When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Title: Seeking Financial Relief: Writing a Detailed Los Angeles, California Letter to Credit Card Company to Lower Payments amidst Financial Difficulties Introduction: In the vibrant city of Los Angeles, California, many individuals find themselves facing financial challenges, making it necessary to seek assistance from credit card companies. This article aims to provide a detailed description of a letter to a credit card company in Los Angeles, California, requesting a reduction in monthly payments due to financial constraints. We will explore various types of letters that can be written, depending on the specific circumstances. 1. Personal Hardship Letter due to Job Loss: In Los Angeles, where employment opportunities are both vast and competitive, a sudden job loss can quickly result in financial instability. Individuals facing unemployment may write a letter expressing their current situation, emphasizing the need for reduced credit card payments while they search for viable employment. 2. Medical Emergency Letter: Los Angeles residents may find themselves burdened with unforeseen medical expenses, which can disrupt their financial equilibrium. For those struggling to manage medical bills, a well-crafted letter can help convey the urgency of the situation, leading to reduced credit card payments until the individual regains financial stability. 3. Economic Downturn Impact Letter: During periods of economic distress, such as a recession or financial crisis, seeking help from credit card providers becomes necessary for many Los Angeles citizens. In this type of letter, individuals can explain how the current economic climate has affected their income, rendering the existing credit card payments unfeasible and requesting temporary relief through lower monthly payment obligations. 4. Natural Disaster Letter: As Los Angeles is prone to various natural disasters like earthquakes and wildfires, residents can encounter significant financial challenges in their aftermath. Individuals impacted by such events can write a letter to credit card companies, outlining their financial hardships due to property damage, loss of income, or increased living expenses. This letter may request a reduction in monthly payments until the affected party can recover and regain financial stability. 5. Temporary Financial Crisis Letter: Temporary financial difficulties can arise from unexpected events such as car accidents, home repairs, or other emergencies. A letter addressing these scenarios can explain the nature of the crisis, highlight the resulting financial strain, and request a temporary reduction in credit card payments until normalcy is achieved. Conclusion: Los Angeles, California, with its diverse population and bustling economy, is not immune to financial hardships that warrant seeking assistance from credit card companies. Writing a well-crafted letter, tailored to specific circumstances, can effectively communicate the need for reduced credit card payments due to financial difficulties. By employing the relevant keywords mentioned above, individuals can create a compelling letter that increases the likelihood of obtaining the much-needed financial relief.Title: Seeking Financial Relief: Writing a Detailed Los Angeles, California Letter to Credit Card Company to Lower Payments amidst Financial Difficulties Introduction: In the vibrant city of Los Angeles, California, many individuals find themselves facing financial challenges, making it necessary to seek assistance from credit card companies. This article aims to provide a detailed description of a letter to a credit card company in Los Angeles, California, requesting a reduction in monthly payments due to financial constraints. We will explore various types of letters that can be written, depending on the specific circumstances. 1. Personal Hardship Letter due to Job Loss: In Los Angeles, where employment opportunities are both vast and competitive, a sudden job loss can quickly result in financial instability. Individuals facing unemployment may write a letter expressing their current situation, emphasizing the need for reduced credit card payments while they search for viable employment. 2. Medical Emergency Letter: Los Angeles residents may find themselves burdened with unforeseen medical expenses, which can disrupt their financial equilibrium. For those struggling to manage medical bills, a well-crafted letter can help convey the urgency of the situation, leading to reduced credit card payments until the individual regains financial stability. 3. Economic Downturn Impact Letter: During periods of economic distress, such as a recession or financial crisis, seeking help from credit card providers becomes necessary for many Los Angeles citizens. In this type of letter, individuals can explain how the current economic climate has affected their income, rendering the existing credit card payments unfeasible and requesting temporary relief through lower monthly payment obligations. 4. Natural Disaster Letter: As Los Angeles is prone to various natural disasters like earthquakes and wildfires, residents can encounter significant financial challenges in their aftermath. Individuals impacted by such events can write a letter to credit card companies, outlining their financial hardships due to property damage, loss of income, or increased living expenses. This letter may request a reduction in monthly payments until the affected party can recover and regain financial stability. 5. Temporary Financial Crisis Letter: Temporary financial difficulties can arise from unexpected events such as car accidents, home repairs, or other emergencies. A letter addressing these scenarios can explain the nature of the crisis, highlight the resulting financial strain, and request a temporary reduction in credit card payments until normalcy is achieved. Conclusion: Los Angeles, California, with its diverse population and bustling economy, is not immune to financial hardships that warrant seeking assistance from credit card companies. Writing a well-crafted letter, tailored to specific circumstances, can effectively communicate the need for reduced credit card payments due to financial difficulties. By employing the relevant keywords mentioned above, individuals can create a compelling letter that increases the likelihood of obtaining the much-needed financial relief.

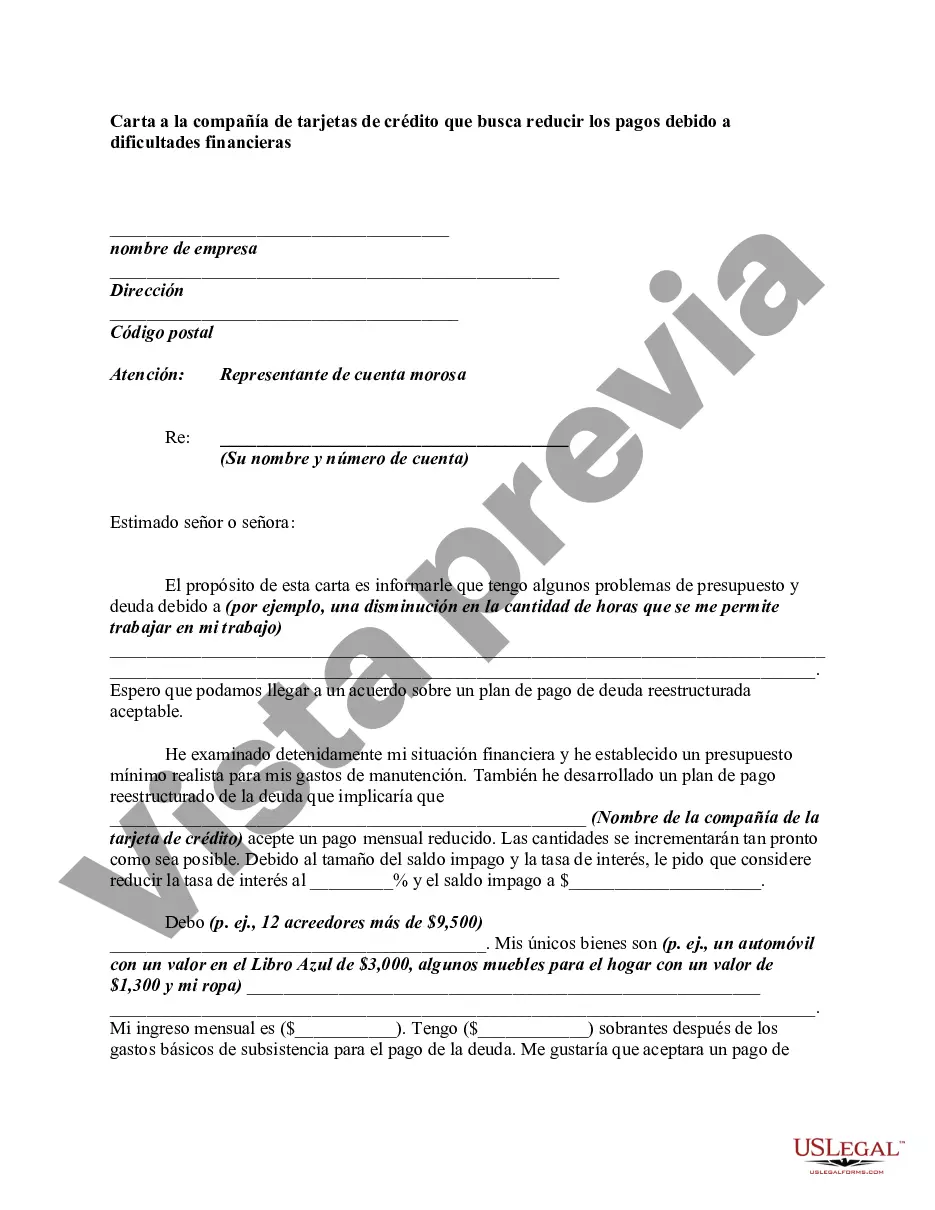

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.