When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

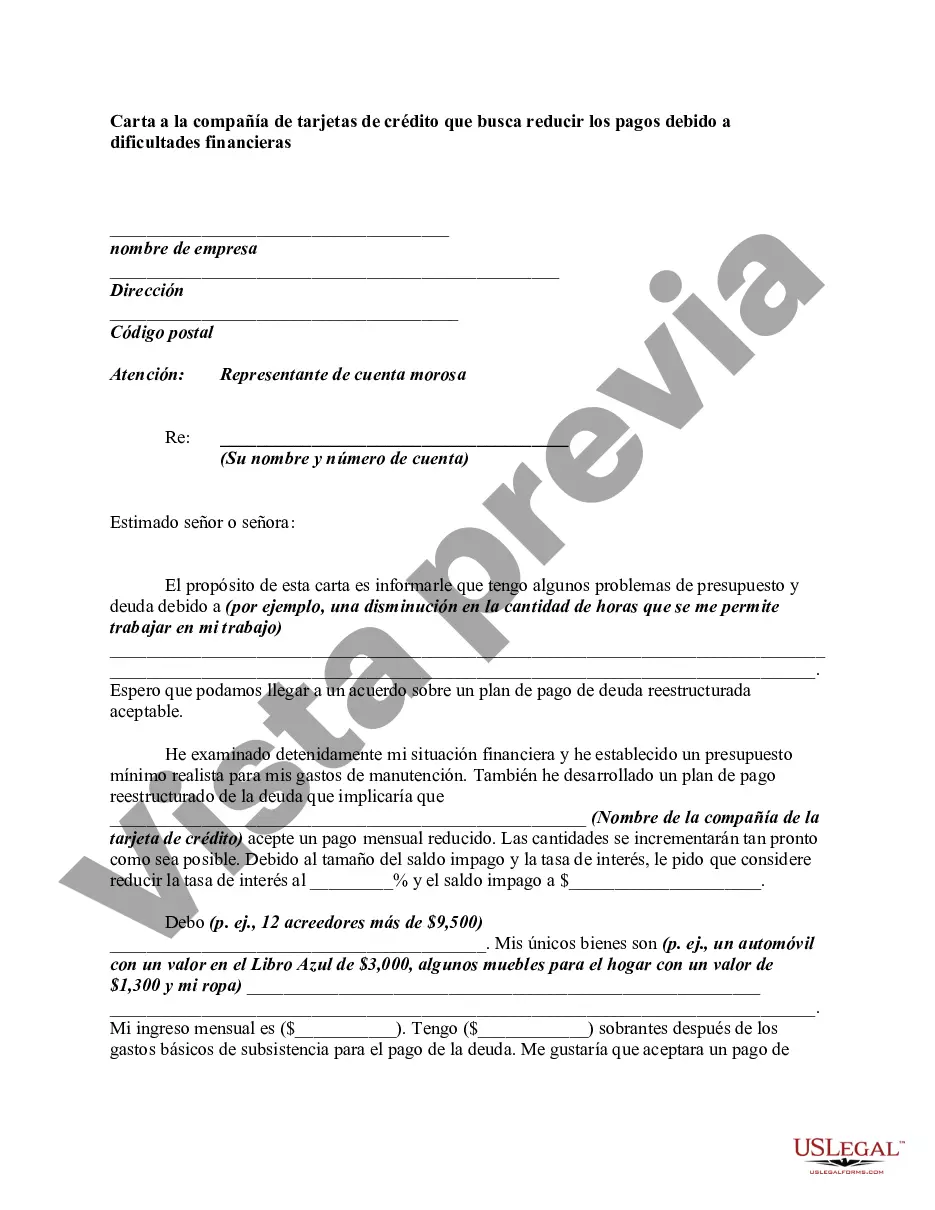

A detailed description of a "Wake North Carolina Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties" aims to provide pertinent keywords and information to help individuals understand the content. Here's an overview: The Wake North Carolina Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties is a formal letter written by individuals residing in or around Wake, North Carolina. The purpose of the letter is to address financial hardships that cardholders face and request a reduction in their credit card payment amount due to their current financial situation. Key elements and keywords for crafting such a letter include: 1. Introduction: Begin the letter by providing the cardholder's name, account number, and contact information. Mention that the letter seeks financial assistance due to difficulties faced in meeting the regular credit card payment obligations. 2. Explanation of Financial Hardships: Elaborate on the specific financial challenges currently being experienced. Examples include job loss, reduced income, medical expenses, divorce, or other unexpected events that have impacted one's ability to meet payment obligations. 3. Request for Lower Payments: Clearly state the objective of the letter — to seek a reduction in credit card payments. Request a feasible payment amount based on the individual's financial situation and resources. It's important to mention the intention to pay off the debt responsibly while seeking temporary relief during the financial stress period. 4. Financial Situation Details: Provide an overview of the current financial state. Highlight any limitations in income, monthly expenses, and outstanding debts that make the current payment obligation unmanageable. 5. Supporting Documentation: Encourage attaching relevant financial documents such as bank statements, income proof, medical bills, or any other evidence that substantiates the financial hardship being faced. 6. Expressing Intent to Maintain Good Standing: Demonstrate the cardholder's commitment to maintaining a positive relationship with the credit card company by emphasizing the desire to fulfill financial obligations once the circumstances improve. Different variations and types of this letter may include: — "Letter to Credit Card Company Seeking Temporary Financial Relief in Wake, North Carolina" — "Wake, NC Letter to Credit Card Company Requesting Payment Plan Modification" — "Credit Card Hardship Letter from Wake, North Carolina Resident Seeking Lower Payments" — "Writing a Letter to Seek Financial Assistance from Credit Card Company in Wake, NC" — "Letter to Credit Card Issuer in Wake, North Carolina Seeking Temporary Payment Reduction due to Financial Hardships".A detailed description of a "Wake North Carolina Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties" aims to provide pertinent keywords and information to help individuals understand the content. Here's an overview: The Wake North Carolina Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties is a formal letter written by individuals residing in or around Wake, North Carolina. The purpose of the letter is to address financial hardships that cardholders face and request a reduction in their credit card payment amount due to their current financial situation. Key elements and keywords for crafting such a letter include: 1. Introduction: Begin the letter by providing the cardholder's name, account number, and contact information. Mention that the letter seeks financial assistance due to difficulties faced in meeting the regular credit card payment obligations. 2. Explanation of Financial Hardships: Elaborate on the specific financial challenges currently being experienced. Examples include job loss, reduced income, medical expenses, divorce, or other unexpected events that have impacted one's ability to meet payment obligations. 3. Request for Lower Payments: Clearly state the objective of the letter — to seek a reduction in credit card payments. Request a feasible payment amount based on the individual's financial situation and resources. It's important to mention the intention to pay off the debt responsibly while seeking temporary relief during the financial stress period. 4. Financial Situation Details: Provide an overview of the current financial state. Highlight any limitations in income, monthly expenses, and outstanding debts that make the current payment obligation unmanageable. 5. Supporting Documentation: Encourage attaching relevant financial documents such as bank statements, income proof, medical bills, or any other evidence that substantiates the financial hardship being faced. 6. Expressing Intent to Maintain Good Standing: Demonstrate the cardholder's commitment to maintaining a positive relationship with the credit card company by emphasizing the desire to fulfill financial obligations once the circumstances improve. Different variations and types of this letter may include: — "Letter to Credit Card Company Seeking Temporary Financial Relief in Wake, North Carolina" — "Wake, NC Letter to Credit Card Company Requesting Payment Plan Modification" — "Credit Card Hardship Letter from Wake, North Carolina Resident Seeking Lower Payments" — "Writing a Letter to Seek Financial Assistance from Credit Card Company in Wake, NC" — "Letter to Credit Card Issuer in Wake, North Carolina Seeking Temporary Payment Reduction due to Financial Hardships".

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.