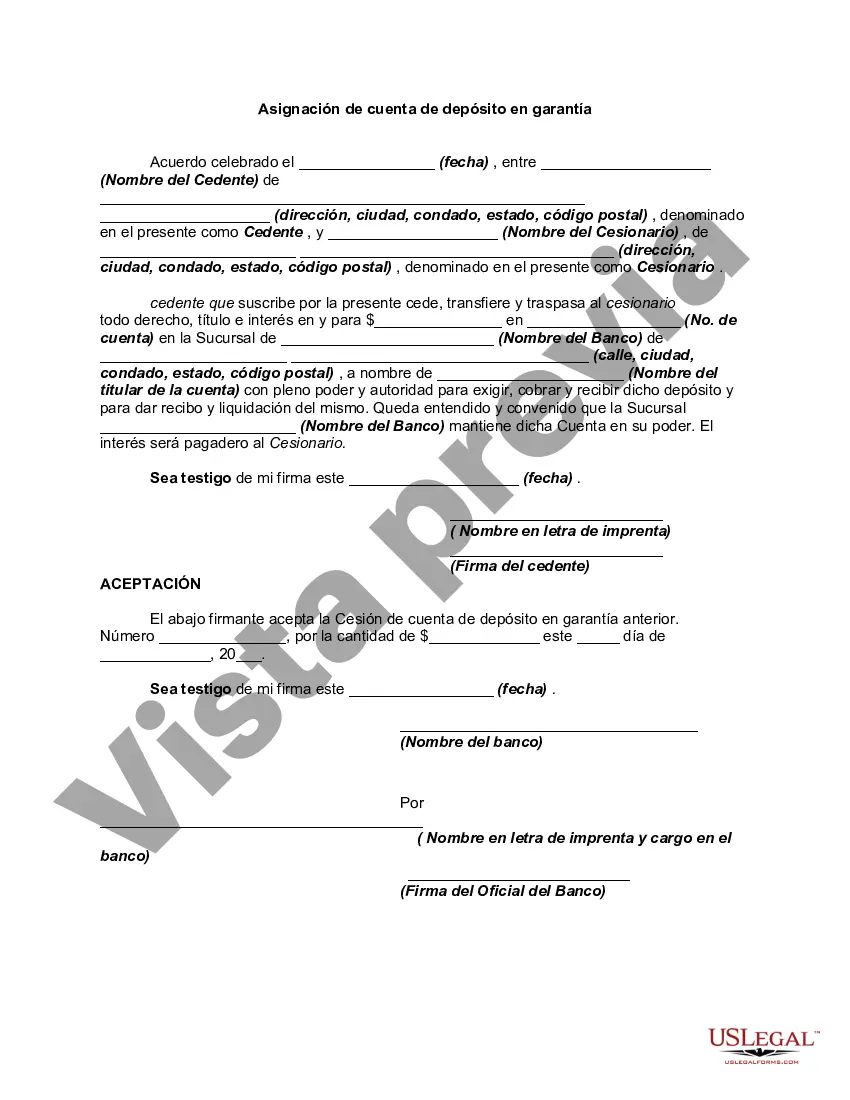

An Assignment is a transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, personal property, or other thing assigned. An escrow account is held in the borrower's name to pay obligations such as property taxes, insurance premiums, lease payments, hazard insurance, and other associated property payments and expenses when they are due in connection with a mortgage loan.

form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Suffolk New York Assignment of Escrow Account is a legal process that involves the transfer of funds or assets held in an escrow account to a designated recipient or entity. This assignment typically occurs when a party transfers their rights or interests in a contract, agreement, or transaction to another party. In Suffolk New York, there are several types of Assignment of Escrow Accounts that may be applicable, depending on the specific circumstances and legal requirements. These include: 1. Real Estate Escrow Assignments: This type of assignment occurs when a buyer or seller in a real estate transaction assigns their rights or interests in an escrow account to a third party, such as a bank or title company. It ensures that funds are securely held until the transaction is completed, protecting the interests of all parties involved. 2. Business Sale Escrow Assignments: In cases where a business is being sold, an escrow account may be established to hold the purchase funds. The Assignment of Escrow Account in this context allows the seller to transfer their claim on the funds to the buyer once all conditions of the sale have been met. 3. Employee Benefits Escrow Assignments: Some companies may establish an escrow account to hold funds for employee benefits, such as retirement plans or healthcare expenses. In certain situations, an employee may assign their rights to these funds to a designated beneficiary or entity. The Suffolk New York Assignment of Escrow Account ensures a smooth transfer of these benefits. 4. Legal Dispute Escrow Assignments: When there is a legal dispute between parties, funds or assets may be placed in an escrow account until the resolution of the dispute. In certain cases, one party involved in the dispute may assign their rights to these funds to another party. This assignment ensures a proper transfer of funds once the dispute is settled. In all types of Suffolk New York Assignment of Escrow Account, it is essential to adhere to the legal requirements and procedures outlined by the New York state laws. This includes drafting a proper assignment agreement, notifying all relevant parties, and ensuring compliance with any applicable regulations. By understanding the various types of Suffolk New York Assignment of Escrow Account, individuals and businesses can navigate these legal processes more effectively, protecting their financial interests and ensuring a smooth transfer of funds or assets.Suffolk New York Assignment of Escrow Account is a legal process that involves the transfer of funds or assets held in an escrow account to a designated recipient or entity. This assignment typically occurs when a party transfers their rights or interests in a contract, agreement, or transaction to another party. In Suffolk New York, there are several types of Assignment of Escrow Accounts that may be applicable, depending on the specific circumstances and legal requirements. These include: 1. Real Estate Escrow Assignments: This type of assignment occurs when a buyer or seller in a real estate transaction assigns their rights or interests in an escrow account to a third party, such as a bank or title company. It ensures that funds are securely held until the transaction is completed, protecting the interests of all parties involved. 2. Business Sale Escrow Assignments: In cases where a business is being sold, an escrow account may be established to hold the purchase funds. The Assignment of Escrow Account in this context allows the seller to transfer their claim on the funds to the buyer once all conditions of the sale have been met. 3. Employee Benefits Escrow Assignments: Some companies may establish an escrow account to hold funds for employee benefits, such as retirement plans or healthcare expenses. In certain situations, an employee may assign their rights to these funds to a designated beneficiary or entity. The Suffolk New York Assignment of Escrow Account ensures a smooth transfer of these benefits. 4. Legal Dispute Escrow Assignments: When there is a legal dispute between parties, funds or assets may be placed in an escrow account until the resolution of the dispute. In certain cases, one party involved in the dispute may assign their rights to these funds to another party. This assignment ensures a proper transfer of funds once the dispute is settled. In all types of Suffolk New York Assignment of Escrow Account, it is essential to adhere to the legal requirements and procedures outlined by the New York state laws. This includes drafting a proper assignment agreement, notifying all relevant parties, and ensuring compliance with any applicable regulations. By understanding the various types of Suffolk New York Assignment of Escrow Account, individuals and businesses can navigate these legal processes more effectively, protecting their financial interests and ensuring a smooth transfer of funds or assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.