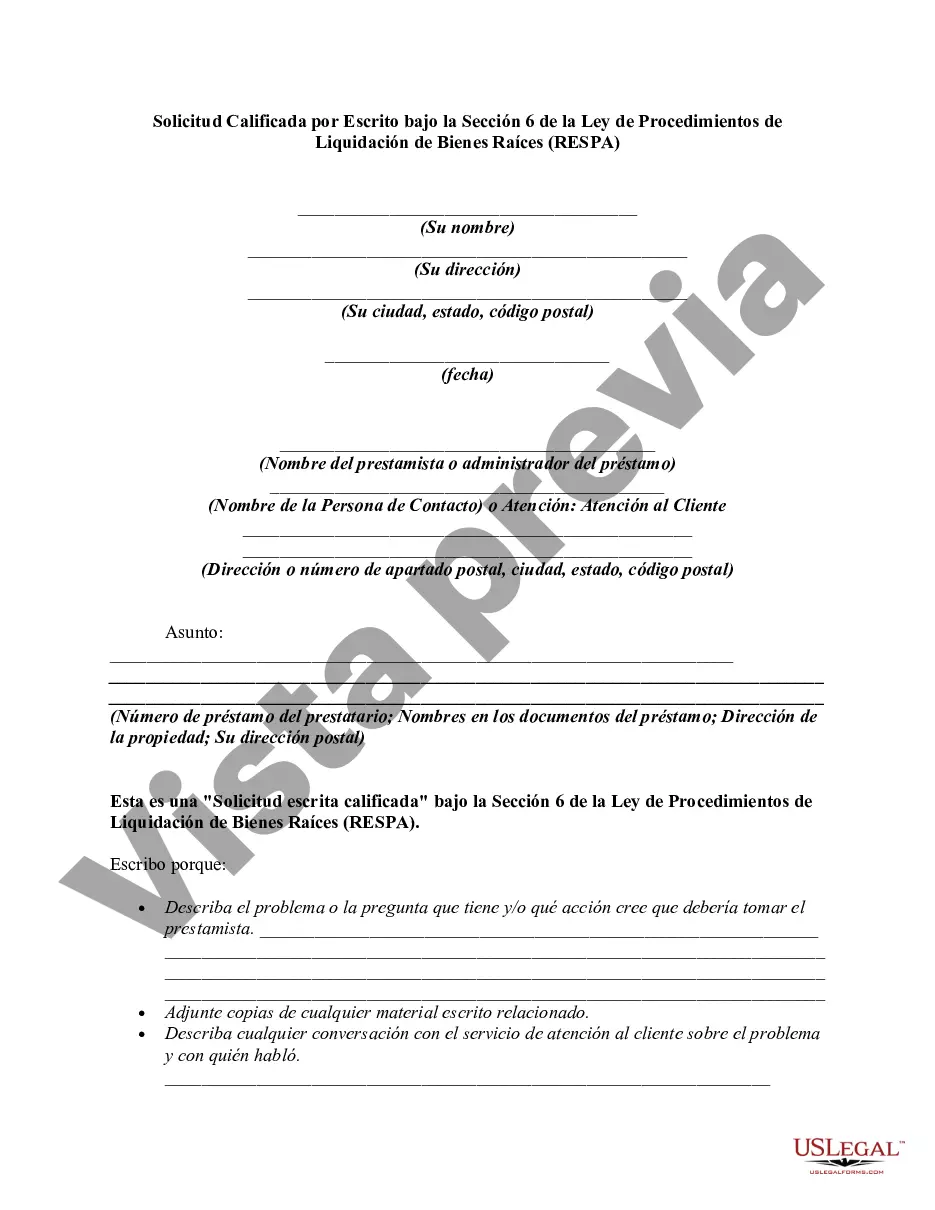

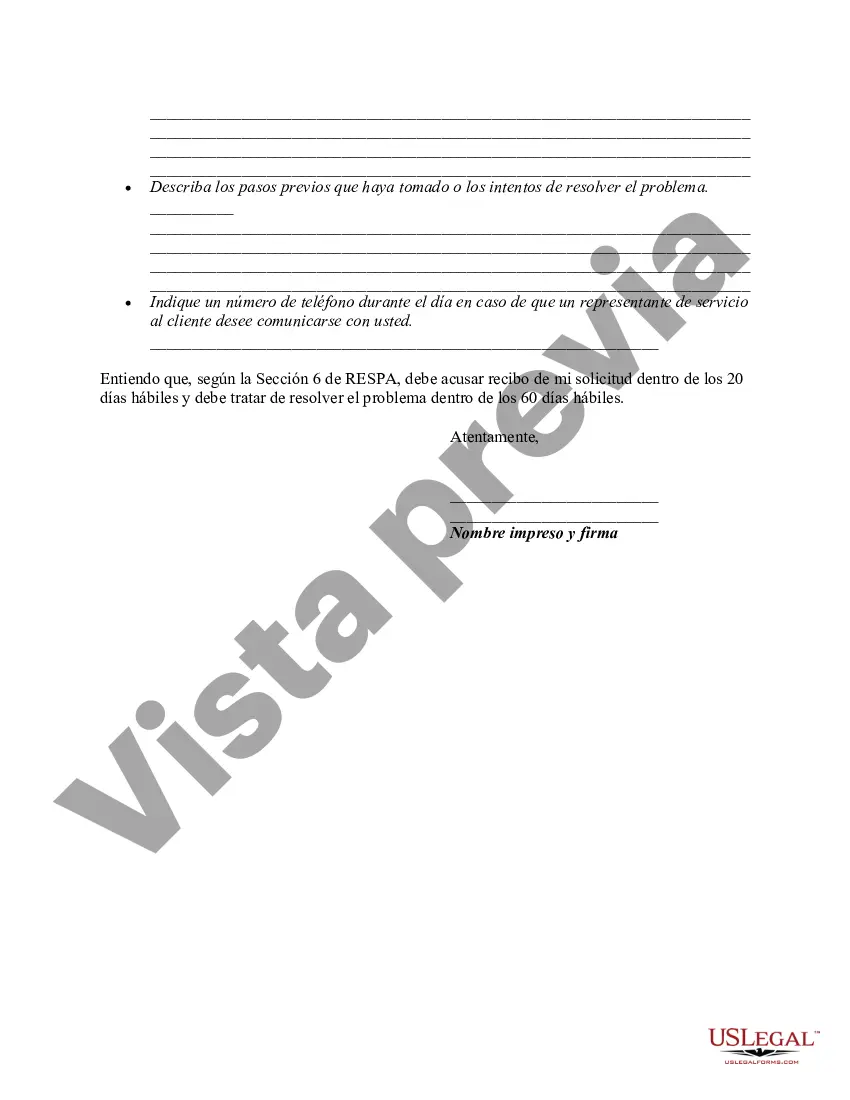

12 USC 2605(e) creates a duty of a loan servicer to respond to the inquiries of borrowers regarding loans covered by RESPA. If the borrower believes there is an error in the mortgage account, he or she can make a "qualified written request" to the loan servicer. The request must be in writing, identify the borrower by name and account, and include a statement of reasons why the borrower believes the account is in error. The request should include the words "qualified written request". It cannot be written on the payment coupon, but must be on a separate piece of paper. The Department of Housing and Urban Development provides a sample letter.

The servicer must acknowledge receipt of the request within 20 days. The servicer then has 60 days (from the request) to take action on the request. The servicer has to either provide a written notification that the error has been corrected, or provide a written explanation as to why the servicer believes the account is correct. Either way, the servicer has to provide the name and telephone number of a person with whom the borrower can discuss the matter.

Fairfax Virginia Qualified Written Request (BWR) under Section 6 of the Real Estate Settlement Procedures Act (RESP) is an essential tool that allows borrowers to request information and address issues related to their mortgage loans. This detailed description will outline the purpose of Was, their statutory requirements, and possible types of Was that can be submitted in Fairfax, Virginia. RESP requires loan services to respond to borrowers' written requests for information and resolve any errors or discrepancies regarding their mortgage accounts. Section 6 of RESP specifically addresses Qualified Written Requests, which provide borrowers with additional legal protections and rights. A Qualified Written Request is a formal written communication submitted by a borrower to their loan service, seeking information or asserting errors about their mortgage loan. A BWR is considered "qualified" if it includes the following elements: 1. The borrower's name, account number, and property address. 2. A clear description of the information being sought or the specific errors identified. 3. Reasonable detail explaining why the borrower believes the loan account is in error or needs clarification. 4. The borrower's contact information, typically including their mailing address and phone number. By submitting a BWR, borrowers in Fairfax, Virginia can request various types of information or address specific concerns related to their mortgage loans. Some common types of Was under Section 6 of RESP include: 1. Statement Requests: Borrowers can request a detailed breakdown of their loan account, including payment history, outstanding principal, interest charges, and escrow activity. 2. Escrow Analysis: In case of discrepancies or concerns regarding escrow payments and calculations, borrowers can submit a BWR to obtain a thorough analysis and explanation. 3. Loan Modification Application: If a borrower is seeking a loan modification or exploring options to modify the terms of their mortgage, they can submit a BWR to initiate the process and gather the necessary information. 4. Foreclosure Prevention: Borrowers facing potential foreclosure can submit a BWR to request detailed information about their default status, foreclosure proceedings, or explore loss mitigation options. It is crucial for borrowers in Fairfax, Virginia to understand their rights and the process of submitting a BWR. The loan service must acknowledge the receipt of a BWR within five business days and must provide a substantive response or resolution within 30 business days, or a maximum of 60 business days in case of certain circumstances. In conclusion, a Fairfax Virginia Qualified Written Request under Section 6 of RESP provides borrowers with a formal avenue to obtain information, address concerns, and potentially resolve issues related to their mortgage loans. By submitting a well-documented BWR, borrowers can empower themselves and navigate the mortgage servicing process more effectively.Fairfax Virginia Qualified Written Request (BWR) under Section 6 of the Real Estate Settlement Procedures Act (RESP) is an essential tool that allows borrowers to request information and address issues related to their mortgage loans. This detailed description will outline the purpose of Was, their statutory requirements, and possible types of Was that can be submitted in Fairfax, Virginia. RESP requires loan services to respond to borrowers' written requests for information and resolve any errors or discrepancies regarding their mortgage accounts. Section 6 of RESP specifically addresses Qualified Written Requests, which provide borrowers with additional legal protections and rights. A Qualified Written Request is a formal written communication submitted by a borrower to their loan service, seeking information or asserting errors about their mortgage loan. A BWR is considered "qualified" if it includes the following elements: 1. The borrower's name, account number, and property address. 2. A clear description of the information being sought or the specific errors identified. 3. Reasonable detail explaining why the borrower believes the loan account is in error or needs clarification. 4. The borrower's contact information, typically including their mailing address and phone number. By submitting a BWR, borrowers in Fairfax, Virginia can request various types of information or address specific concerns related to their mortgage loans. Some common types of Was under Section 6 of RESP include: 1. Statement Requests: Borrowers can request a detailed breakdown of their loan account, including payment history, outstanding principal, interest charges, and escrow activity. 2. Escrow Analysis: In case of discrepancies or concerns regarding escrow payments and calculations, borrowers can submit a BWR to obtain a thorough analysis and explanation. 3. Loan Modification Application: If a borrower is seeking a loan modification or exploring options to modify the terms of their mortgage, they can submit a BWR to initiate the process and gather the necessary information. 4. Foreclosure Prevention: Borrowers facing potential foreclosure can submit a BWR to request detailed information about their default status, foreclosure proceedings, or explore loss mitigation options. It is crucial for borrowers in Fairfax, Virginia to understand their rights and the process of submitting a BWR. The loan service must acknowledge the receipt of a BWR within five business days and must provide a substantive response or resolution within 30 business days, or a maximum of 60 business days in case of certain circumstances. In conclusion, a Fairfax Virginia Qualified Written Request under Section 6 of RESP provides borrowers with a formal avenue to obtain information, address concerns, and potentially resolve issues related to their mortgage loans. By submitting a well-documented BWR, borrowers can empower themselves and navigate the mortgage servicing process more effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.