When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Title: Mecklenburg, North Carolina: Seeking Financial Relief — Letter to Credit Card Company Requesting Lower Payments Introduction: Dear [Credit Card Company], I am writing to request your assistance in addressing my current financial difficulties. As a resident of Mecklenburg, North Carolina, I have been facing unexpected challenges that have affected my ability to meet my credit card payments promptly. I hope to discuss potential options that could help alleviate the burden of my financial situation. 1. Mecklenburg North Carolina: Economic Overview Economyom— - Job Market - Industries - Income Levels 2. Financial Challenges Faced by Mecklenburg Residents — Unemployment rate— - Increasing living expenses — Unforeseen circumstances (medical emergencies, natural disasters) — Slow income growth 3. Description of Personal Financial Difficulties — Income reductiolossos— - Medical expenses and health issues — Family emergencies or unexpected life events — Inflation and rising cost— - Balancing multiple financial obligations 4. Explanation of Current Credit Card Situation — Account detail— - Outstanding balances — Monthly payments and interest rate— - Credit history 5. Request for Lower Payments — Reason for seeking financiareliefie— - Discussing the financial strain faced — Expressing commitment to honoring credit obligations despite the difficulties 6. Available Options to Ease Financial Burden — Temporary or permanent payment reduction (lower interest rate or monthly installments) — Extended repaymenPLAla— - Debt consolidation possibilities — Financial counseling and guidance resources — Debt forgiveness or settlement programs (if applicable) 7. Discussion of Potential Long-term Benefits — Willingness to rebuild creditworthiness — Demonstrating responsible financial behavior — Future repayment plans 8. Conclusion and Request for Prompt Action — Gratitude for considerinrequestedes— - Proposal to reach a win-win solution — Request for the credit card company's prompt response (Note: It is important to personalize the letter and provide accurate information specific to one's financial situation while using the above structure as a guideline.) Alternate Type: Mecklenburg North Carolina: Requesting Financial Assistance — Letter to Credit Card Company Explaining Temporary Inability to Make Payments Alternate Type: Mecklenburg North Carolina: Request for Debt Restructuring — Letter to Credit Card Company Seeking a Revised Repayment Plan Alternate Type: Mecklenburg North Carolina: Explaining Financial Crisis — Letter to Credit Card Company Requesting a Temporary Hold on Payments Alternate Type: Mecklenburg North Carolina: Seeking Permanent Payment Reduction — Letter to Credit Card Company Explaining Ongoing Financial Hardship.Title: Mecklenburg, North Carolina: Seeking Financial Relief — Letter to Credit Card Company Requesting Lower Payments Introduction: Dear [Credit Card Company], I am writing to request your assistance in addressing my current financial difficulties. As a resident of Mecklenburg, North Carolina, I have been facing unexpected challenges that have affected my ability to meet my credit card payments promptly. I hope to discuss potential options that could help alleviate the burden of my financial situation. 1. Mecklenburg North Carolina: Economic Overview Economyom— - Job Market - Industries - Income Levels 2. Financial Challenges Faced by Mecklenburg Residents — Unemployment rate— - Increasing living expenses — Unforeseen circumstances (medical emergencies, natural disasters) — Slow income growth 3. Description of Personal Financial Difficulties — Income reductiolossos— - Medical expenses and health issues — Family emergencies or unexpected life events — Inflation and rising cost— - Balancing multiple financial obligations 4. Explanation of Current Credit Card Situation — Account detail— - Outstanding balances — Monthly payments and interest rate— - Credit history 5. Request for Lower Payments — Reason for seeking financiareliefie— - Discussing the financial strain faced — Expressing commitment to honoring credit obligations despite the difficulties 6. Available Options to Ease Financial Burden — Temporary or permanent payment reduction (lower interest rate or monthly installments) — Extended repaymenPLAla— - Debt consolidation possibilities — Financial counseling and guidance resources — Debt forgiveness or settlement programs (if applicable) 7. Discussion of Potential Long-term Benefits — Willingness to rebuild creditworthiness — Demonstrating responsible financial behavior — Future repayment plans 8. Conclusion and Request for Prompt Action — Gratitude for considerinrequestedes— - Proposal to reach a win-win solution — Request for the credit card company's prompt response (Note: It is important to personalize the letter and provide accurate information specific to one's financial situation while using the above structure as a guideline.) Alternate Type: Mecklenburg North Carolina: Requesting Financial Assistance — Letter to Credit Card Company Explaining Temporary Inability to Make Payments Alternate Type: Mecklenburg North Carolina: Request for Debt Restructuring — Letter to Credit Card Company Seeking a Revised Repayment Plan Alternate Type: Mecklenburg North Carolina: Explaining Financial Crisis — Letter to Credit Card Company Requesting a Temporary Hold on Payments Alternate Type: Mecklenburg North Carolina: Seeking Permanent Payment Reduction — Letter to Credit Card Company Explaining Ongoing Financial Hardship.

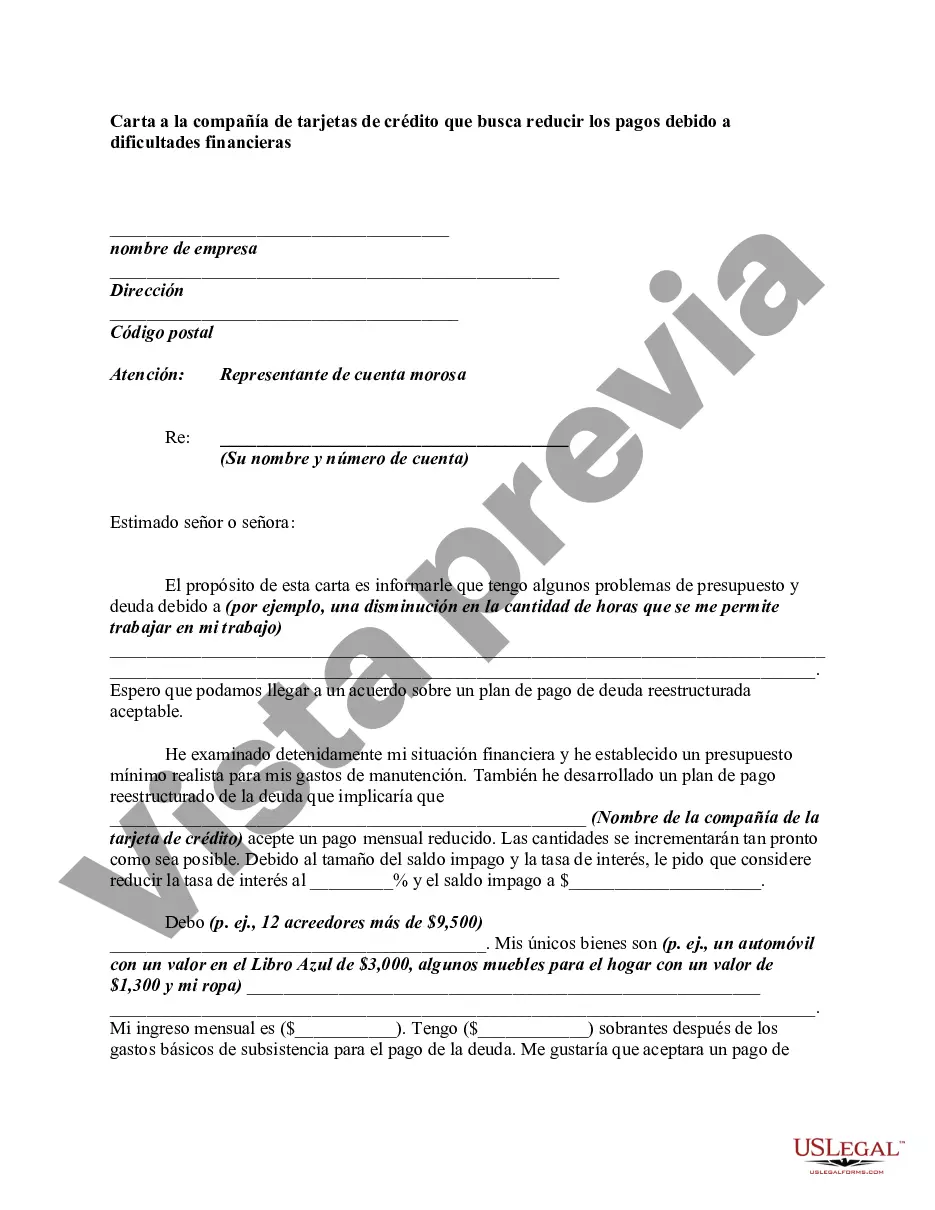

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.