or serious financial consequences for debtors who might be facing temporary financial difficulties. This type of agreement helps create a more favorable and manageable financial situation for debtors, offering them flexibility and breathing room to effectively address their financial obligations. By extending the repayment term, debtors can alleviate immediate financial strain and potentially avoid severe consequences, including foreclosure, repossession, or legal actions initiated by creditors. There are various types of Santa Clara California Agreements to Extend Debt Payment designed to meet the specific needs and circumstances of individuals or businesses, including: 1. Personal/agreement: This type of agreement is tailored to individuals seeking financial relief for personal debts such as credit card bills, medical expenses, or student loans. It allows them to negotiate with creditors to extend the repayment period, potentially reducing monthly payments or interest rates. 2. Business/agreement: Businesses facing financial hardships and struggling to meet their debt obligations can opt for this type of agreement. It enables businesses to restructure their debts, renegotiate payment terms, or obtain additional funding to alleviate financial strain and maintain ongoing operations. 3. Mortgage/agreement: Homeowners in Santa Clara, California, encountering difficulties in making their mortgage payments can utilize this agreement to negotiate an extended repayment term with their lenders. By doing so, they can avoid foreclosure and potential eviction while working towards financial stability. 4. Loan/agreement: Borrowers with outstanding loans who are unable to make timely payments can opt for a loan extension agreement. This arrangement allows for a reevaluation of the loan terms, such as interest rates, repayment period, or monthly installments, thereby providing temporary relief during financial hardships. The Santa Clara California Agreement to Extend Debt Payment grants debtors an opportunity to regain control of their financial situation without resorting to drastic measures like bankruptcy. It enables debtors and creditors to work collaboratively to find mutually beneficial solutions, benefiting both parties in the long run. By providing debtors the chance to restructure their repayment plans, this agreement promotes financial stability, protects credit scores, and helps avoid the disruptive consequences of default.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.