When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Title: San Bernardino, California: A Vibrant City Amid Financial Challenges Introduction: Located in Southern California, San Bernardino is a captivating city known for its scenic landscapes and rich cultural heritage. However, like many other regions, some residents may experience financial hardships that require seeking assistance from credit card companies. In this article, we will explore the various types of letters that San Bernardino residents can write to credit card companies seeking to lower their payments due to financial difficulties. 1. San Bernardino California Letter to Credit Card Company Seeking Temporary Payment Reduction: At times, individuals in San Bernardino may encounter unexpected financial setbacks, such as job loss or medical emergencies, which impact their capacity to repay credit card debt. This type of letter seeks to request a temporary reduction in monthly payments to alleviate immediate financial strain while establishing a plan to eventually resume regular payments. 2. San Bernardino California Letter to Credit Card Company Seeking Negotiated Lower Interest Rate: When managing credit card debt becomes overwhelming, some San Bernardino residents might benefit from negotiating a lower interest rate on their outstanding balances. This letter aims to explain the reasons behind financial difficulties and propose a reduced interest rate to make repayment more manageable. 3. San Bernardino California Letter to Credit Card Company Seeking to Lower Minimum Monthly Payments: For individuals seeking a more long-term solution, a letter requesting a permanent reduction in minimum monthly payments can provide relief and sustainability. This type of letter outlines current financial challenges and seeks to modify payment terms to align with the cardholder's ability to meet their obligations. 4. San Bernardino California Letter to Credit Card Company Seeking a Debt Settlement: In dire financial situations, San Bernardino residents may find it necessary to write a letter requesting a debt settlement from credit card companies. This letter typically offers a lump sum payment or decreased balance in exchange for the account being considered paid in full. It is essential to outline the reasons for financial hardship and propose a reasonable settlement amount. Conclusion: San Bernardino, California, is a city that offers a diverse range of experiences amidst occasional financial difficulties faced by its residents. Writing a well-crafted letter to a credit card company can help individuals in San Bernardino find temporary or long-term relief from financial burdens by seeking lower payments, reduced interest rates, modified payment terms, or debt settlement options. With careful consideration and effective communication, San Bernardino residents can pave the way towards a more stable financial future.Title: San Bernardino, California: A Vibrant City Amid Financial Challenges Introduction: Located in Southern California, San Bernardino is a captivating city known for its scenic landscapes and rich cultural heritage. However, like many other regions, some residents may experience financial hardships that require seeking assistance from credit card companies. In this article, we will explore the various types of letters that San Bernardino residents can write to credit card companies seeking to lower their payments due to financial difficulties. 1. San Bernardino California Letter to Credit Card Company Seeking Temporary Payment Reduction: At times, individuals in San Bernardino may encounter unexpected financial setbacks, such as job loss or medical emergencies, which impact their capacity to repay credit card debt. This type of letter seeks to request a temporary reduction in monthly payments to alleviate immediate financial strain while establishing a plan to eventually resume regular payments. 2. San Bernardino California Letter to Credit Card Company Seeking Negotiated Lower Interest Rate: When managing credit card debt becomes overwhelming, some San Bernardino residents might benefit from negotiating a lower interest rate on their outstanding balances. This letter aims to explain the reasons behind financial difficulties and propose a reduced interest rate to make repayment more manageable. 3. San Bernardino California Letter to Credit Card Company Seeking to Lower Minimum Monthly Payments: For individuals seeking a more long-term solution, a letter requesting a permanent reduction in minimum monthly payments can provide relief and sustainability. This type of letter outlines current financial challenges and seeks to modify payment terms to align with the cardholder's ability to meet their obligations. 4. San Bernardino California Letter to Credit Card Company Seeking a Debt Settlement: In dire financial situations, San Bernardino residents may find it necessary to write a letter requesting a debt settlement from credit card companies. This letter typically offers a lump sum payment or decreased balance in exchange for the account being considered paid in full. It is essential to outline the reasons for financial hardship and propose a reasonable settlement amount. Conclusion: San Bernardino, California, is a city that offers a diverse range of experiences amidst occasional financial difficulties faced by its residents. Writing a well-crafted letter to a credit card company can help individuals in San Bernardino find temporary or long-term relief from financial burdens by seeking lower payments, reduced interest rates, modified payment terms, or debt settlement options. With careful consideration and effective communication, San Bernardino residents can pave the way towards a more stable financial future.

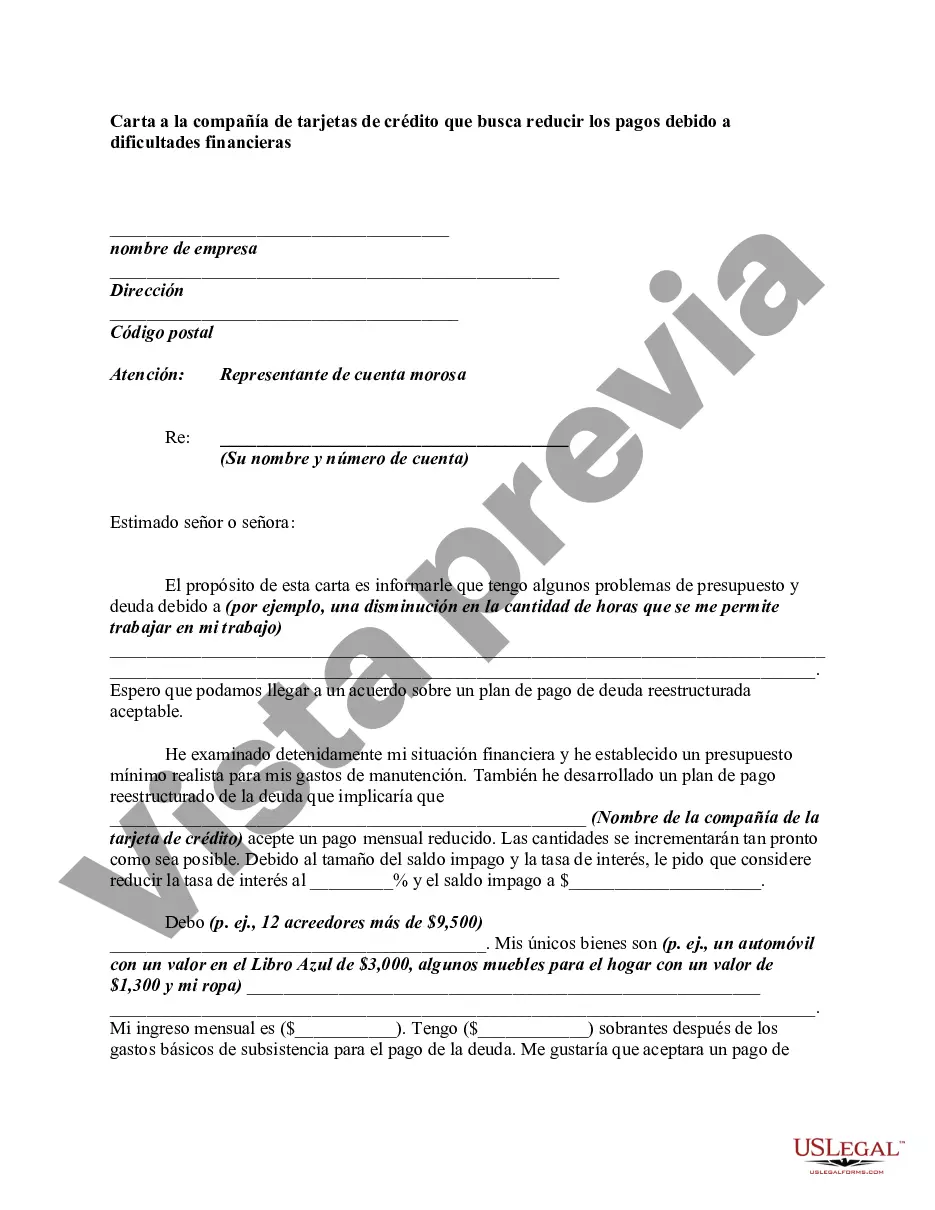

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.