An Assignment is a transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, personal property, or other thing assigned. An escrow account is held in the borrower's name to pay obligations such as property taxes, insurance premiums, lease payments, hazard insurance, and other associated property payments and expenses when they are due in connection with a mortgage loan.

form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

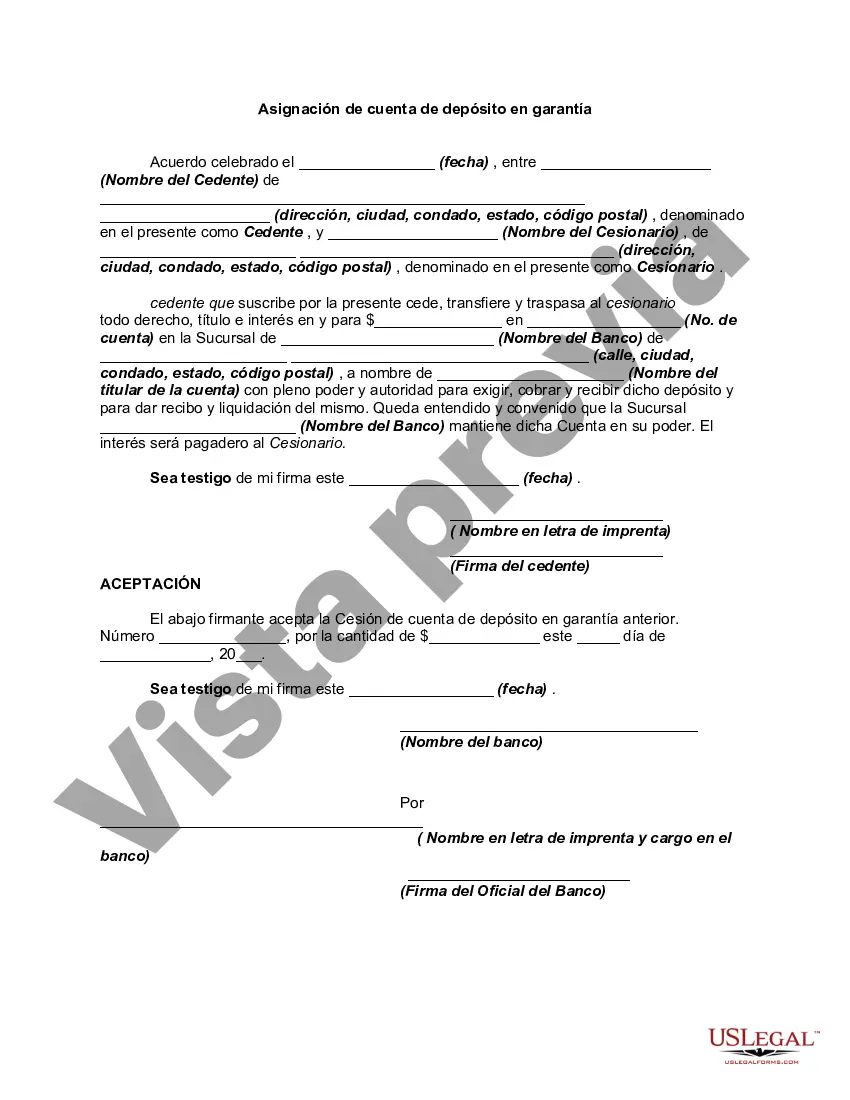

Collin Texas Assignment of Escrow Account is a legal document that transfers the rights, claims, and obligations of an existing escrow account to another party. This assignment typically occurs when there is a change in ownership or possession of a property. In Collin County, Texas, there are several types of Assignment of Escrow Accounts that may be encountered, such as: 1. Residential Property Assignment: This type of assignment occurs when a residential property is sold or transferred to a new owner. The existing escrow account, which holds funds for property taxes, insurance, and other related expenses, is assigned to the buyer or the new mortgage lender. 2. Commercial Property Assignment: When a commercial property changes hands, the existing escrow account can be assigned to the buyer or the new entity that assumes ownership. This ensures that the ongoing financial obligations, including property taxes, insurance premiums, and maintenance costs, are transferred smoothly. 3. Rental Property Assignment: In the case of a rental property, the assignment of escrow account may occur if the property is sold or changes management. The new owner or property management company takes over the responsibility of managing the escrow account and utilizing the funds for property-related expenses. 4. Mortgage Lender Assignment: Sometimes, a mortgage lender may assign an escrow account to another financial institution or service. This can happen due to various reasons such as the sale of the loan, changing internal processes, or transferring servicing rights. The assignment ensures that the new lender or service can effectively manage the escrow funds on behalf of the borrower. The Collin Texas Assignment of Escrow Account document typically contains details regarding the parties involved, the property address, the escrow account number, and the terms of the assignment. It is crucial to consult with a real estate attorney or escrow professional to ensure that the assignment is executed properly and in compliance with local laws and regulations. Note: The information provided above is for general informational purposes only and should not be considered legal advice. It is recommended to consult with a qualified professional for specific guidance regarding Collin Texas Assignment of Escrow Account.Collin Texas Assignment of Escrow Account is a legal document that transfers the rights, claims, and obligations of an existing escrow account to another party. This assignment typically occurs when there is a change in ownership or possession of a property. In Collin County, Texas, there are several types of Assignment of Escrow Accounts that may be encountered, such as: 1. Residential Property Assignment: This type of assignment occurs when a residential property is sold or transferred to a new owner. The existing escrow account, which holds funds for property taxes, insurance, and other related expenses, is assigned to the buyer or the new mortgage lender. 2. Commercial Property Assignment: When a commercial property changes hands, the existing escrow account can be assigned to the buyer or the new entity that assumes ownership. This ensures that the ongoing financial obligations, including property taxes, insurance premiums, and maintenance costs, are transferred smoothly. 3. Rental Property Assignment: In the case of a rental property, the assignment of escrow account may occur if the property is sold or changes management. The new owner or property management company takes over the responsibility of managing the escrow account and utilizing the funds for property-related expenses. 4. Mortgage Lender Assignment: Sometimes, a mortgage lender may assign an escrow account to another financial institution or service. This can happen due to various reasons such as the sale of the loan, changing internal processes, or transferring servicing rights. The assignment ensures that the new lender or service can effectively manage the escrow funds on behalf of the borrower. The Collin Texas Assignment of Escrow Account document typically contains details regarding the parties involved, the property address, the escrow account number, and the terms of the assignment. It is crucial to consult with a real estate attorney or escrow professional to ensure that the assignment is executed properly and in compliance with local laws and regulations. Note: The information provided above is for general informational purposes only and should not be considered legal advice. It is recommended to consult with a qualified professional for specific guidance regarding Collin Texas Assignment of Escrow Account.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.