This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

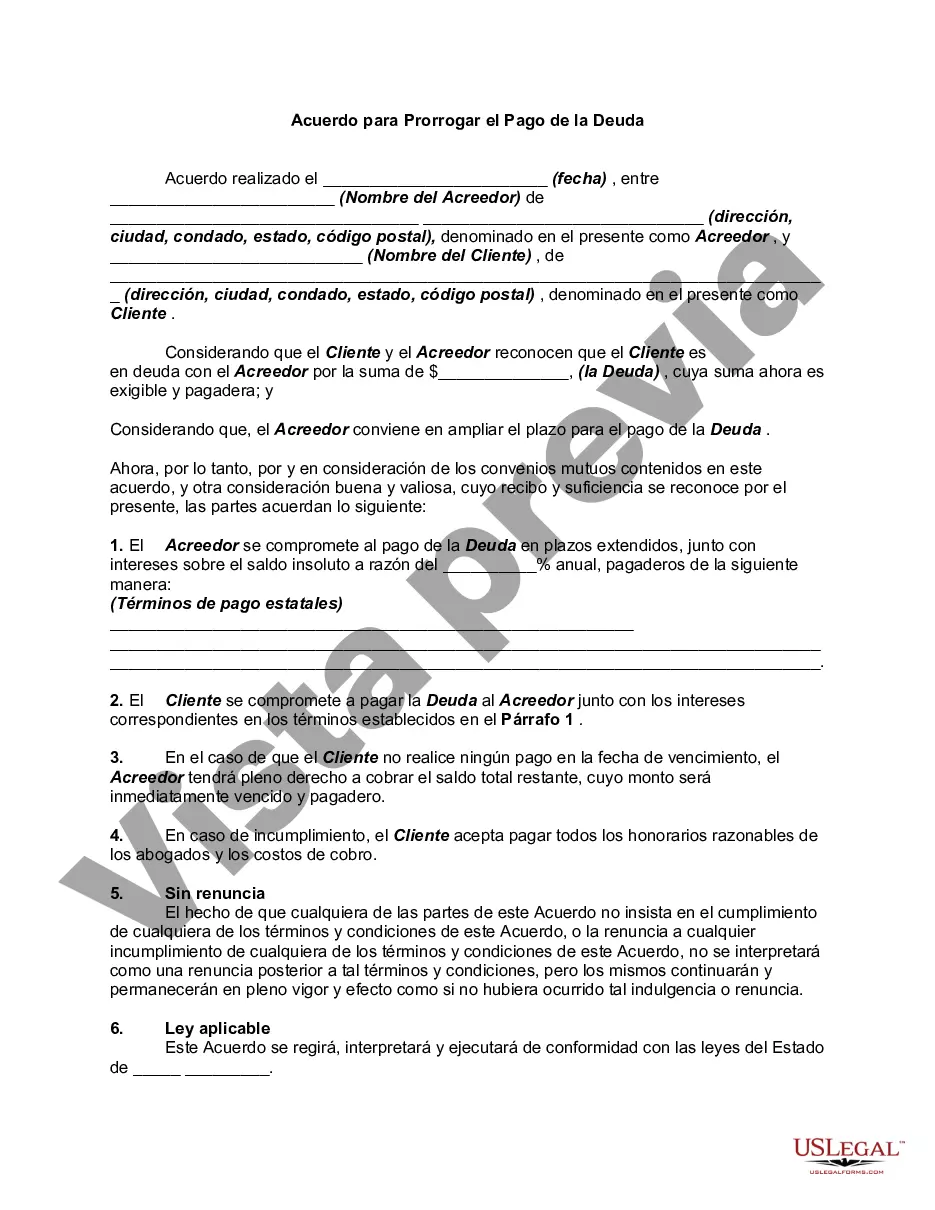

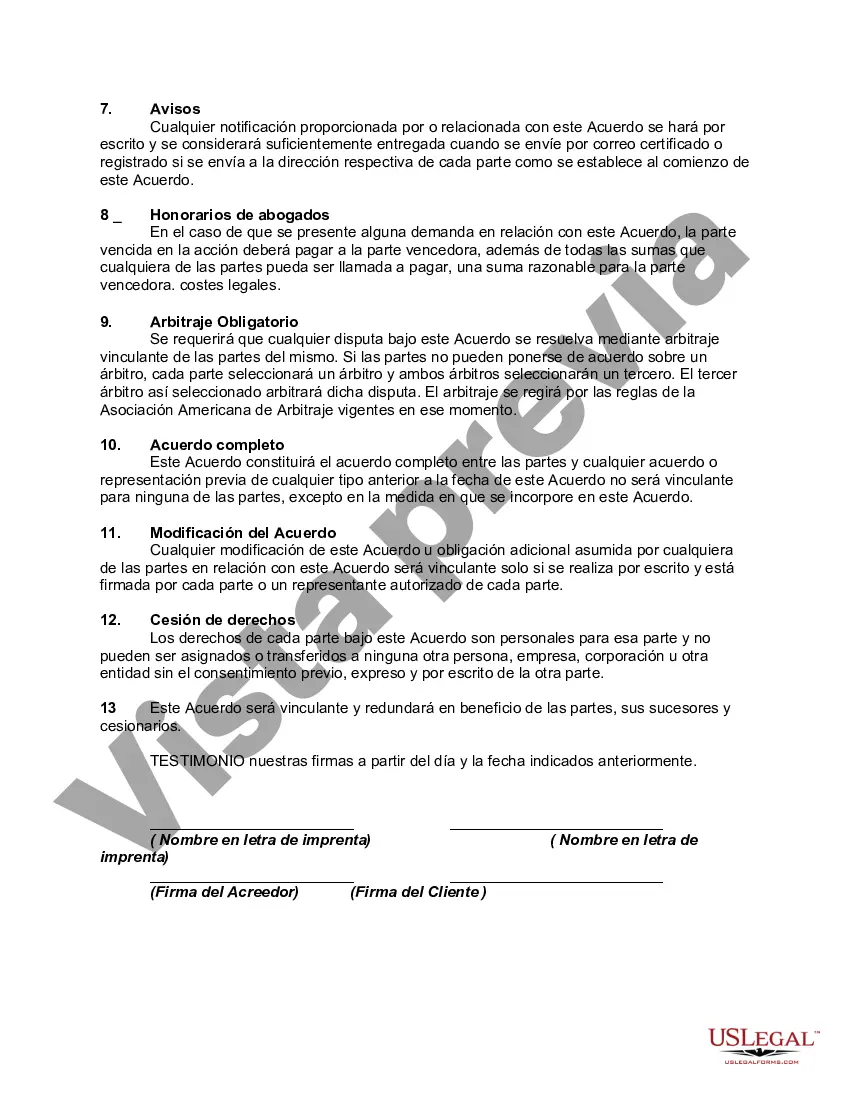

The Suffolk New York Agreement to Extend Debt Payment is a legal agreement that allows individuals or organizations to extend the period in which they must repay their debts. It serves as a solution for borrowers who are experiencing financial difficulties and need more time to meet their financial obligations. The agreement is designed to provide a temporary relief to borrowers by granting them an extension, typically for a fixed period. Under this agreement, the borrower and the lender negotiate and agree upon new terms for repayment, taking into consideration the borrower's financial situation, such as income, expenses, and assets. Different types of Suffolk New York Agreements to Extend Debt Payment include: 1. Personal Debt Extension Agreement: This type of agreement is primarily used by individuals who are struggling with personal loan repayments, credit card debt, or other forms of consumer debt. It allows the borrower to negotiate new repayment terms, such as reduced monthly installments or a longer repayment period. 2. Business Debt Extension Agreement: This agreement is commonly utilized by businesses facing financial challenges, such as cash flow problems or declining sales. The agreement enables the business to renegotiate its debt obligations with lenders and extend the repayment schedule. This extension provides the business with an opportunity to stabilize its finances and continue operating without the burden of immediate payment. 3. Municipal Debt Extension Agreement: Municipalities, such as towns or cities, may also enter into a Suffolk New York Agreement to Extend Debt Payment. This arrangement is used when a municipality is facing fiscal difficulties and requires additional time to repay outstanding debt, such as bonds or loans. The agreement helps the municipality manage its financial obligations while avoiding default. In conclusion, the Suffolk New York Agreement to Extend Debt Payment is a flexible solution that allows borrowers, individuals, businesses, and even municipalities, to extend their debt repayment period. It provides temporary relief to borrowers facing financial challenges by negotiating new repayment terms, ultimately helping them regain financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.