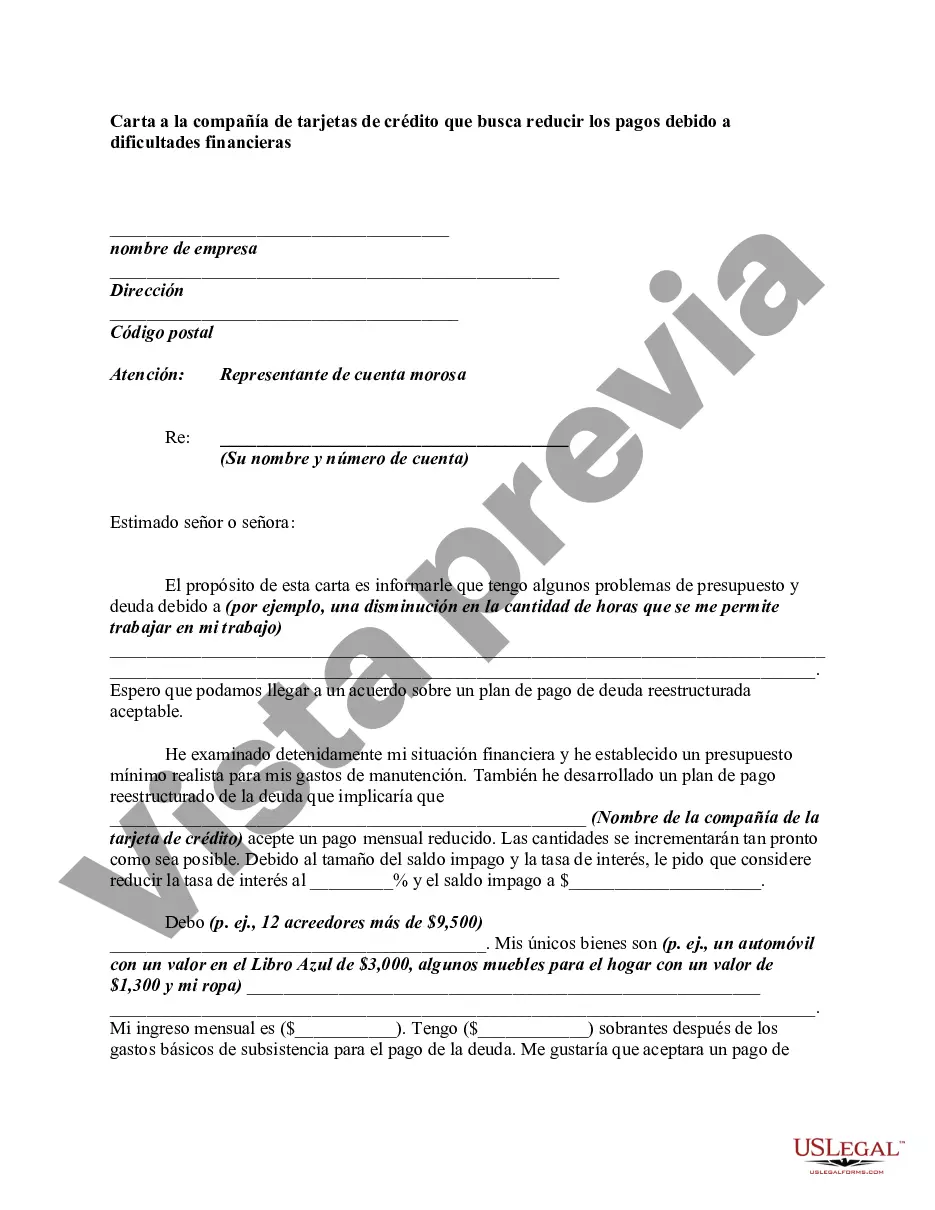

When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Hennepin County, Minnesota, located in the state's southeastern region, is home to a diverse population and a vibrant economy. The county is known for its rich history, cultural attractions, and natural beauty. With prominent cities like Minneapolis and St. Paul within its borders, Hennepin County offers a variety of opportunities for residents and visitors alike. When facing financial difficulties, it may become necessary to seek assistance from your credit card company. Writing a Hennepin Minnesota Letter to Credit Card Company Seeking to Lower Payments due to Financial Difficulties can be a crucial step towards finding relief and improving your financial situation. This type of correspondence aims to address the challenges faced by individuals who are struggling to meet their credit card payment obligations. While there may not be specific types of such letters specific to Hennepin County, the content and approach of the letter remain consistent. Here are some relevant keywords to consider when drafting your letter: 1. Financial hardships: Clearly explain the financial difficulties you are experiencing, such as a job loss, medical expenses, or unforeseen circumstances that have impacted your ability to make credit card payments. 2. Debt management: Discuss any efforts you have made to manage your debt, such as seeking professional financial advice or enrolling in a debt management plan. 3. Lower monthly payments: Clearly state your request for a reduction in your monthly credit card payments, emphasizing why it is necessary for your financial stability. 4. Temporary or permanent solution: Depending on your circumstances, you can consider requesting a temporary reduction in payments until your financial situation improves or a permanent adjustment based on your current income and expenses. 5. Payment alternatives: Mention any payment alternatives you may be seeking, such as a lower interest rate or the option to make smaller, more manageable payments over an extended period. 6. Willingness to cooperate: Express your willingness to work with the credit card company to find a mutually beneficial solution, emphasizing your commitment to repaying your debt. Remember to include your account details, contact information, and any supporting documentation regarding your financial difficulties, such as pay stubs, medical bills, or unemployment documents. Writing a Hennepin Minnesota Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties can be a daunting task. However, articulating your situation clearly, providing supporting evidence, and expressing your willingness to cooperate can greatly increase the chances of reaching a favorable agreement with your credit card company.Hennepin County, Minnesota, located in the state's southeastern region, is home to a diverse population and a vibrant economy. The county is known for its rich history, cultural attractions, and natural beauty. With prominent cities like Minneapolis and St. Paul within its borders, Hennepin County offers a variety of opportunities for residents and visitors alike. When facing financial difficulties, it may become necessary to seek assistance from your credit card company. Writing a Hennepin Minnesota Letter to Credit Card Company Seeking to Lower Payments due to Financial Difficulties can be a crucial step towards finding relief and improving your financial situation. This type of correspondence aims to address the challenges faced by individuals who are struggling to meet their credit card payment obligations. While there may not be specific types of such letters specific to Hennepin County, the content and approach of the letter remain consistent. Here are some relevant keywords to consider when drafting your letter: 1. Financial hardships: Clearly explain the financial difficulties you are experiencing, such as a job loss, medical expenses, or unforeseen circumstances that have impacted your ability to make credit card payments. 2. Debt management: Discuss any efforts you have made to manage your debt, such as seeking professional financial advice or enrolling in a debt management plan. 3. Lower monthly payments: Clearly state your request for a reduction in your monthly credit card payments, emphasizing why it is necessary for your financial stability. 4. Temporary or permanent solution: Depending on your circumstances, you can consider requesting a temporary reduction in payments until your financial situation improves or a permanent adjustment based on your current income and expenses. 5. Payment alternatives: Mention any payment alternatives you may be seeking, such as a lower interest rate or the option to make smaller, more manageable payments over an extended period. 6. Willingness to cooperate: Express your willingness to work with the credit card company to find a mutually beneficial solution, emphasizing your commitment to repaying your debt. Remember to include your account details, contact information, and any supporting documentation regarding your financial difficulties, such as pay stubs, medical bills, or unemployment documents. Writing a Hennepin Minnesota Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties can be a daunting task. However, articulating your situation clearly, providing supporting evidence, and expressing your willingness to cooperate can greatly increase the chances of reaching a favorable agreement with your credit card company.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.