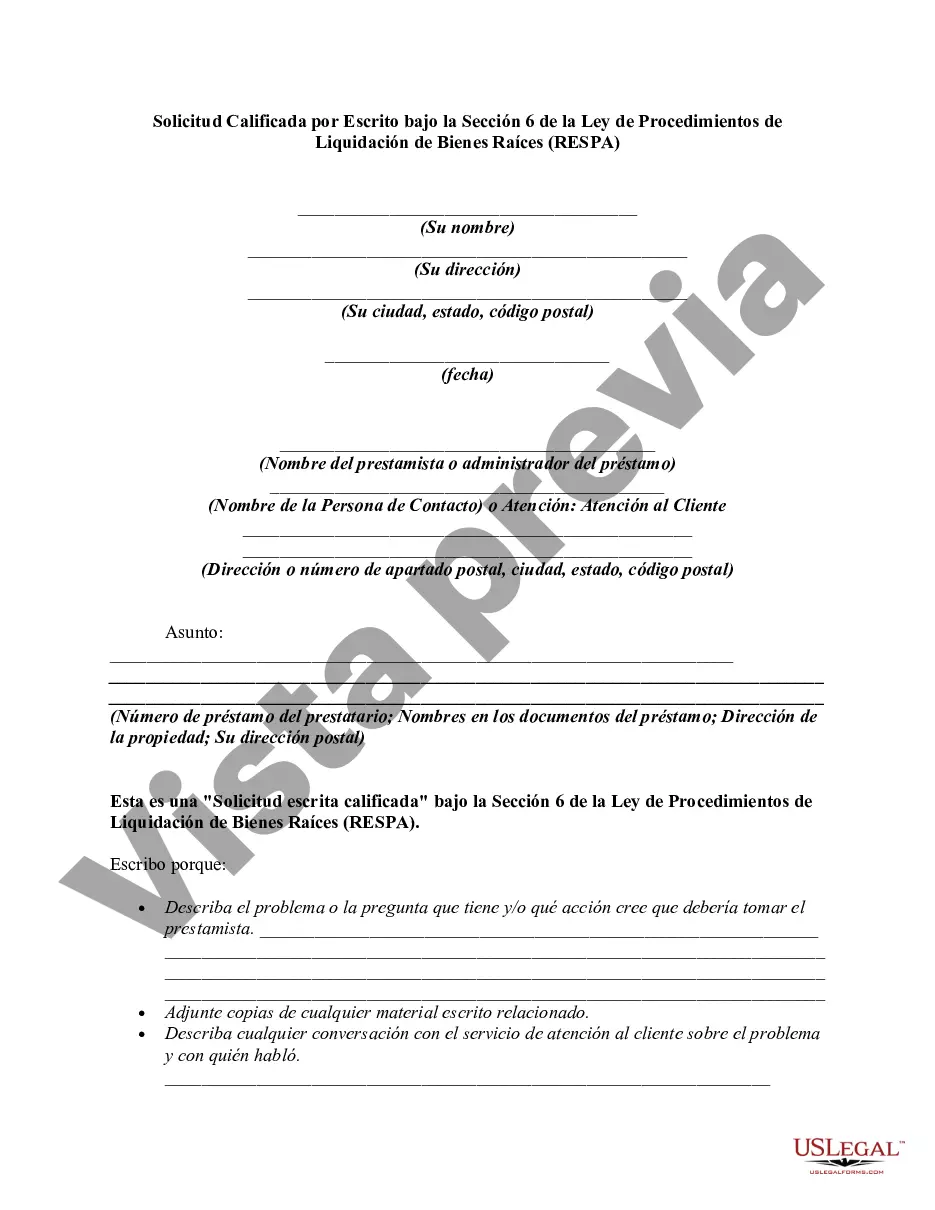

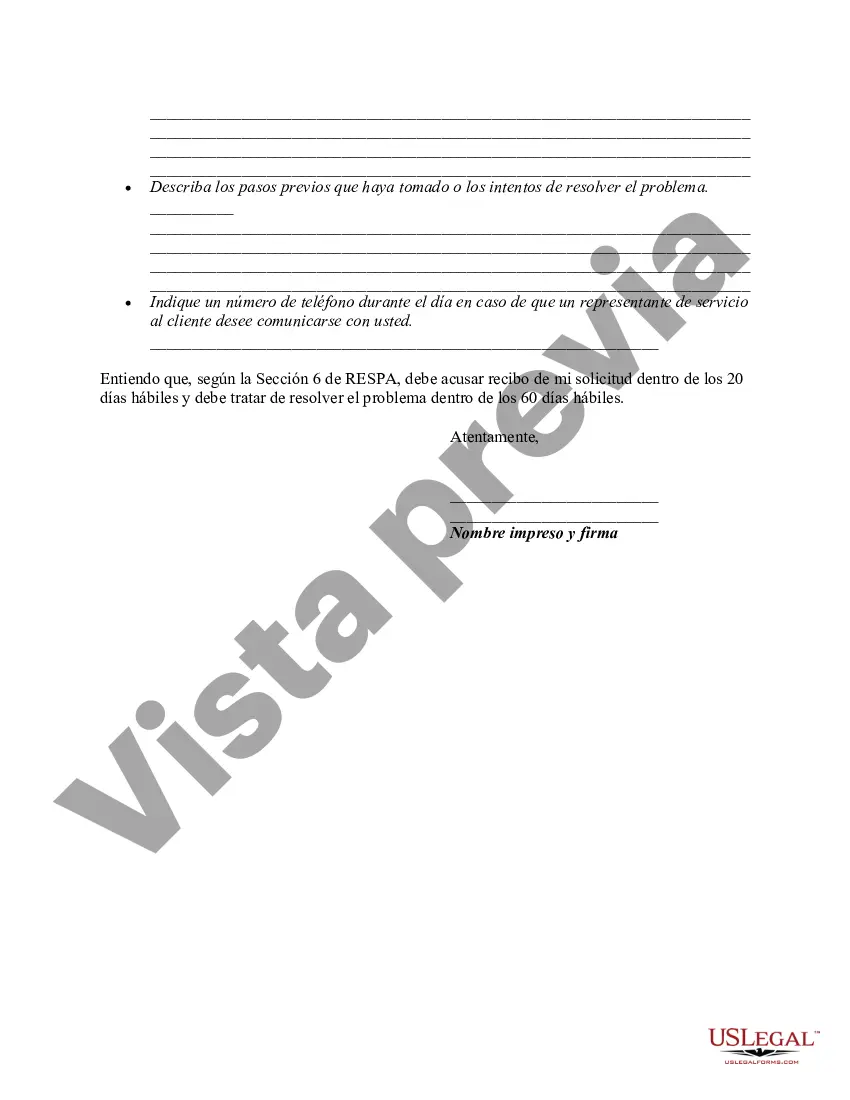

12 USC 2605(e) creates a duty of a loan servicer to respond to the inquiries of borrowers regarding loans covered by RESPA. If the borrower believes there is an error in the mortgage account, he or she can make a "qualified written request" to the loan servicer. The request must be in writing, identify the borrower by name and account, and include a statement of reasons why the borrower believes the account is in error. The request should include the words "qualified written request". It cannot be written on the payment coupon, but must be on a separate piece of paper. The Department of Housing and Urban Development provides a sample letter.

The servicer must acknowledge receipt of the request within 20 days. The servicer then has 60 days (from the request) to take action on the request. The servicer has to either provide a written notification that the error has been corrected, or provide a written explanation as to why the servicer believes the account is correct. Either way, the servicer has to provide the name and telephone number of a person with whom the borrower can discuss the matter.

Franklin Ohio Qualified Written Request (BWR) is a legal tool provided under Section 6 of the Real Estate Settlement Procedures Act (RESP), which empowers homeowners to request information and resolve issues related to their mortgage loans. A BWR can be initiated by any individual living in Franklin, Ohio, who has a mortgage loan serviced by a lender, loan service, or debt collector covered by RESP. This powerful mechanism allows borrowers to obtain detailed information about their loan, challenge incorrect charges or errors, and address any concerns or disputes they may have. A Franklin Ohio Qualified Written Request under Section 6 of RESP must be sent in writing to the loan service and include specific details and requests, as required by the legislation. Some essential elements typically included in a BWR are: 1. Identification and Contact Information: The homeowner needs to provide their full name, address, and loan account number to ensure accurate identification. 2. Description of Requested Information: The BWR should clearly state the information the borrower seeks, such as a breakdown of the loan's history, payment records, escrow account details, or any other pertinent documents the borrower desires to review. 3. Explanation of Dispute or Concern: The borrower should clearly outline any issues, disputes, or concerns regarding the loan terms, charges, or other matters in order to facilitate appropriate resolution. 4. Relevant Supporting Documents: The homeowner may attach any relevant supporting documents that support their inquiry or dispute, such as payment receipts, statements, or correspondence with the loan service. 5. Request for Response and Resolution Timeline: The borrower should specify a reasonable timeline for the loan service to respond and resolve the issues raised in the BWR. It is important to note that while Franklin Ohio Was are primarily used to resolve disputes and obtain loan information, they can also assist borrowers in pursuing legal action if the loan service fails to respond or address the concerns within the required timeframe. This underscores the significance of utilizing a BWR as an effective means of protecting homeowners' rights and ensuring fair treatment under RESP. Different types of Was may arise depending on the specific nature of the borrower's inquiry or dispute. Some common examples include Was for loan modification requests, clarification of escrow account discrepancies, adjustment of payment errors, or clarification of fees and charges imposed by the loan service. Regardless of the type, Franklin Ohio Was are an important tool that empowers homeowners to seek transparency and accountability in their mortgage loan processes while safeguarding their rights as borrowers.Franklin Ohio Qualified Written Request (BWR) is a legal tool provided under Section 6 of the Real Estate Settlement Procedures Act (RESP), which empowers homeowners to request information and resolve issues related to their mortgage loans. A BWR can be initiated by any individual living in Franklin, Ohio, who has a mortgage loan serviced by a lender, loan service, or debt collector covered by RESP. This powerful mechanism allows borrowers to obtain detailed information about their loan, challenge incorrect charges or errors, and address any concerns or disputes they may have. A Franklin Ohio Qualified Written Request under Section 6 of RESP must be sent in writing to the loan service and include specific details and requests, as required by the legislation. Some essential elements typically included in a BWR are: 1. Identification and Contact Information: The homeowner needs to provide their full name, address, and loan account number to ensure accurate identification. 2. Description of Requested Information: The BWR should clearly state the information the borrower seeks, such as a breakdown of the loan's history, payment records, escrow account details, or any other pertinent documents the borrower desires to review. 3. Explanation of Dispute or Concern: The borrower should clearly outline any issues, disputes, or concerns regarding the loan terms, charges, or other matters in order to facilitate appropriate resolution. 4. Relevant Supporting Documents: The homeowner may attach any relevant supporting documents that support their inquiry or dispute, such as payment receipts, statements, or correspondence with the loan service. 5. Request for Response and Resolution Timeline: The borrower should specify a reasonable timeline for the loan service to respond and resolve the issues raised in the BWR. It is important to note that while Franklin Ohio Was are primarily used to resolve disputes and obtain loan information, they can also assist borrowers in pursuing legal action if the loan service fails to respond or address the concerns within the required timeframe. This underscores the significance of utilizing a BWR as an effective means of protecting homeowners' rights and ensuring fair treatment under RESP. Different types of Was may arise depending on the specific nature of the borrower's inquiry or dispute. Some common examples include Was for loan modification requests, clarification of escrow account discrepancies, adjustment of payment errors, or clarification of fees and charges imposed by the loan service. Regardless of the type, Franklin Ohio Was are an important tool that empowers homeowners to seek transparency and accountability in their mortgage loan processes while safeguarding their rights as borrowers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.