This form is a general form of a bill of sale for personal property (i.e. goods). It should not be used to convey title to real property or title to a motor vehicle.

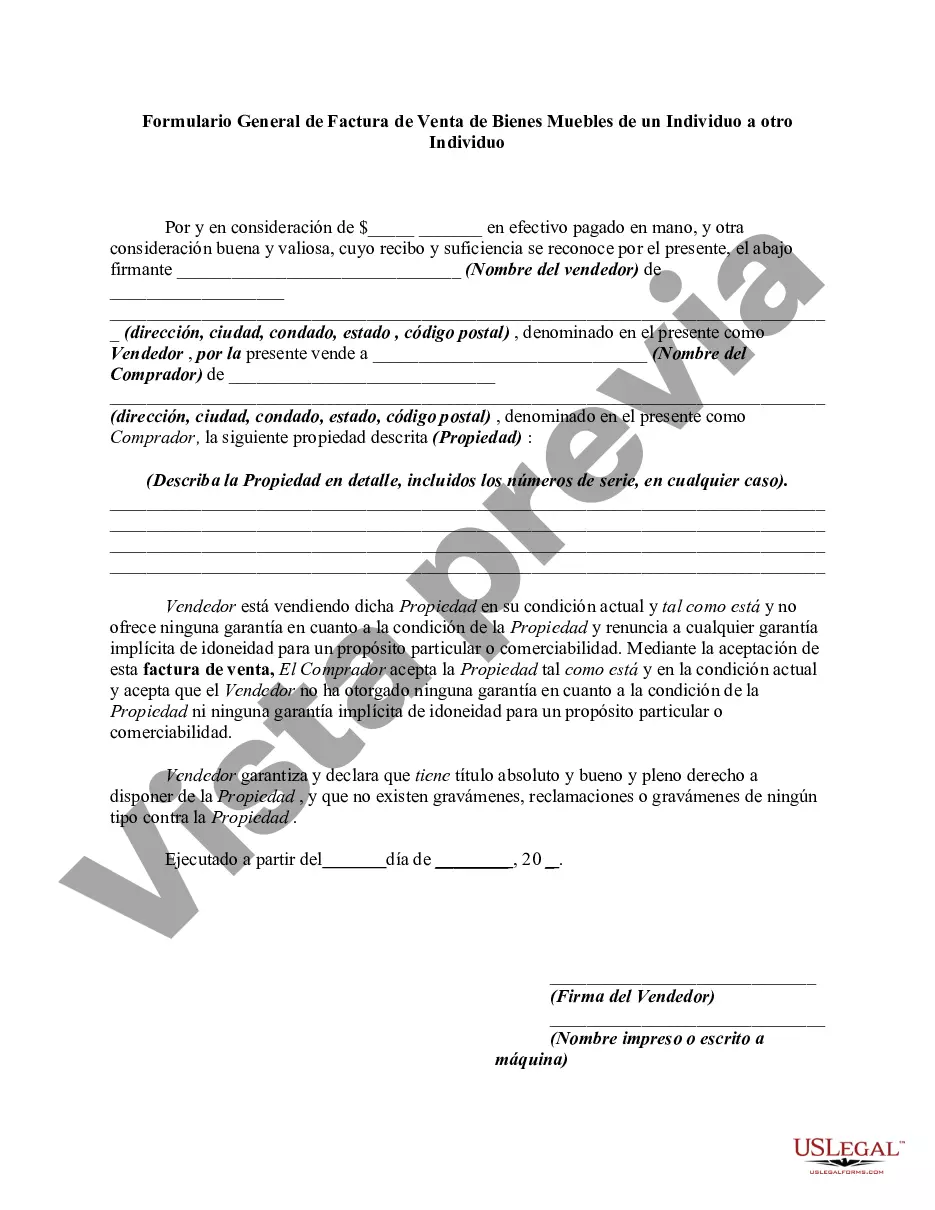

The Franklin Ohio General Form for Bill of Sale of Personal Property from One Individual to another Individual is a legal document that serves as proof of the transfer of ownership of personal property from one person to another. This form outlines the specific details of the transaction and ensures a smooth transfer of property. Here is a detailed description of what this form entails: 1. Introduction: The form begins with an introduction that clearly states that it is a Bill of Sale for personal property in Franklin, Ohio. It also mentions the names of the parties involved — the seller and the buyer. 2. Property Description: The form includes a section to describe the personal property being sold. This can include various types of items such as vehicles, furniture, electronics, or any other tangible goods. The description should be detailed enough to clearly identify the specific items being transferred. 3. Purchase Price: The next section of the form details the agreed-upon purchase price for the personal property. The buyer and the seller must agree on the amount and record it accurately in this section. Additionally, any specific terms of payment, such as installments or cash transactions, should be mentioned here. 4. Seller's Representations: This section states that the seller has full ownership rights to the property being sold and has the authority to transfer those rights to the buyer. It also includes a statement that the property is being sold "as-is," indicating that the buyer accepts the property's condition at the time of the sale. 5. Buyer's Acknowledgment: The form requires the buyer's signature, indicating their acknowledgment that they are purchasing the specific personal property as described in the document. The buyer's signature confirms their acceptance of the terms outlined in the Bill of Sale. 6. Seller's Certification: The seller is also required to sign the form, certifying that all the information provided is true and accurate to the best of their knowledge. This certification holds the seller accountable for the correctness of the document. Additional types of the Franklin Ohio General Form for Bill of Sale of Personal Property from One Individual to another Individual may include: 1. Real Estate Bill of Sale: This type of bill of sale is used specifically for the transfer of real estate or immovable property between two individuals in Franklin, Ohio. 2. Motor Vehicle Bill of Sale: When a vehicle is being sold from one individual to another in Franklin, Ohio, a specialized bill of sale for motor vehicles may be used. This form includes specific sections for vehicle information, such as make, model, year, Vehicle Identification Number (VIN), and odometer reading. 3. Firearm Bill of Sale: In the case of the sale of firearms or other weapons, a specific bill of sale tailored to the regulations and requirements in Franklin, Ohio, is utilized. This type of bill of sale may include additional sections to record firearm specifications, serial numbers, and background check information. It is important to note that the above information is general and not exhaustive. It is crucial to consult legal professionals or appropriate authorities in Franklin, Ohio, to obtain the most accurate and up-to-date forms and information related to the Bill of Sale of Personal Property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.