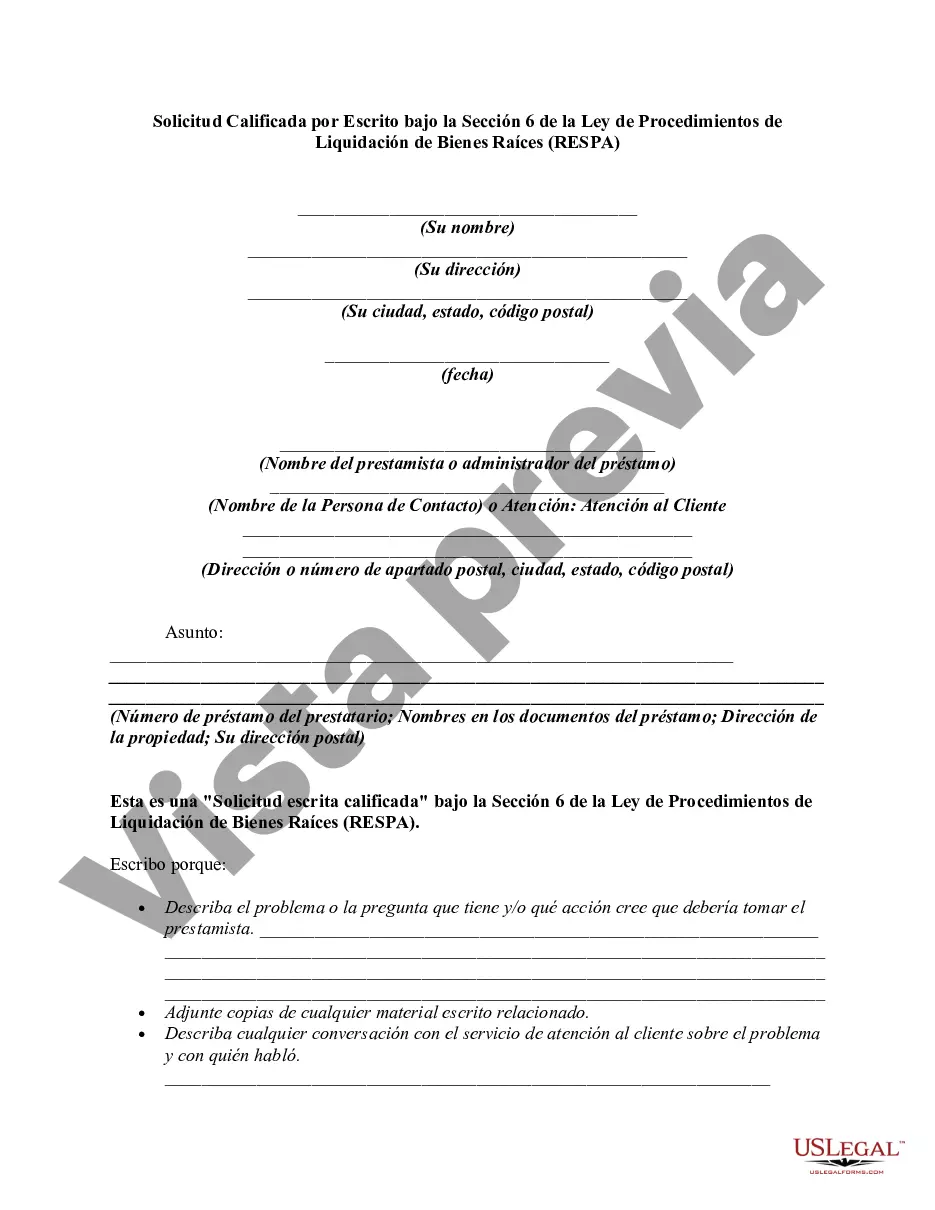

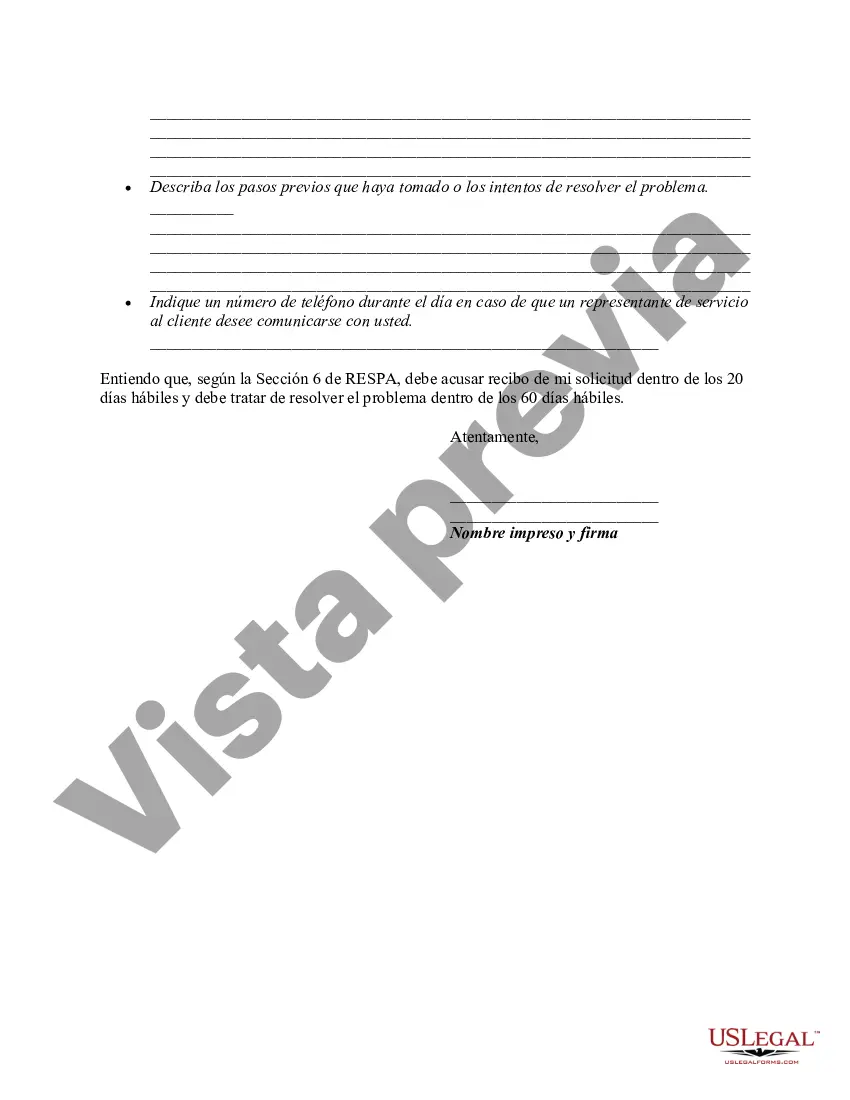

12 USC 2605(e) creates a duty of a loan servicer to respond to the inquiries of borrowers regarding loans covered by RESPA. If the borrower believes there is an error in the mortgage account, he or she can make a "qualified written request" to the loan servicer. The request must be in writing, identify the borrower by name and account, and include a statement of reasons why the borrower believes the account is in error. The request should include the words "qualified written request". It cannot be written on the payment coupon, but must be on a separate piece of paper. The Department of Housing and Urban Development provides a sample letter.

The servicer must acknowledge receipt of the request within 20 days. The servicer then has 60 days (from the request) to take action on the request. The servicer has to either provide a written notification that the error has been corrected, or provide a written explanation as to why the servicer believes the account is correct. Either way, the servicer has to provide the name and telephone number of a person with whom the borrower can discuss the matter.

A San Diego California Qualified Written Request (BWR) under Section 6 of the Real Estate Settlement Procedures Act (RESP) is a formal written communication that consumers can use to request certain information or seek clarification regarding their mortgage loan. This legal provision aims to promote transparency, accountability, and fairness in the real estate settlement process. When submitting a San Diego California BWR, it is crucial to include specific keywords and elements to ensure its effectiveness. These may include: 1. Real Estate Settlement Procedures Act (RESP): This is the federal law that governs the mortgage loan settlement process to protect consumers against unfair practices and provide them with certain rights. 2. Section 6: Refers to the section within RESP that specifically covers the guidelines and requirements for submitting a Qualified Written Request. 3. Mortgage Service: The company or entity responsible for managing and administering a mortgage loan on behalf of the lender. This includes collecting payments, handling escrow accounts, and providing customer service. 4. Detailed Description: The San Diego California BWR should provide a comprehensive explanation of the issue(s) or question(s) the borrower wants to be addressed. It is essential to describe the problem clearly and concisely to ensure proper understanding and timely resolution. 5. Requested Information: The BWR should clearly state the specific documents, statements, or information being sought from the mortgage service. This can include loan agreements, statements, payment history, escrow account details, or any other relevant information pertaining to the loan. Different Types of San Diego California Qualified Written Requests under Section 6 of RESP may also exist, depending on the nature of the borrower's concerns. Some possible variations include: 1. Loan Modification BWR: If the borrower wants to explore loan modification options, they may submit a BWR specifically requesting information on available programs, eligibility criteria, and related documents. 2. Error Resolution BWR: If the borrower has identified a mistake or error in the loan statements, escrow calculations, or any other aspect of the loan administration, they may file a BWR to seek clarification, rectification, or a detailed explanation regarding the discrepancy. 3. Escrow Account BWR: Borrowers who have questions regarding the management or utilization of their escrow accounts, such as insurance or tax payments, may submit a BWR to request specific details or inquire about any irregularities. 4. Foreclosure Prevention BWR: In cases where the borrower is facing foreclosure or believes they are at risk, a BWR can be used to seek information about potential options for avoiding foreclosure, including loan workout plans, repayment plans, or other alternatives. Remember, the San Diego California BWR should adhere to the guidelines and requirements set forth in Section 6 of RESP. It is advisable to consult legal resources or seek professional assistance to ensure the BWR is properly formatted, includes all necessary elements, and is delivered to the appropriate recipient.A San Diego California Qualified Written Request (BWR) under Section 6 of the Real Estate Settlement Procedures Act (RESP) is a formal written communication that consumers can use to request certain information or seek clarification regarding their mortgage loan. This legal provision aims to promote transparency, accountability, and fairness in the real estate settlement process. When submitting a San Diego California BWR, it is crucial to include specific keywords and elements to ensure its effectiveness. These may include: 1. Real Estate Settlement Procedures Act (RESP): This is the federal law that governs the mortgage loan settlement process to protect consumers against unfair practices and provide them with certain rights. 2. Section 6: Refers to the section within RESP that specifically covers the guidelines and requirements for submitting a Qualified Written Request. 3. Mortgage Service: The company or entity responsible for managing and administering a mortgage loan on behalf of the lender. This includes collecting payments, handling escrow accounts, and providing customer service. 4. Detailed Description: The San Diego California BWR should provide a comprehensive explanation of the issue(s) or question(s) the borrower wants to be addressed. It is essential to describe the problem clearly and concisely to ensure proper understanding and timely resolution. 5. Requested Information: The BWR should clearly state the specific documents, statements, or information being sought from the mortgage service. This can include loan agreements, statements, payment history, escrow account details, or any other relevant information pertaining to the loan. Different Types of San Diego California Qualified Written Requests under Section 6 of RESP may also exist, depending on the nature of the borrower's concerns. Some possible variations include: 1. Loan Modification BWR: If the borrower wants to explore loan modification options, they may submit a BWR specifically requesting information on available programs, eligibility criteria, and related documents. 2. Error Resolution BWR: If the borrower has identified a mistake or error in the loan statements, escrow calculations, or any other aspect of the loan administration, they may file a BWR to seek clarification, rectification, or a detailed explanation regarding the discrepancy. 3. Escrow Account BWR: Borrowers who have questions regarding the management or utilization of their escrow accounts, such as insurance or tax payments, may submit a BWR to request specific details or inquire about any irregularities. 4. Foreclosure Prevention BWR: In cases where the borrower is facing foreclosure or believes they are at risk, a BWR can be used to seek information about potential options for avoiding foreclosure, including loan workout plans, repayment plans, or other alternatives. Remember, the San Diego California BWR should adhere to the guidelines and requirements set forth in Section 6 of RESP. It is advisable to consult legal resources or seek professional assistance to ensure the BWR is properly formatted, includes all necessary elements, and is delivered to the appropriate recipient.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.