When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Title: Exploring a Comprehensive Phoenix Arizona Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties Keywords: Phoenix Arizona, letter, credit card company, lower payments, financial difficulties Introduction: In this comprehensive guide, we'll explore the details of a Phoenix, Arizona letter to a credit card company seeking to lower payments due to financial difficulties. Phoenix, Arizona, known for its sunny weather and vibrant lifestyle, undoubtedly has a significant number of residents facing financial challenges, requiring them to seek assistance from creditors. We'll delve into the intricacies of crafting this particular letter, addressing various aspects such as the identification of financial difficulties, reasons for seeking lower payments, and potential variations of letters based on individual circumstances. 1. Importance of Addressing Financial Difficulties: — Highlighting the prevalence of financial hardships faced by many Phoenix, Arizona residents — Recognizing the need to address the issue proactively with credit card companies for potential relief — Emphasizing the significance of maintaining open communication channels with creditors 2. Crafting a Convincing Letter: — Expressing gratitude towards the creditor's previous assistance — Detailing the specific financial challenges faced by the individual or family — Providing supporting documentation like income statements, expense breakdowns, or medical bills to substantiate the financial difficulties — Explaining any efforts made to reduce expenses or seek additional income sources 3. Explaining the Need for Lower Payments: — Describing the current unmanageable payment structure and its negative impact — Explaining the potential implications of failing to make payments or resorting to bankruptcy — Requesting a review of the payment terms in light of the individual's financial situation 4. Varying Letters Based on Individual Circumstances: — Letter for individuals facing job loss or reduction in income — Letter for individuals dealing with medical emergencies or high medical expenses — Letter for individuals affected by natural disasters or unforeseen events impacting their finances 5. Communicating a Willingness to Cooperate: — Expressing a genuine intention to resolve the financial challenges — Proposing viable alternatives such as longer payment plans or reduced interest rates — Requesting a hardship plan, debt restructuring, or debt consolidation options if applicable Conclusion: Crafting a Phoenix, Arizona letter to a credit card company seeking to lower payments due to financial difficulties is a crucial step towards mitigating the impact of financial challenges. By honestly explaining the individual's financial situation, outlining the need for lower payments, and proposing viable alternatives, this letter sets the groundwork for a potentially favorable resolution. Remember, maintaining open and sincere communication with credit card companies is not only crucial but also demonstrates a proactive approach towards overcoming financial hardships.Title: Exploring a Comprehensive Phoenix Arizona Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties Keywords: Phoenix Arizona, letter, credit card company, lower payments, financial difficulties Introduction: In this comprehensive guide, we'll explore the details of a Phoenix, Arizona letter to a credit card company seeking to lower payments due to financial difficulties. Phoenix, Arizona, known for its sunny weather and vibrant lifestyle, undoubtedly has a significant number of residents facing financial challenges, requiring them to seek assistance from creditors. We'll delve into the intricacies of crafting this particular letter, addressing various aspects such as the identification of financial difficulties, reasons for seeking lower payments, and potential variations of letters based on individual circumstances. 1. Importance of Addressing Financial Difficulties: — Highlighting the prevalence of financial hardships faced by many Phoenix, Arizona residents — Recognizing the need to address the issue proactively with credit card companies for potential relief — Emphasizing the significance of maintaining open communication channels with creditors 2. Crafting a Convincing Letter: — Expressing gratitude towards the creditor's previous assistance — Detailing the specific financial challenges faced by the individual or family — Providing supporting documentation like income statements, expense breakdowns, or medical bills to substantiate the financial difficulties — Explaining any efforts made to reduce expenses or seek additional income sources 3. Explaining the Need for Lower Payments: — Describing the current unmanageable payment structure and its negative impact — Explaining the potential implications of failing to make payments or resorting to bankruptcy — Requesting a review of the payment terms in light of the individual's financial situation 4. Varying Letters Based on Individual Circumstances: — Letter for individuals facing job loss or reduction in income — Letter for individuals dealing with medical emergencies or high medical expenses — Letter for individuals affected by natural disasters or unforeseen events impacting their finances 5. Communicating a Willingness to Cooperate: — Expressing a genuine intention to resolve the financial challenges — Proposing viable alternatives such as longer payment plans or reduced interest rates — Requesting a hardship plan, debt restructuring, or debt consolidation options if applicable Conclusion: Crafting a Phoenix, Arizona letter to a credit card company seeking to lower payments due to financial difficulties is a crucial step towards mitigating the impact of financial challenges. By honestly explaining the individual's financial situation, outlining the need for lower payments, and proposing viable alternatives, this letter sets the groundwork for a potentially favorable resolution. Remember, maintaining open and sincere communication with credit card companies is not only crucial but also demonstrates a proactive approach towards overcoming financial hardships.

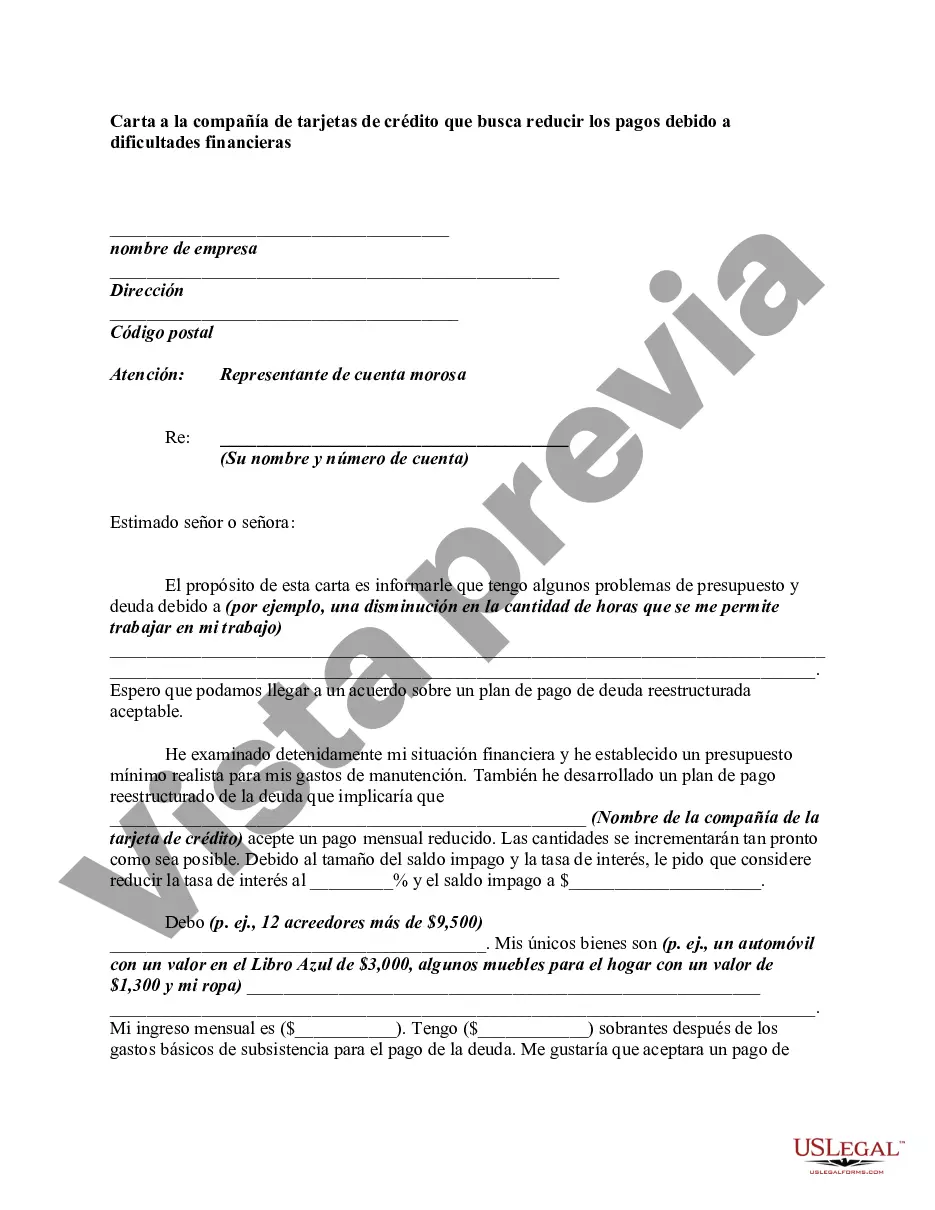

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.