Harris Texas Assignment of Deed of Trust

Description

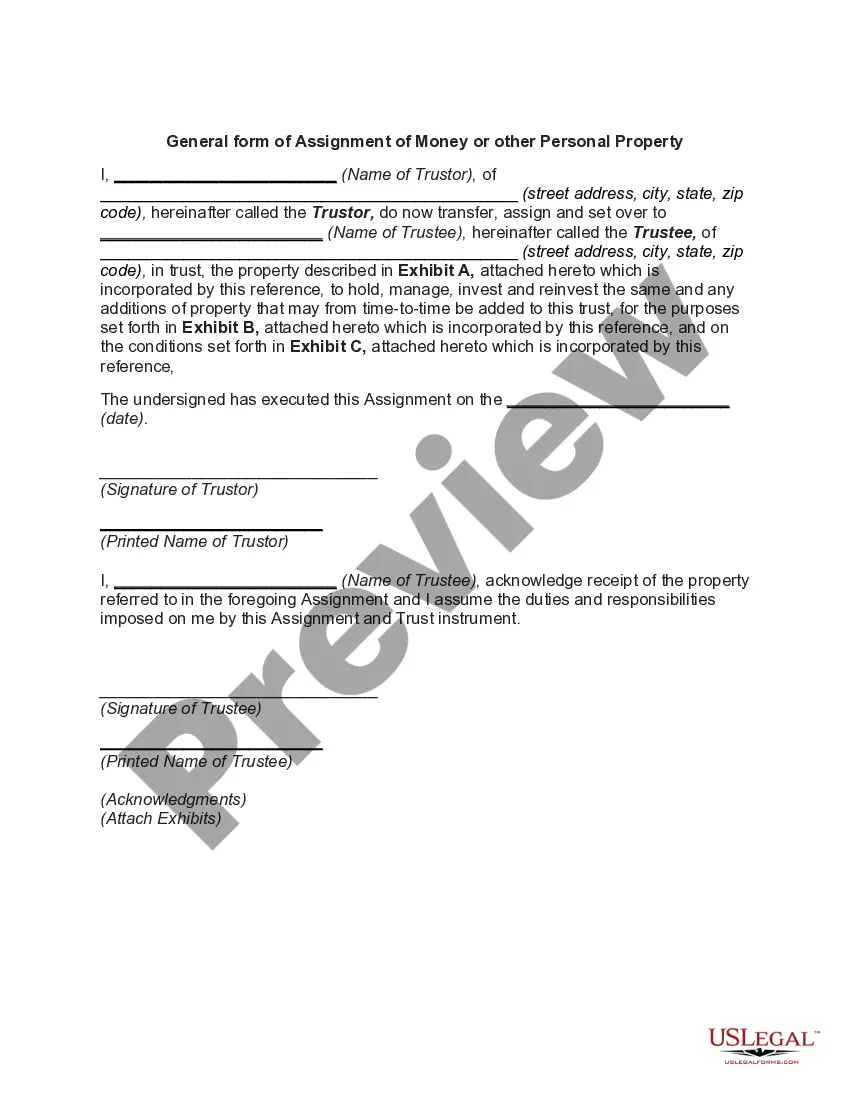

How to fill out Assignment Of Deed Of Trust?

Generating paperwork, such as the Harris Assignment of Deed of Trust, to manage your legal matters is a challenging and time-intensive endeavor.

Many situations necessitate an attorney's involvement, which can also make this process costly.

However, you can take control of your legal issues and handle them independently.

The process for onboarding new users is equally straightforward! Here’s what you should accomplish before obtaining the Harris Assignment of Deed of Trust: Ensure that your form is tailored to your state/county, as the laws for crafting legal documents may vary from one state to another.

- US Legal Forms is here to assist you.

- Our platform offers more than 85,000 legal documents designed for various situations and life events.

- We ensure that each document complies with the laws of each state, alleviating your concerns about possible legal issues regarding compliance.

- If you're familiar with our offerings and hold a subscription with US, you already recognize how straightforward it is to access the Harris Assignment of Deed of Trust template.

- Simply Log In to your account, download the template, and customize it to your needs.

- Lost your document? No problem. You can retrieve it in the My documents section of your account - on either desktop or mobile.

Form popularity

FAQ

The Trustee, usually chosen by the lender, is the person who represents both the Grantor and the Grantee (Beneficiary) if there is a default under a Deed of Trust. When no specific trustee is required by the lender, someone willing and able to hold a foreclosure sale if necessary may be selected.

Deed Of Trust Vs. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid. In the event of default on the loan, the trustee is responsible for starting the foreclosure process.

The trustee is the person or entity who will hold legal title to the property after the transfer. The beneficiary or beneficiaries are those whom the trust is intended to benefit. In the case of a mortgage, this would be the lender.

In Florida, an assignment of mortgage: Transfers the assignor's rights under the mortgage to the assignee. Permits the assignee to pursue the same remedies, including foreclosure, as the original lender. Generally retains priority of the mortgage that is assigned for the benefit of the assignee.

Meaning of deed of assignment in Englisha legal agreement to give an asset or to sell a debt to someone else: This deed of assignment enables ownership of a life-insurance policy to be transferred from the current owner to another person or organization.

An assignment of trust deed is a document that lenders use when they sell loans secured by trust deeds. While they can freely sell the promissory notes between themselves, the trust deeds that give them the right to foreclose have to be assigned with a legal document.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

If you're the borrower, you're called the grantor, or sometimes the trustor. Your lender is the beneficiary because it receives money from you and benefits from the deal. The trustee is effectively your lender's watchdog he stands by ready to act when you pay off your loan or if you default on the payments.

How to WriteStep 1 Obtain The California Deed Of Trust Form For Your Use.Step 2 Determine And Present Where This Deed Must Be Returned.Step 3 Report The Assessor's Parcel Number.Step 4 Record The Effective Date Of This Deed.Step 5 Produce The Debtor's Identity As The Trustor.More items...?