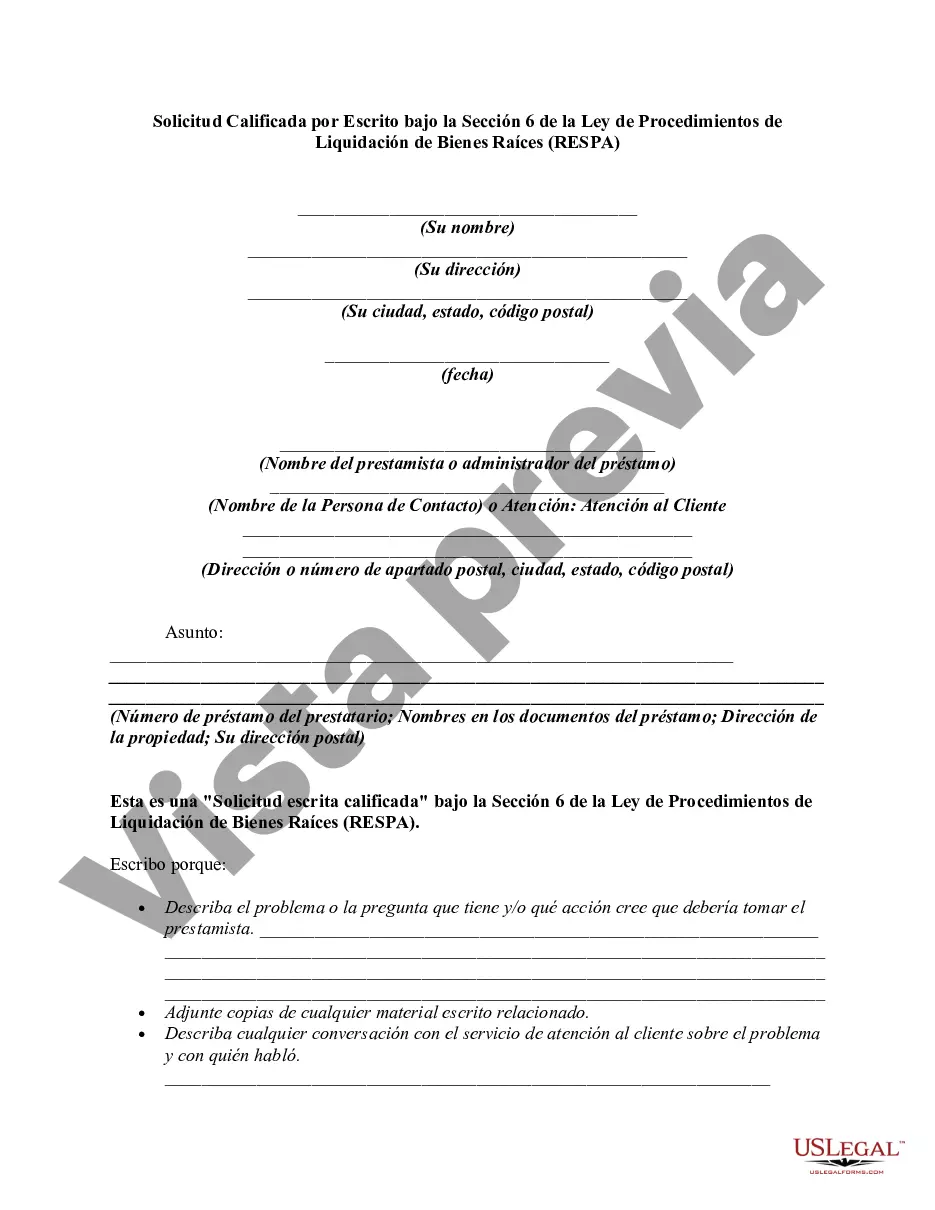

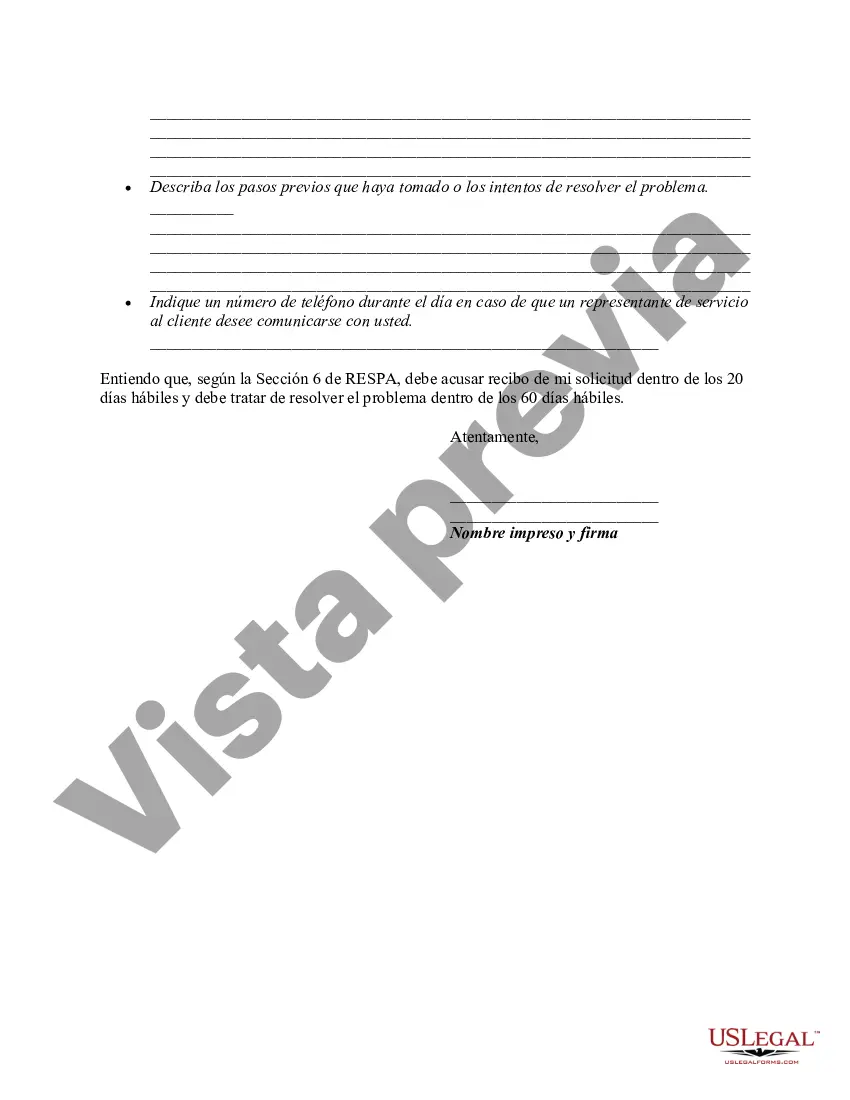

12 USC 2605(e) creates a duty of a loan servicer to respond to the inquiries of borrowers regarding loans covered by RESPA. If the borrower believes there is an error in the mortgage account, he or she can make a "qualified written request" to the loan servicer. The request must be in writing, identify the borrower by name and account, and include a statement of reasons why the borrower believes the account is in error. The request should include the words "qualified written request". It cannot be written on the payment coupon, but must be on a separate piece of paper. The Department of Housing and Urban Development provides a sample letter.

The servicer must acknowledge receipt of the request within 20 days. The servicer then has 60 days (from the request) to take action on the request. The servicer has to either provide a written notification that the error has been corrected, or provide a written explanation as to why the servicer believes the account is correct. Either way, the servicer has to provide the name and telephone number of a person with whom the borrower can discuss the matter.

A Houston Texas Qualified Written Request (BWR) under Section 6 of the Real Estate Settlement Procedures Act (RESP) is a formal written request made by a borrower to their loan service to seek information or resolve issues related to their mortgage loan. Under Section 6 of RESP, borrowers have the right to submit a Qualified Written Request to their loan service, which requires the service to provide specific information or take necessary actions within a designated timeframe. This provision aims to protect consumers from unfair and deceptive practices by mortgage lenders and loan services. A Houston Texas BWR can be used to address various concerns such as discrepancies in loan balances, reporting errors, denials of loan modifications, force-placed insurance, improper fees, or any other issues related to the mortgage loan servicing process. It is important to note that a Houston Texas BWR must meet certain criteria to be considered "qualified" under RESP. It should be a written request that includes the borrower's name, account information, and specific details about the issue or information sought. The borrower can also include relevant supporting documents, such as billing statements or correspondence, to strengthen their request. Once a Houston Texas BWR is received by the loan service, they are required to acknowledge receipt within five business days. The service then has 30 business days to investigate and provide a response to the borrower. The response should include a resolution or explanation of the issue raised, along with any actions the service plans to take. Different types of Was under Section 6 of RESP in Houston Texas may include requests for loan modification information, payment history breakdowns, escrow account statements, foreclosure avoidance options, or clarification on fees and charges assessed by the loan service. In conclusion, a Houston Texas Qualified Written Request under Section 6 of RESP is a powerful tool that allows borrowers to seek information, resolve issues, and protect their rights in the mortgage loan servicing process. It offers a way for borrowers to communicate and request necessary actions from their loan services in a formal and legally protected manner.A Houston Texas Qualified Written Request (BWR) under Section 6 of the Real Estate Settlement Procedures Act (RESP) is a formal written request made by a borrower to their loan service to seek information or resolve issues related to their mortgage loan. Under Section 6 of RESP, borrowers have the right to submit a Qualified Written Request to their loan service, which requires the service to provide specific information or take necessary actions within a designated timeframe. This provision aims to protect consumers from unfair and deceptive practices by mortgage lenders and loan services. A Houston Texas BWR can be used to address various concerns such as discrepancies in loan balances, reporting errors, denials of loan modifications, force-placed insurance, improper fees, or any other issues related to the mortgage loan servicing process. It is important to note that a Houston Texas BWR must meet certain criteria to be considered "qualified" under RESP. It should be a written request that includes the borrower's name, account information, and specific details about the issue or information sought. The borrower can also include relevant supporting documents, such as billing statements or correspondence, to strengthen their request. Once a Houston Texas BWR is received by the loan service, they are required to acknowledge receipt within five business days. The service then has 30 business days to investigate and provide a response to the borrower. The response should include a resolution or explanation of the issue raised, along with any actions the service plans to take. Different types of Was under Section 6 of RESP in Houston Texas may include requests for loan modification information, payment history breakdowns, escrow account statements, foreclosure avoidance options, or clarification on fees and charges assessed by the loan service. In conclusion, a Houston Texas Qualified Written Request under Section 6 of RESP is a powerful tool that allows borrowers to seek information, resolve issues, and protect their rights in the mortgage loan servicing process. It offers a way for borrowers to communicate and request necessary actions from their loan services in a formal and legally protected manner.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.