When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Title: Cuyahoga, Ohio: A Comprehensive Guide and Sample Letter to Credit Card Companies Seeking Lower Payments Introduction: Cuyahoga County, located in the state of Ohio, is a vibrant region with a diverse population and a bustling economy. However, like many other places, individuals in Cuyahoga County may experience financial difficulties, which can lead to challenges in keeping up with credit card payments. In such situations, writing a well-crafted letter to credit card companies seeking to lower payments is crucial. This article aims to provide a detailed description of Cuyahoga, Ohio, while also offering various types of sample letters to assist individuals facing financial hardships. 1. Cuyahoga, Ohio: An Overview — Understand the geography, demographics, and key features of Cuyahoga County, Ohio. — Highlight the economic landscape and industries that drive the region's economy. — Provide relevant facts and statistics about Cuyahoga County to present a holistic view. 2. Financial Difficulties in Cuyahoga County — Discuss common financial challenges faced by individuals in Cuyahoga County. — Address specific issues contributing to financial difficulties, like unemployment rates, medical expenses, and other related factors. — Explain the impact of these difficulties on credit card payments. 3. Sample Letter to Credit Card Company Seeking a Lower Payment Plan — Briefly introduce the purpose of the letter, i.e., requesting a reduction in credit card payments. — Emphasize the individual's financial hardship and the specific reasons for seeking relief. — Detail the current financial situation, including income, expenses, and outstanding debts. — Explain why a lower payment plan is necessary and how it can help the individual regain financial stability. — Express gratitude for the credit card company's understanding and cooperation. 4. Additional Types of Cuyahoga Ohio Letters to Credit Card Companies — Sample Letter Requesting a Temporary Forbearance Program: Exploring a temporary suspension of credit card payments. — Sample Letter Seeking an Interest Rate Reduction: Requesting a lower interest rate to alleviate the burden of credit card debt. — Sample Letter Examining Alternative Repayment Options: Proposing alternative repayment plans, such as consolidated payments or long-term installments. Conclusion: Facing financial difficulties can be challenging, but taking proactive steps like writing a detailed letter to credit card companies seeking lower payments can make a significant difference. By understanding the nuances of Cuyahoga, Ohio, and utilizing various sample letters tailored to specific needs, individuals in financial distress can increase their chances of finding relief and regaining control over their financial situations.Title: Cuyahoga, Ohio: A Comprehensive Guide and Sample Letter to Credit Card Companies Seeking Lower Payments Introduction: Cuyahoga County, located in the state of Ohio, is a vibrant region with a diverse population and a bustling economy. However, like many other places, individuals in Cuyahoga County may experience financial difficulties, which can lead to challenges in keeping up with credit card payments. In such situations, writing a well-crafted letter to credit card companies seeking to lower payments is crucial. This article aims to provide a detailed description of Cuyahoga, Ohio, while also offering various types of sample letters to assist individuals facing financial hardships. 1. Cuyahoga, Ohio: An Overview — Understand the geography, demographics, and key features of Cuyahoga County, Ohio. — Highlight the economic landscape and industries that drive the region's economy. — Provide relevant facts and statistics about Cuyahoga County to present a holistic view. 2. Financial Difficulties in Cuyahoga County — Discuss common financial challenges faced by individuals in Cuyahoga County. — Address specific issues contributing to financial difficulties, like unemployment rates, medical expenses, and other related factors. — Explain the impact of these difficulties on credit card payments. 3. Sample Letter to Credit Card Company Seeking a Lower Payment Plan — Briefly introduce the purpose of the letter, i.e., requesting a reduction in credit card payments. — Emphasize the individual's financial hardship and the specific reasons for seeking relief. — Detail the current financial situation, including income, expenses, and outstanding debts. — Explain why a lower payment plan is necessary and how it can help the individual regain financial stability. — Express gratitude for the credit card company's understanding and cooperation. 4. Additional Types of Cuyahoga Ohio Letters to Credit Card Companies — Sample Letter Requesting a Temporary Forbearance Program: Exploring a temporary suspension of credit card payments. — Sample Letter Seeking an Interest Rate Reduction: Requesting a lower interest rate to alleviate the burden of credit card debt. — Sample Letter Examining Alternative Repayment Options: Proposing alternative repayment plans, such as consolidated payments or long-term installments. Conclusion: Facing financial difficulties can be challenging, but taking proactive steps like writing a detailed letter to credit card companies seeking lower payments can make a significant difference. By understanding the nuances of Cuyahoga, Ohio, and utilizing various sample letters tailored to specific needs, individuals in financial distress can increase their chances of finding relief and regaining control over their financial situations.

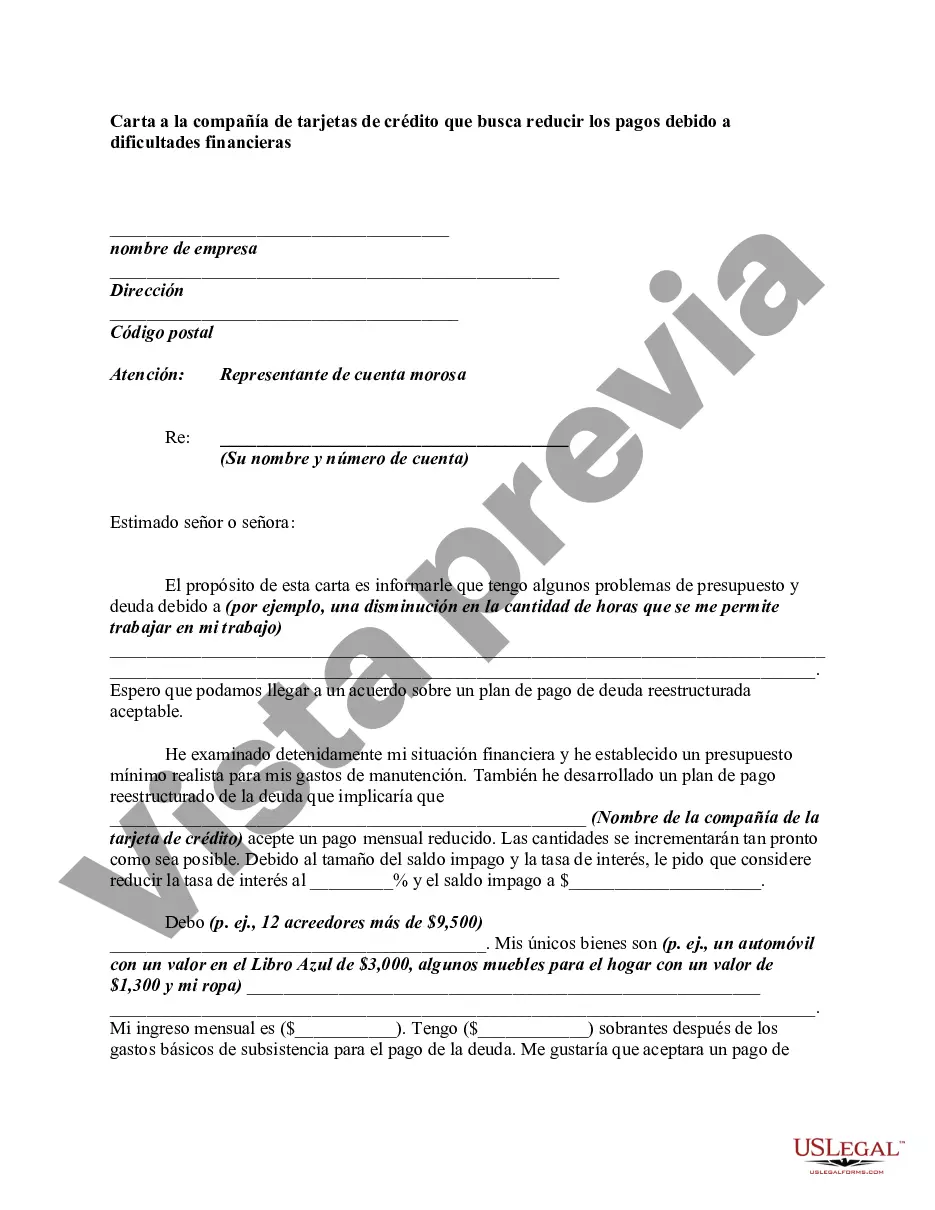

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.