Discrimination favoring management or highly paid employees is not permitted for deductible health and accident insurance plans. For self-insured medical reimbursement plans (i.e., direct payment or reimbursement by the employer of the medical bills of the employee or family), no discrimination, either in eligibility or benefits, is permitted if "highly compensated individuals" are to receive all plan benefits tax-free. The plan must benefit, in general, at least 70% of employees who are not highly compensated employees. However, there are exceptions. A "highly compensated employee" is one who has a significant ownership interest in the company, or who is one of the five highest paid officers or employees. An alternative designation is an income threshold, currently $80,000. If a self-insured plan is discriminatory, an employee who is considered a highly compensated employee must include the amount of discriminatory benefits received in gross income.

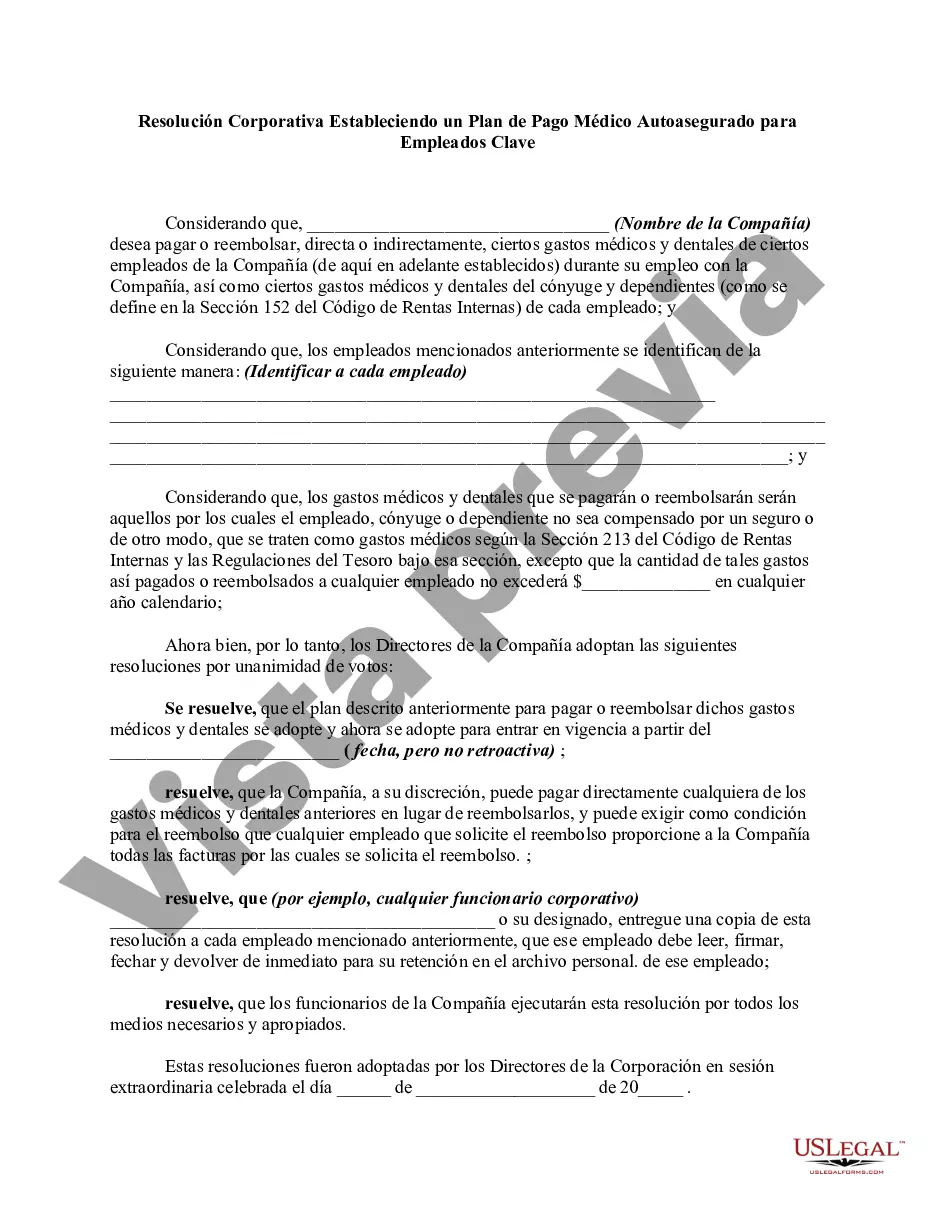

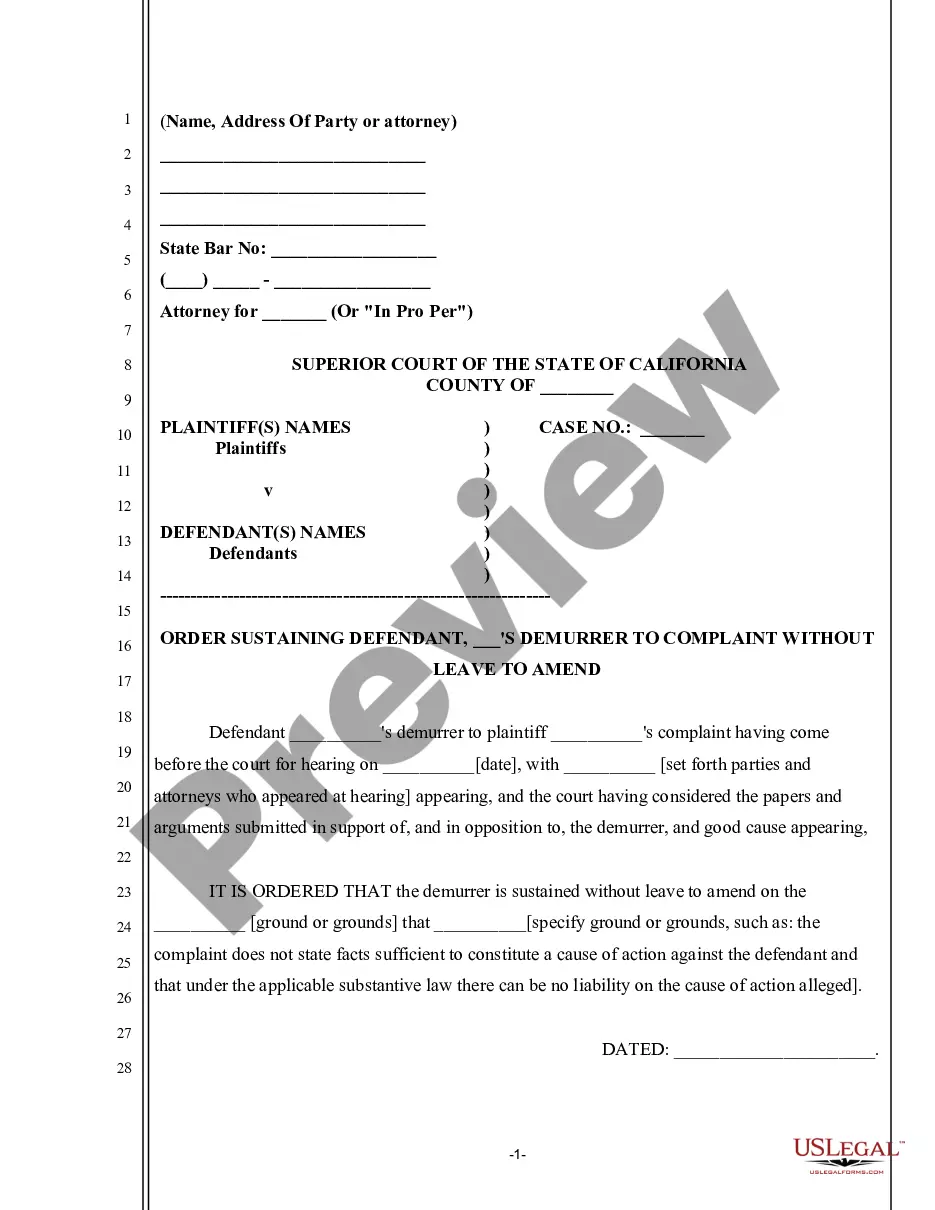

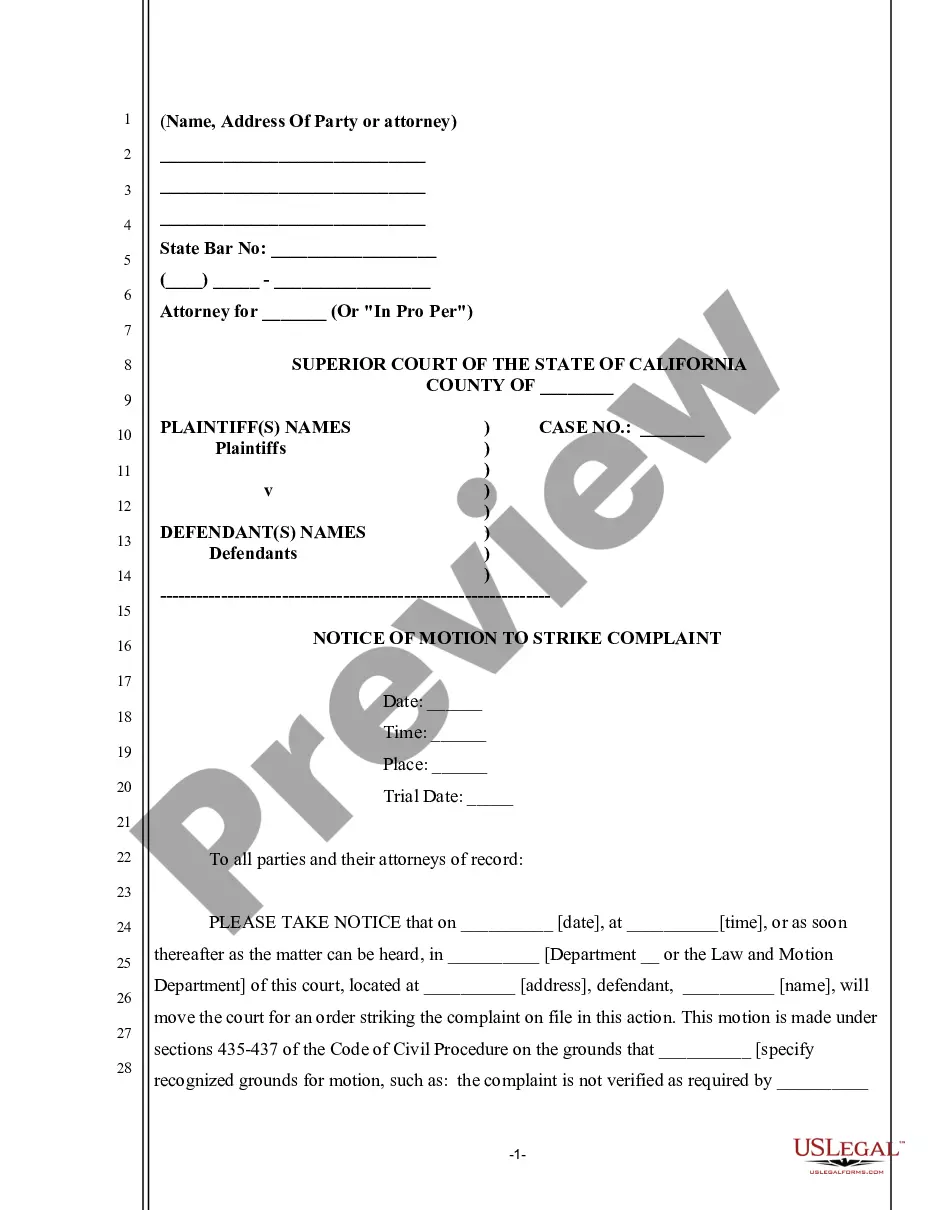

Dallas, Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees A corporate resolution is a legally binding document that outlines important decisions made by a corporation's board of directors. In Dallas, Texas, corporations have the option to establish a self-insured medical payment plan for their key employees. This type of resolution allows the corporation to take on the responsibility of providing medical payment coverage directly to their key employees, rather than relying on an external insurance provider. This corporate resolution is specifically designed to cater to key employees, who are often vital to a corporation's success and play crucial roles in its growth. By establishing a self-insured medical payment plan, corporations aim to ensure that their key employees receive comprehensive and tailored medical coverage, reflecting their importance within the organization. Self-insured medical payment plans offer corporations flexibility and control over the healthcare benefits they provide to their key employees. This approach allows corporations to design plans that align with the specific needs and requirements of their workforce, ensuring maximum satisfaction and support. These plans often cover a wide range of medical expenses, including doctor visits, hospitalizations, surgeries, prescription medications, and preventive care. Key employees may include top-level executives, managers, and other individuals who hold critical positions within the corporation. By prioritizing the healthcare needs of these employees, corporations acknowledge the pivotal role they play in decision-making processes, strategy development, team management, and overall organizational success. Different types of Dallas, Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees may include variations in coverage levels, deductible amounts, premium structures, and options for additional benefits such as dental and vision care. Corporations can tailor these plans to meet the unique needs of their key employees and strike a balance between comprehensive coverage and cost-effectiveness. In conclusion, the Dallas, Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees provides a framework for corporations to take direct responsibility for their key employees' healthcare benefits. These resolutions aim to offer tailored, comprehensive coverage to key employees and allow corporations to have greater control over the design and administration of their medical payment plans. Different variations of these resolutions may exist to cater to the specific needs and preferences of corporations in Dallas, Texas.Dallas, Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees A corporate resolution is a legally binding document that outlines important decisions made by a corporation's board of directors. In Dallas, Texas, corporations have the option to establish a self-insured medical payment plan for their key employees. This type of resolution allows the corporation to take on the responsibility of providing medical payment coverage directly to their key employees, rather than relying on an external insurance provider. This corporate resolution is specifically designed to cater to key employees, who are often vital to a corporation's success and play crucial roles in its growth. By establishing a self-insured medical payment plan, corporations aim to ensure that their key employees receive comprehensive and tailored medical coverage, reflecting their importance within the organization. Self-insured medical payment plans offer corporations flexibility and control over the healthcare benefits they provide to their key employees. This approach allows corporations to design plans that align with the specific needs and requirements of their workforce, ensuring maximum satisfaction and support. These plans often cover a wide range of medical expenses, including doctor visits, hospitalizations, surgeries, prescription medications, and preventive care. Key employees may include top-level executives, managers, and other individuals who hold critical positions within the corporation. By prioritizing the healthcare needs of these employees, corporations acknowledge the pivotal role they play in decision-making processes, strategy development, team management, and overall organizational success. Different types of Dallas, Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees may include variations in coverage levels, deductible amounts, premium structures, and options for additional benefits such as dental and vision care. Corporations can tailor these plans to meet the unique needs of their key employees and strike a balance between comprehensive coverage and cost-effectiveness. In conclusion, the Dallas, Texas Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees provides a framework for corporations to take direct responsibility for their key employees' healthcare benefits. These resolutions aim to offer tailored, comprehensive coverage to key employees and allow corporations to have greater control over the design and administration of their medical payment plans. Different variations of these resolutions may exist to cater to the specific needs and preferences of corporations in Dallas, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.