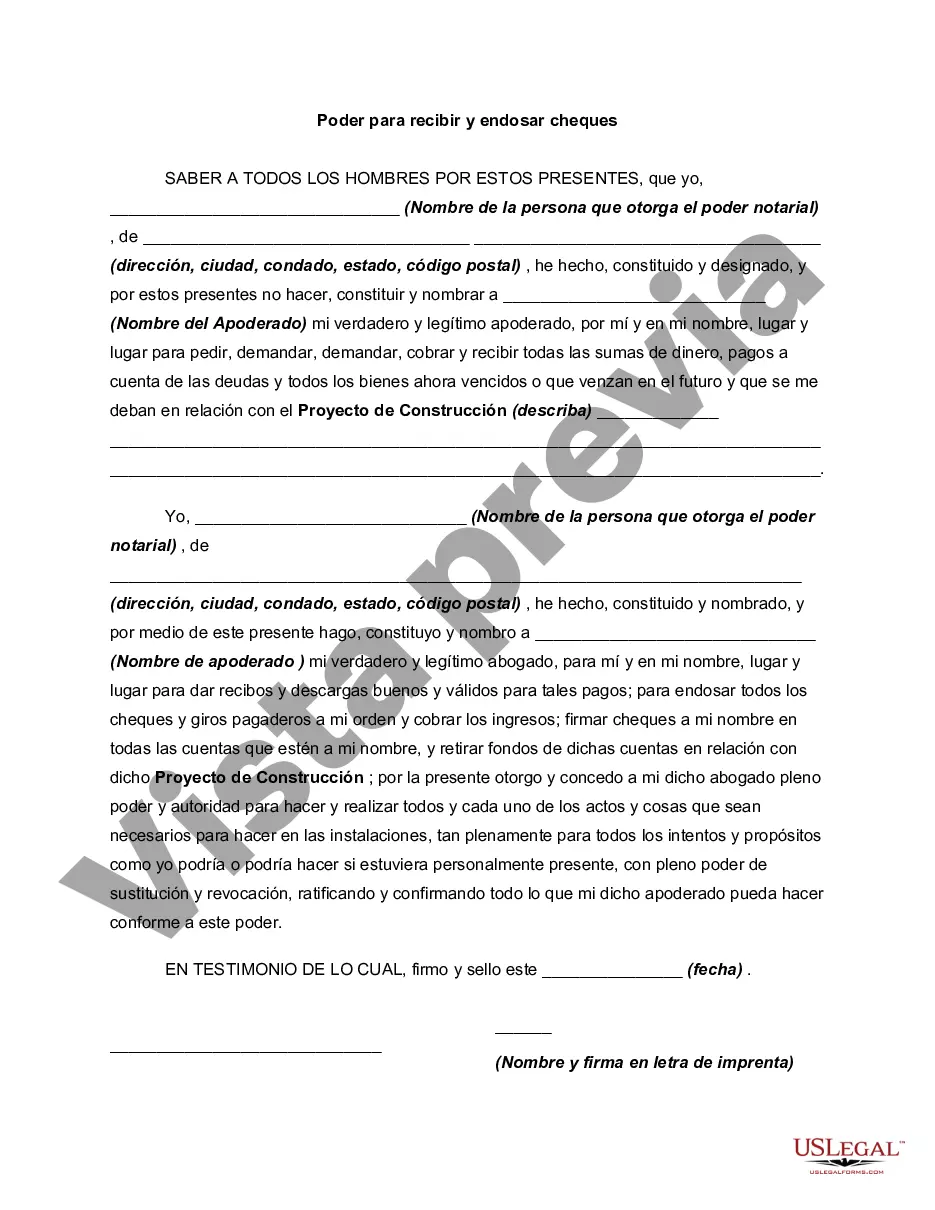

A power of attorney is an instrument containing an authorization for one to act as the agent of the principal. The person appointed is usually called an Attorney-in-Fact. A power of attorney can be either general or limited. This power of attorney is obviously limited.

San Diego, California Power of Attorney to Receive and Endorse Checks: A Comprehensive Guide Power of Attorney (POA) is a legal document that allows an individual, referred to as the principal, to authorize another person, known as the attorney-in-fact or agent, to act on their behalf in financial matters and make legally binding decisions. When it comes to receiving and endorsing checks, a specific type of Power of Attorney is required to ensure smooth and efficient handling of financial transactions. In San Diego, California, there are various types of Power of Attorney to Receive and Endorse Checks, each serving different purposes. Let's explore them in detail. 1. General Power of Attorney: This is a broad authorization that grants the agent the power to handle all financial matters on behalf of the principal, including receiving and endorsing checks. It is often used when the principal expects to be unavailable or incapacitated for an extended period, such as when traveling abroad or undergoing medical treatment. 2. Limited Power of Attorney: Unlike a general POA, a limited POA grants the agent authority over specific tasks or transactions only. In the context of receiving and endorsing checks, a limited POA may be created to give the agent the power to handle a particular account or handle checks related to a specific business or property. 3. Special Power of Attorney: This type of POA provides the agent the authority to handle a specific task or transaction, such as receiving and endorsing checks, but is usually limited in scope or timeframe. For instance, if the principal is involved in a legal case or business transaction and requires someone to handle checks on their behalf temporarily, a special POA can be created for that purpose. 4. Durable Power of Attorney: A durable POA remains in effect even if the principal becomes incapacitated or mentally incompetent. This type of POA is essential when it comes to receiving and endorsing checks, as it ensures continuous management of finances if the principal becomes unable to handle their affairs independently. 5. Springing Power of Attorney: A springing POA becomes effective only upon the occurrence of a specific event, typically when the principal becomes incapacitated. It allows the agent to receive and endorse checks once the trigger event occurs, providing a safeguard against unauthorized access to the principal's finances before the need arises. When establishing a San Diego, California Power of Attorney to Receive and Endorse Checks, it is crucial to consult an experienced attorney who specializes in estate planning and understands the state's legal requirements. This ensures that the POA document aligns with specific needs and adheres to California's laws and regulations. By designating someone trustworthy as your attorney-in-fact and granting them the power to receive and endorse checks on your behalf, you can have peace of mind knowing that your financial matters will be handled efficiently, even when you are unable to do so.San Diego, California Power of Attorney to Receive and Endorse Checks: A Comprehensive Guide Power of Attorney (POA) is a legal document that allows an individual, referred to as the principal, to authorize another person, known as the attorney-in-fact or agent, to act on their behalf in financial matters and make legally binding decisions. When it comes to receiving and endorsing checks, a specific type of Power of Attorney is required to ensure smooth and efficient handling of financial transactions. In San Diego, California, there are various types of Power of Attorney to Receive and Endorse Checks, each serving different purposes. Let's explore them in detail. 1. General Power of Attorney: This is a broad authorization that grants the agent the power to handle all financial matters on behalf of the principal, including receiving and endorsing checks. It is often used when the principal expects to be unavailable or incapacitated for an extended period, such as when traveling abroad or undergoing medical treatment. 2. Limited Power of Attorney: Unlike a general POA, a limited POA grants the agent authority over specific tasks or transactions only. In the context of receiving and endorsing checks, a limited POA may be created to give the agent the power to handle a particular account or handle checks related to a specific business or property. 3. Special Power of Attorney: This type of POA provides the agent the authority to handle a specific task or transaction, such as receiving and endorsing checks, but is usually limited in scope or timeframe. For instance, if the principal is involved in a legal case or business transaction and requires someone to handle checks on their behalf temporarily, a special POA can be created for that purpose. 4. Durable Power of Attorney: A durable POA remains in effect even if the principal becomes incapacitated or mentally incompetent. This type of POA is essential when it comes to receiving and endorsing checks, as it ensures continuous management of finances if the principal becomes unable to handle their affairs independently. 5. Springing Power of Attorney: A springing POA becomes effective only upon the occurrence of a specific event, typically when the principal becomes incapacitated. It allows the agent to receive and endorse checks once the trigger event occurs, providing a safeguard against unauthorized access to the principal's finances before the need arises. When establishing a San Diego, California Power of Attorney to Receive and Endorse Checks, it is crucial to consult an experienced attorney who specializes in estate planning and understands the state's legal requirements. This ensures that the POA document aligns with specific needs and adheres to California's laws and regulations. By designating someone trustworthy as your attorney-in-fact and granting them the power to receive and endorse checks on your behalf, you can have peace of mind knowing that your financial matters will be handled efficiently, even when you are unable to do so.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.