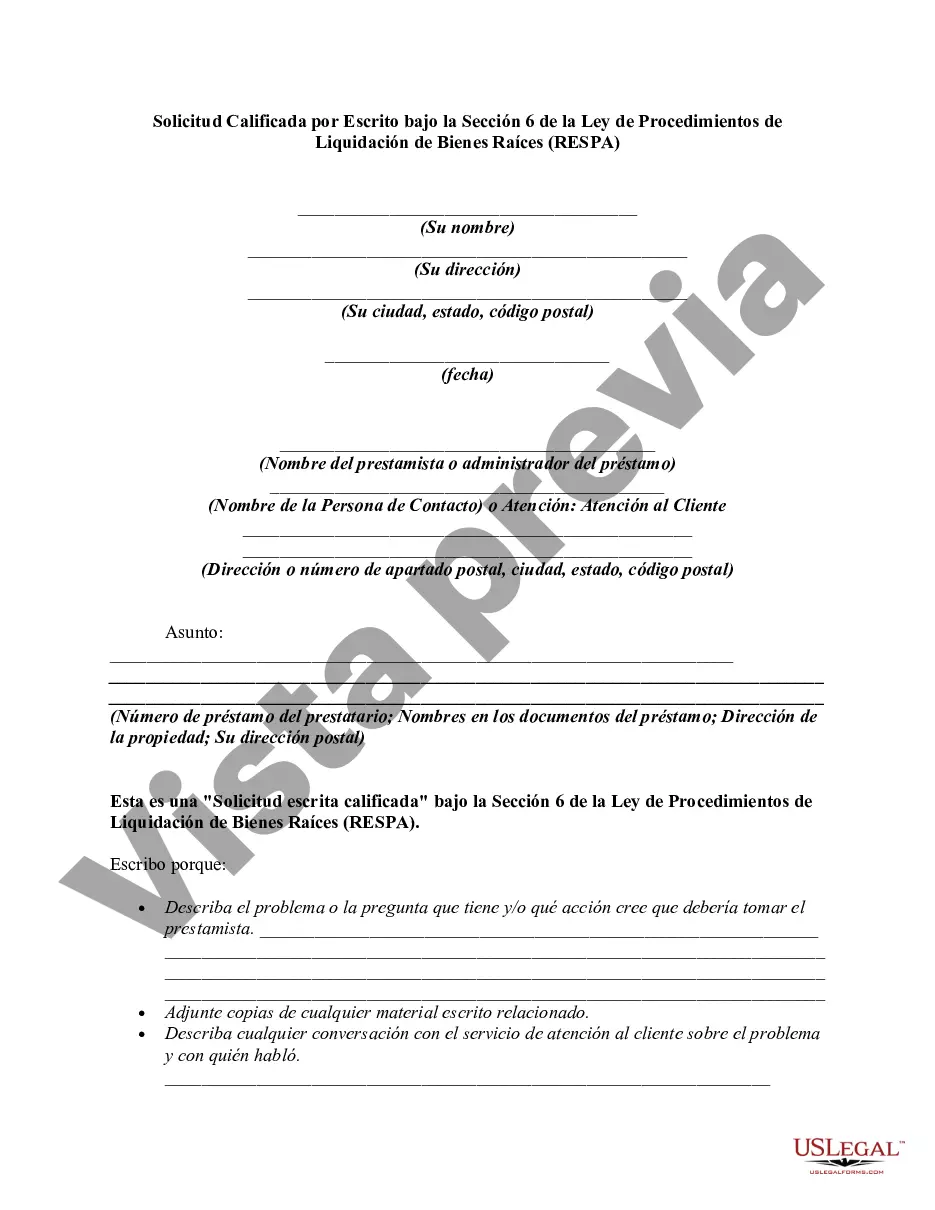

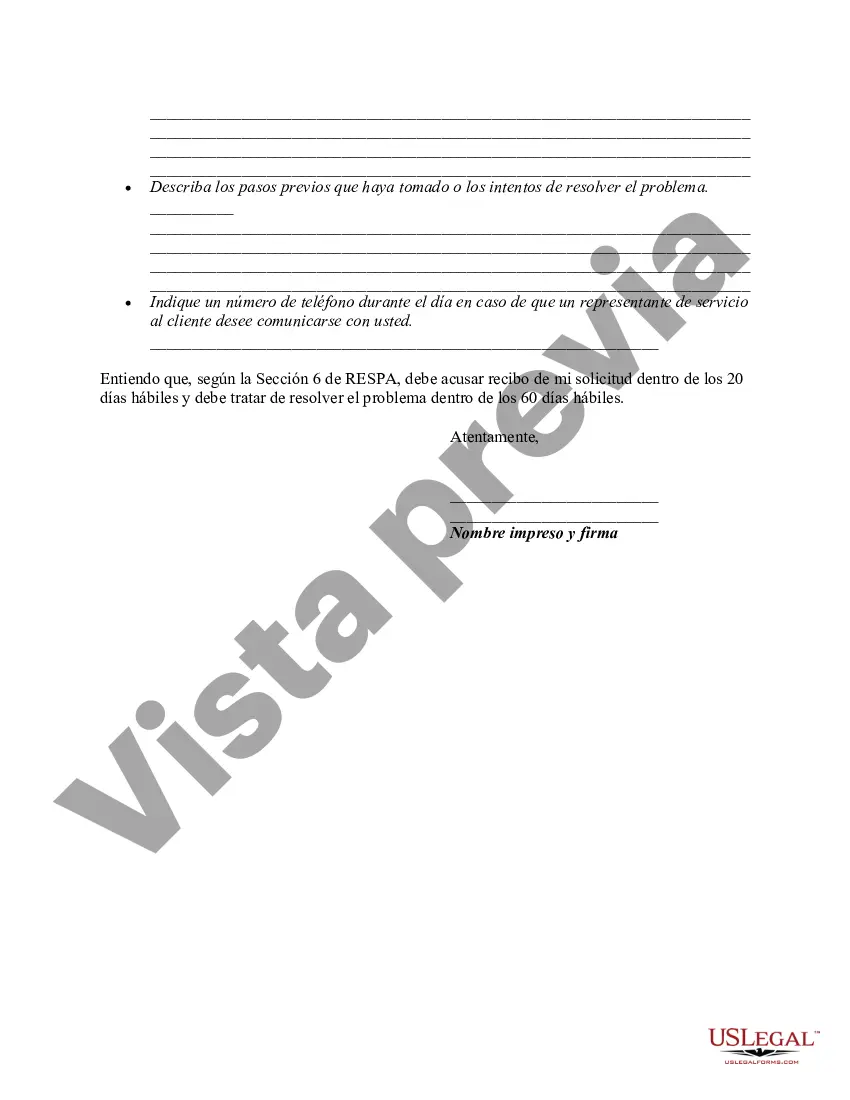

12 USC 2605(e) creates a duty of a loan servicer to respond to the inquiries of borrowers regarding loans covered by RESPA. If the borrower believes there is an error in the mortgage account, he or she can make a "qualified written request" to the loan servicer. The request must be in writing, identify the borrower by name and account, and include a statement of reasons why the borrower believes the account is in error. The request should include the words "qualified written request". It cannot be written on the payment coupon, but must be on a separate piece of paper. The Department of Housing and Urban Development provides a sample letter.

The servicer must acknowledge receipt of the request within 20 days. The servicer then has 60 days (from the request) to take action on the request. The servicer has to either provide a written notification that the error has been corrected, or provide a written explanation as to why the servicer believes the account is correct. Either way, the servicer has to provide the name and telephone number of a person with whom the borrower can discuss the matter.

A Salt Lake Utah Qualified Written Request (BWR) under Section 6 of the Real Estate Settlement Procedures Act (RESP) is a formal inquiry made by a borrower to their mortgage loan service requesting information about their loan or mortgage account. This request is protected by RESP, which ensures that borrowers have certain rights and protections when it comes to the servicing of their mortgage loans. A Salt Lake Utah BWR may cover various aspects related to a mortgage loan, including: 1. Loan Account Information: The borrower can request detailed information about their loan account, such as the loan balance, interest rate, escrow account details, and any fees or charges associated with the loan. 2. Payment History: The borrower can request a comprehensive payment history, showing all payments made, including the dates, amounts, and how they were allocated towards principal, interest, escrow, or other fees. 3. Escrow Analysis: If the loan includes an escrow account for property taxes and insurance, the borrower can seek information about escrow payments, disbursements, and any analysis or adjustments conducted by the loan service. 4. Loan Documents and Disclosures: The borrower has the right to request copies of all loan documents, including the note, mortgage, and any addenda. They can also request information on any disclosures provided at loan origination or during the loan's servicing. 5. Error Resolution: If the borrower believes there are errors or discrepancies in the servicing of their loan, they can use a BWR to outline the specific issues and request an investigation by the loan service. 6. Contact Information: A borrower can request accurate and up-to-date contact information for their loan service, which is important for communicating further regarding the loan. Different types of Salt Lake Utah Was may include: 1. Initial Inquiry: When a borrower has concerns or questions about their mortgage loan account, they can submit an initial BWR to obtain essential information about the loan. 2. Error Notification: If a borrower identifies errors in their loan servicing, such as incorrect payment postings or mishandling of escrow funds, they can submit a BWR to notify the loan service and request an investigation. 3. Dispute Resolution: If the initial BWR does not resolve the borrower's concerns, they can submit a follow-up BWR to escalate the issue and request a resolution. In summary, a Salt Lake Utah BWR under Section 6 of RESP is a formal request made by a borrower to obtain information regarding their mortgage loan account. It serves as a tool to ensure transparency, accuracy, and compliance with federal regulations in the servicing of mortgage loans.A Salt Lake Utah Qualified Written Request (BWR) under Section 6 of the Real Estate Settlement Procedures Act (RESP) is a formal inquiry made by a borrower to their mortgage loan service requesting information about their loan or mortgage account. This request is protected by RESP, which ensures that borrowers have certain rights and protections when it comes to the servicing of their mortgage loans. A Salt Lake Utah BWR may cover various aspects related to a mortgage loan, including: 1. Loan Account Information: The borrower can request detailed information about their loan account, such as the loan balance, interest rate, escrow account details, and any fees or charges associated with the loan. 2. Payment History: The borrower can request a comprehensive payment history, showing all payments made, including the dates, amounts, and how they were allocated towards principal, interest, escrow, or other fees. 3. Escrow Analysis: If the loan includes an escrow account for property taxes and insurance, the borrower can seek information about escrow payments, disbursements, and any analysis or adjustments conducted by the loan service. 4. Loan Documents and Disclosures: The borrower has the right to request copies of all loan documents, including the note, mortgage, and any addenda. They can also request information on any disclosures provided at loan origination or during the loan's servicing. 5. Error Resolution: If the borrower believes there are errors or discrepancies in the servicing of their loan, they can use a BWR to outline the specific issues and request an investigation by the loan service. 6. Contact Information: A borrower can request accurate and up-to-date contact information for their loan service, which is important for communicating further regarding the loan. Different types of Salt Lake Utah Was may include: 1. Initial Inquiry: When a borrower has concerns or questions about their mortgage loan account, they can submit an initial BWR to obtain essential information about the loan. 2. Error Notification: If a borrower identifies errors in their loan servicing, such as incorrect payment postings or mishandling of escrow funds, they can submit a BWR to notify the loan service and request an investigation. 3. Dispute Resolution: If the initial BWR does not resolve the borrower's concerns, they can submit a follow-up BWR to escalate the issue and request a resolution. In summary, a Salt Lake Utah BWR under Section 6 of RESP is a formal request made by a borrower to obtain information regarding their mortgage loan account. It serves as a tool to ensure transparency, accuracy, and compliance with federal regulations in the servicing of mortgage loans.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.