An Assignment is a transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, personal property, or other thing assigned. An escrow account is held in the borrower's name to pay obligations such as property taxes, insurance premiums, lease payments, hazard insurance, and other associated property payments and expenses when they are due in connection with a mortgage loan.

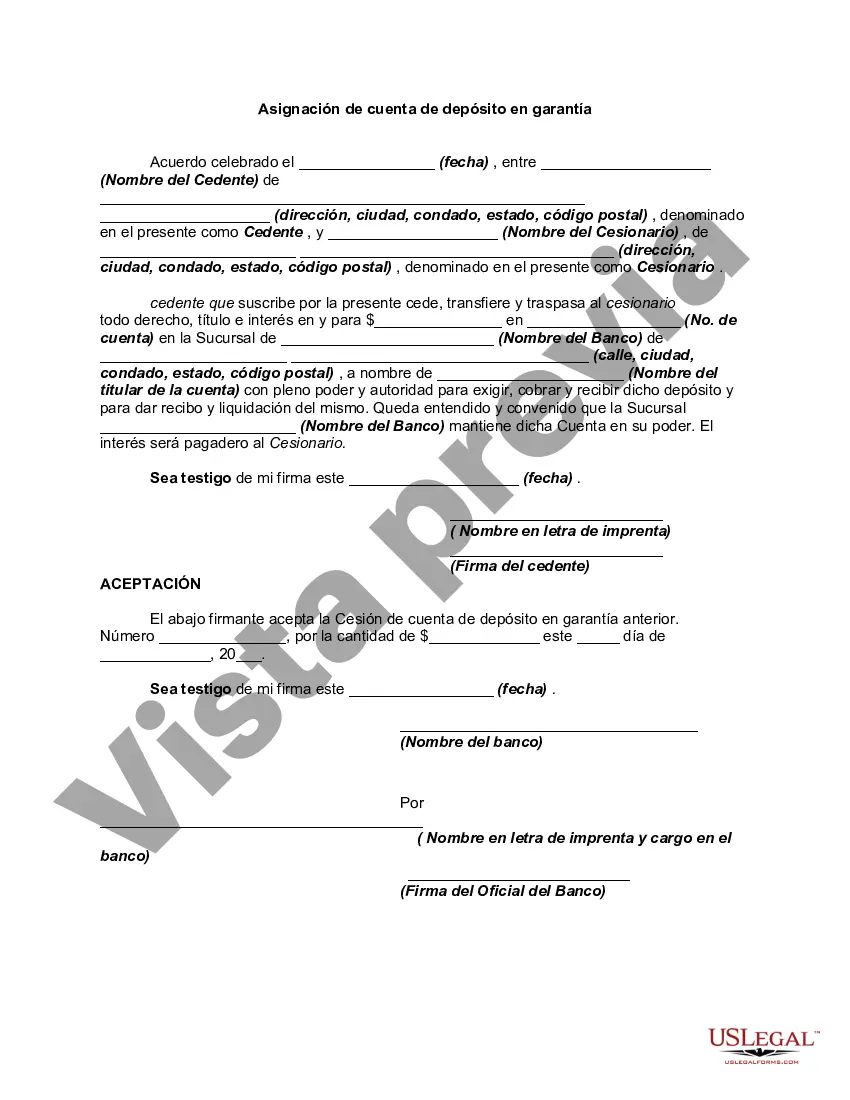

form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Chicago, Illinois Assignment of Escrow Account: A Comprehensive Overview In the financial world, an escrow account is widely used to hold funds securely during a transaction between two parties. In Chicago, Illinois, the Assignment of Escrow Account plays a crucial role in facilitating various legal and financial processes. This detailed description will provide an in-depth understanding of what the Chicago Assignment of Escrow Account entails, considering its significance in the city's business landscape. An Assignment of Escrow Account refers to the act of transferring ownership or control of an escrow account from one party to another. This account acts as a neutral entity, holding funds or assets, until all the predetermined conditions of a contractual agreement or legal transaction are met. Whether it's a real estate deal, business acquisition, or legal settlement, an escrow account ensures that both parties involved have a level of protection and trust during the process. In Chicago, Illinois, there are several types of Assignment of Escrow Accounts, each catering to the specific needs of the respective transaction. Some notable variations include: 1. Real Estate Escrow Accounts: These accounts are commonly utilized in buying and selling real estate properties. The buyer typically deposits the agreed-upon purchase price into an escrow account, ensuring that the funds are held securely until all contractual obligations are met, such as completing inspections, securing financing, and obtaining necessary permits. Once all requirements are fulfilled, the escrow funds are released, and ownership is transferred to the buyer. 2. Business Acquisition Escrow Accounts: When businesses change hands in Chicago, an escrow account might be established to safeguard funds throughout the acquisition process. This type of escrow ensures that all financial obligations and contingencies, such as non-compete agreements, employee benefit transfers, or tax-related matters, are satisfied before the funds are released. 3. Legal Settlement Escrow Accounts: In legal disputes or settlements, an escrow account can be employed to hold funds until the conditions of the settlement are met. This type of escrow account provides both parties with a trusted and impartial repository for the settlement amount, ensuring compliance with court judgments or arbitration decisions. Regardless of the type of Assignment of Escrow Account in Chicago, Illinois, certain key elements remain constant. These include: 1. Escrow Agent: An independent third party, such as a bank or an attorney, is designated to hold the funds or assets in the escrow account and ensure they are distributed according to the terms of the agreement. 2. Escrow Agreement: This legally binding contract outlines the specific terms, conditions, and obligations of both parties involved in the transaction. It governs the release of funds from the escrow account. 3. Escrow Instructions: These instructions detail the specific actions required to release or disburse the funds, including the respective responsibilities of each party, timelines, and conditions that must be met. 4. Dispute Resolution: In case of a disagreement or dispute regarding the release of the escrow funds, the escrow agreement often stipulates a procedure for resolving such conflicts, which may involve mediation, arbitration, or a court process. In conclusion, the Assignment of Escrow Account in Chicago, Illinois, serves as a critical mechanism in various real estate transactions, business acquisitions, and legal settlements. Its purpose is to ensure that funds or assets are securely held until all the specific conditions outlined in the agreement are met. The diverse types of escrow accounts, such as real estate, business acquisition, and legal settlement escrow accounts, cater to the distinct requirements of these transactions. The involvement of an escrow agent, an escrow agreement, specific instructions, and a dispute resolution process are vital components that contribute to the success and security of the Chicago Assignment of Escrow Account process.Chicago, Illinois Assignment of Escrow Account: A Comprehensive Overview In the financial world, an escrow account is widely used to hold funds securely during a transaction between two parties. In Chicago, Illinois, the Assignment of Escrow Account plays a crucial role in facilitating various legal and financial processes. This detailed description will provide an in-depth understanding of what the Chicago Assignment of Escrow Account entails, considering its significance in the city's business landscape. An Assignment of Escrow Account refers to the act of transferring ownership or control of an escrow account from one party to another. This account acts as a neutral entity, holding funds or assets, until all the predetermined conditions of a contractual agreement or legal transaction are met. Whether it's a real estate deal, business acquisition, or legal settlement, an escrow account ensures that both parties involved have a level of protection and trust during the process. In Chicago, Illinois, there are several types of Assignment of Escrow Accounts, each catering to the specific needs of the respective transaction. Some notable variations include: 1. Real Estate Escrow Accounts: These accounts are commonly utilized in buying and selling real estate properties. The buyer typically deposits the agreed-upon purchase price into an escrow account, ensuring that the funds are held securely until all contractual obligations are met, such as completing inspections, securing financing, and obtaining necessary permits. Once all requirements are fulfilled, the escrow funds are released, and ownership is transferred to the buyer. 2. Business Acquisition Escrow Accounts: When businesses change hands in Chicago, an escrow account might be established to safeguard funds throughout the acquisition process. This type of escrow ensures that all financial obligations and contingencies, such as non-compete agreements, employee benefit transfers, or tax-related matters, are satisfied before the funds are released. 3. Legal Settlement Escrow Accounts: In legal disputes or settlements, an escrow account can be employed to hold funds until the conditions of the settlement are met. This type of escrow account provides both parties with a trusted and impartial repository for the settlement amount, ensuring compliance with court judgments or arbitration decisions. Regardless of the type of Assignment of Escrow Account in Chicago, Illinois, certain key elements remain constant. These include: 1. Escrow Agent: An independent third party, such as a bank or an attorney, is designated to hold the funds or assets in the escrow account and ensure they are distributed according to the terms of the agreement. 2. Escrow Agreement: This legally binding contract outlines the specific terms, conditions, and obligations of both parties involved in the transaction. It governs the release of funds from the escrow account. 3. Escrow Instructions: These instructions detail the specific actions required to release or disburse the funds, including the respective responsibilities of each party, timelines, and conditions that must be met. 4. Dispute Resolution: In case of a disagreement or dispute regarding the release of the escrow funds, the escrow agreement often stipulates a procedure for resolving such conflicts, which may involve mediation, arbitration, or a court process. In conclusion, the Assignment of Escrow Account in Chicago, Illinois, serves as a critical mechanism in various real estate transactions, business acquisitions, and legal settlements. Its purpose is to ensure that funds or assets are securely held until all the specific conditions outlined in the agreement are met. The diverse types of escrow accounts, such as real estate, business acquisition, and legal settlement escrow accounts, cater to the distinct requirements of these transactions. The involvement of an escrow agent, an escrow agreement, specific instructions, and a dispute resolution process are vital components that contribute to the success and security of the Chicago Assignment of Escrow Account process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.