An Assignment is a transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, personal property, or other thing assigned. An escrow account is held in the borrower's name to pay obligations such as property taxes, insurance premiums, lease payments, hazard insurance, and other associated property payments and expenses when they are due in connection with a mortgage loan.

form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Cook Illinois Assignment of Escrow Account refers to a legal agreement that involves the transfer of an escrow account to Cook County, Illinois. This assignment is commonly encountered in real estate transactions when purchasing property or during the foreclosure process. The Cook Illinois Assignment of Escrow Account is designed to protect the interests of all parties involved by ensuring the funds are properly distributed and managed. Key terms associated with the Cook Illinois Assignment of Escrow Account include "escrow account," "Cook County," "real estate," "purchase," "foreclosure," and "agreement." Understanding these keywords is crucial to comprehending the process and importance of this assignment. There may be different types of Cook Illinois Assignment of Escrow Account, depending on the specific circumstances. Here are a few examples: 1. Purchase Escrow Account Assignment: In a real estate purchase, the buyer typically deposits the funds into an escrow account managed by a neutral third party. The Cook Illinois Assignment of Escrow Account in this case involves transferring the escrow account to Cook County, ensuring that the funds are distributed appropriately according to the terms of the purchase agreement. 2. Foreclosure Escrow Account Assignment: During foreclosure proceedings, an escrow account may hold funds to cover expenses such as property taxes, insurance, or maintenance costs. The Cook Illinois Assignment of Escrow Account related to foreclosure ensures these funds are properly managed and disbursed after the property is acquired by Cook County. 3. Tax Escrow Account Assignment: In certain cases, an escrow account may be established to hold funds for property tax payments. The Cook Illinois Assignment of Escrow Account pertaining to taxes involves transferring this account to Cook County, ensuring timely payment of property taxes. Overall, the Cook Illinois Assignment of Escrow Account plays a crucial role in protecting the interests of all parties involved in real estate transactions within Cook County. Whether it's a purchase, foreclosure, or tax-related scenario, this assignment ensures that funds are managed appropriately and distributed according to legal obligations and agreements.Cook Illinois Assignment of Escrow Account refers to a legal agreement that involves the transfer of an escrow account to Cook County, Illinois. This assignment is commonly encountered in real estate transactions when purchasing property or during the foreclosure process. The Cook Illinois Assignment of Escrow Account is designed to protect the interests of all parties involved by ensuring the funds are properly distributed and managed. Key terms associated with the Cook Illinois Assignment of Escrow Account include "escrow account," "Cook County," "real estate," "purchase," "foreclosure," and "agreement." Understanding these keywords is crucial to comprehending the process and importance of this assignment. There may be different types of Cook Illinois Assignment of Escrow Account, depending on the specific circumstances. Here are a few examples: 1. Purchase Escrow Account Assignment: In a real estate purchase, the buyer typically deposits the funds into an escrow account managed by a neutral third party. The Cook Illinois Assignment of Escrow Account in this case involves transferring the escrow account to Cook County, ensuring that the funds are distributed appropriately according to the terms of the purchase agreement. 2. Foreclosure Escrow Account Assignment: During foreclosure proceedings, an escrow account may hold funds to cover expenses such as property taxes, insurance, or maintenance costs. The Cook Illinois Assignment of Escrow Account related to foreclosure ensures these funds are properly managed and disbursed after the property is acquired by Cook County. 3. Tax Escrow Account Assignment: In certain cases, an escrow account may be established to hold funds for property tax payments. The Cook Illinois Assignment of Escrow Account pertaining to taxes involves transferring this account to Cook County, ensuring timely payment of property taxes. Overall, the Cook Illinois Assignment of Escrow Account plays a crucial role in protecting the interests of all parties involved in real estate transactions within Cook County. Whether it's a purchase, foreclosure, or tax-related scenario, this assignment ensures that funds are managed appropriately and distributed according to legal obligations and agreements.

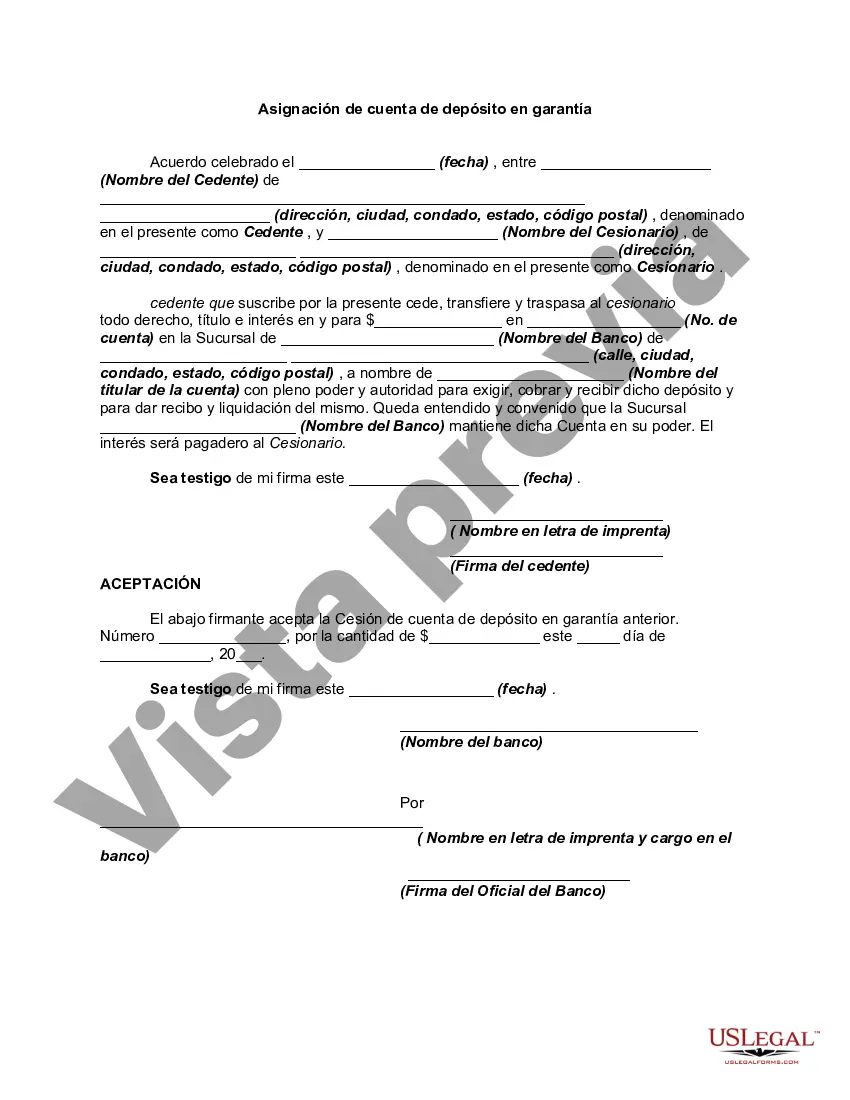

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.