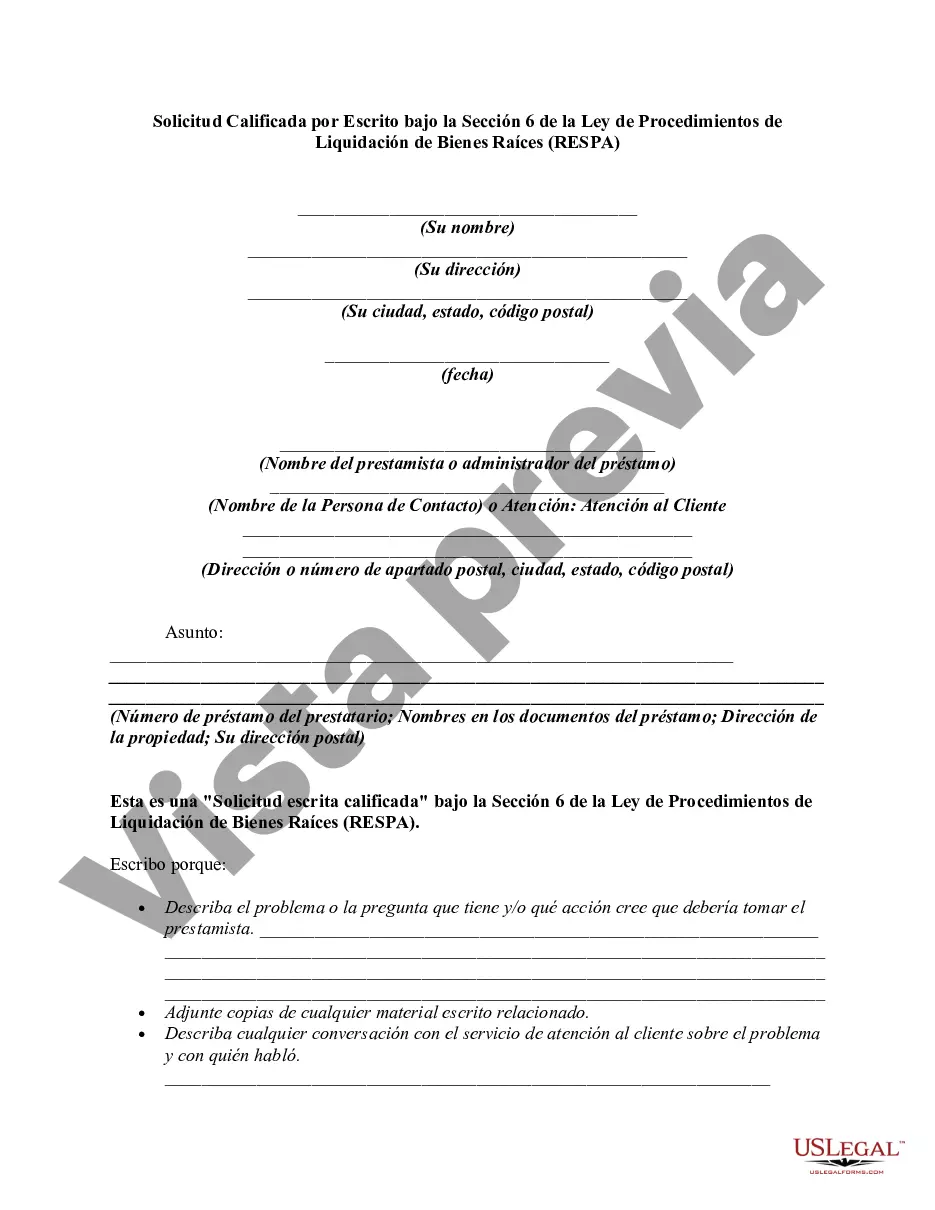

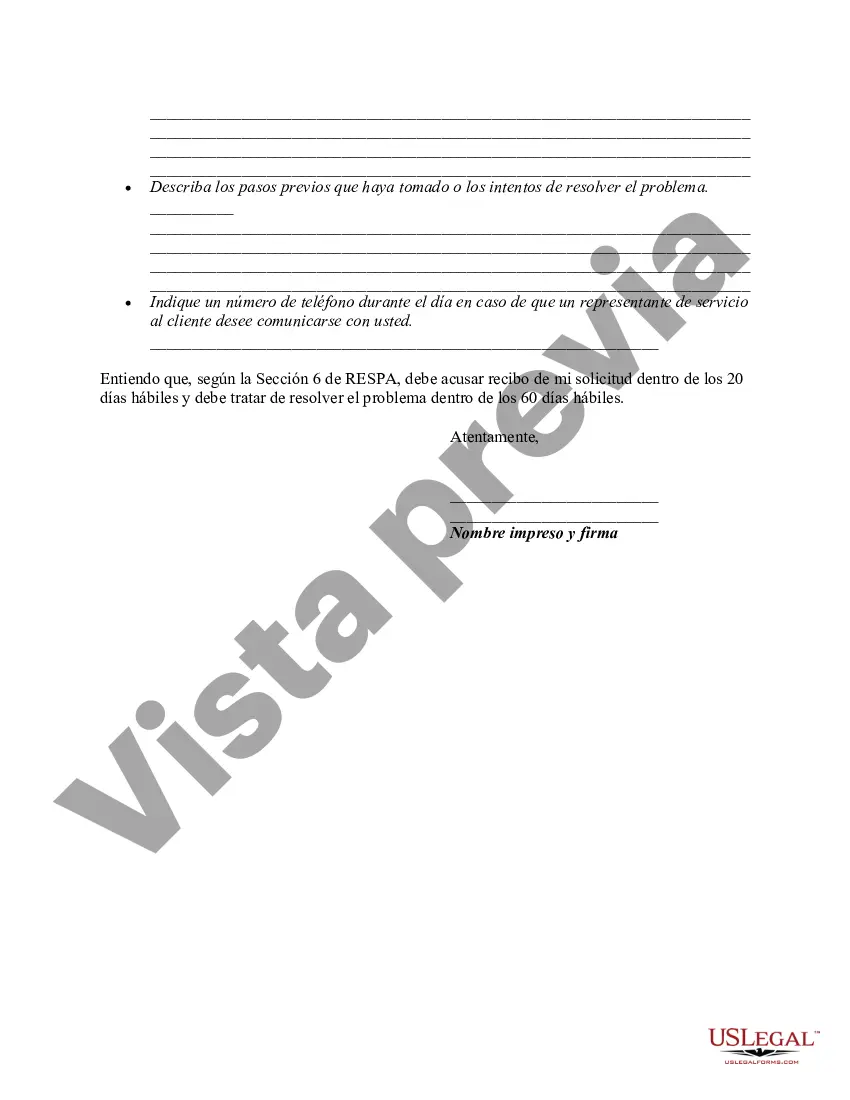

12 USC 2605(e) creates a duty of a loan servicer to respond to the inquiries of borrowers regarding loans covered by RESPA. If the borrower believes there is an error in the mortgage account, he or she can make a "qualified written request" to the loan servicer. The request must be in writing, identify the borrower by name and account, and include a statement of reasons why the borrower believes the account is in error. The request should include the words "qualified written request". It cannot be written on the payment coupon, but must be on a separate piece of paper. The Department of Housing and Urban Development provides a sample letter.

The servicer must acknowledge receipt of the request within 20 days. The servicer then has 60 days (from the request) to take action on the request. The servicer has to either provide a written notification that the error has been corrected, or provide a written explanation as to why the servicer believes the account is correct. Either way, the servicer has to provide the name and telephone number of a person with whom the borrower can discuss the matter.

San Jose California Qualified Written Request under Section 6 of the Real Estate Settlement Procedures Act (RESP) The Qualified Written Request (BWR) is a crucial tool provided by the Real Estate Settlement Procedures Act (RESP) that empowers the residents of San Jose, California, to protect their rights and address any issues related to their real estate transactions. Under section 6 of RESP, the BWR gives homeowners the ability to seek information, clarification, or resolution of certain concerns they may have regarding their mortgage loans. This detailed description will highlight the significance of Was in San Jose, California, and shed light on their various types. The San Jose California Qualified Written Request under Section 6 enables homeowners to communicate with their loan services and services' designated addresses. Through this request, homeowners can seek information regarding the loan account, balances, payment history, escrow account, and any other details related to their mortgage. Was play a vital role in San Jose since they act as a mechanism for resolving issues such as errors in loan servicing, improper fees, loan modification denials, and other violations of RESP. By sending a BWR, homeowners in San Jose exercise their rights to receive accurate and detailed information about their mortgage loan transactions. Types of San Jose California Qualified Written Request under Section 6: 1. Initial Qualified Written Request: This type involves the borrower's first formal request to the loan service, seeking information about their mortgage account, payments, or any other concerns arising from the loan terms and conditions. 2. Subsequent Qualified Written Request: This type refers to subsequent requests made by the borrower, typically when their initial request remains unresolved or requires additional clarification. Homeowners may utilize subsequent Was to persistently seek a resolution to their issues. 3. Escrow Account Related Qualified Written Request: Borrowers can submit this type of BWR when they have concerns or discrepancies relating to their escrow account, such as improper calculation of property taxes, insurance premiums, or any other escrow-related matter. 4. Loan Modification Qualified Written Request: Homeowners in San Jose who are seeking loan modification options may use this BWR to request relevant documentation, clarification on eligibility criteria, or an explanation for any denial or delay in the loan modification process. 5. Violation Complaint Qualified Written Request: In cases where borrowers believe that violations of RESP have occurred, such as mishandling of loan payments, failure to provide requested documentation, or imposition of unauthorized fees, they can submit this type of BWR to report the alleged violations and seek resolution. It's important to note that submitting a Qualified Written Request is a legal process and should adhere to RESP guidelines. Homeowners in San Jose are strongly encouraged to consult with a real estate attorney or seek guidance from HUD (U.S. Department of Housing and Urban Development) before submitting a BWR to ensure that their requests are properly structured and effectively address their concerns.San Jose California Qualified Written Request under Section 6 of the Real Estate Settlement Procedures Act (RESP) The Qualified Written Request (BWR) is a crucial tool provided by the Real Estate Settlement Procedures Act (RESP) that empowers the residents of San Jose, California, to protect their rights and address any issues related to their real estate transactions. Under section 6 of RESP, the BWR gives homeowners the ability to seek information, clarification, or resolution of certain concerns they may have regarding their mortgage loans. This detailed description will highlight the significance of Was in San Jose, California, and shed light on their various types. The San Jose California Qualified Written Request under Section 6 enables homeowners to communicate with their loan services and services' designated addresses. Through this request, homeowners can seek information regarding the loan account, balances, payment history, escrow account, and any other details related to their mortgage. Was play a vital role in San Jose since they act as a mechanism for resolving issues such as errors in loan servicing, improper fees, loan modification denials, and other violations of RESP. By sending a BWR, homeowners in San Jose exercise their rights to receive accurate and detailed information about their mortgage loan transactions. Types of San Jose California Qualified Written Request under Section 6: 1. Initial Qualified Written Request: This type involves the borrower's first formal request to the loan service, seeking information about their mortgage account, payments, or any other concerns arising from the loan terms and conditions. 2. Subsequent Qualified Written Request: This type refers to subsequent requests made by the borrower, typically when their initial request remains unresolved or requires additional clarification. Homeowners may utilize subsequent Was to persistently seek a resolution to their issues. 3. Escrow Account Related Qualified Written Request: Borrowers can submit this type of BWR when they have concerns or discrepancies relating to their escrow account, such as improper calculation of property taxes, insurance premiums, or any other escrow-related matter. 4. Loan Modification Qualified Written Request: Homeowners in San Jose who are seeking loan modification options may use this BWR to request relevant documentation, clarification on eligibility criteria, or an explanation for any denial or delay in the loan modification process. 5. Violation Complaint Qualified Written Request: In cases where borrowers believe that violations of RESP have occurred, such as mishandling of loan payments, failure to provide requested documentation, or imposition of unauthorized fees, they can submit this type of BWR to report the alleged violations and seek resolution. It's important to note that submitting a Qualified Written Request is a legal process and should adhere to RESP guidelines. Homeowners in San Jose are strongly encouraged to consult with a real estate attorney or seek guidance from HUD (U.S. Department of Housing and Urban Development) before submitting a BWR to ensure that their requests are properly structured and effectively address their concerns.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.