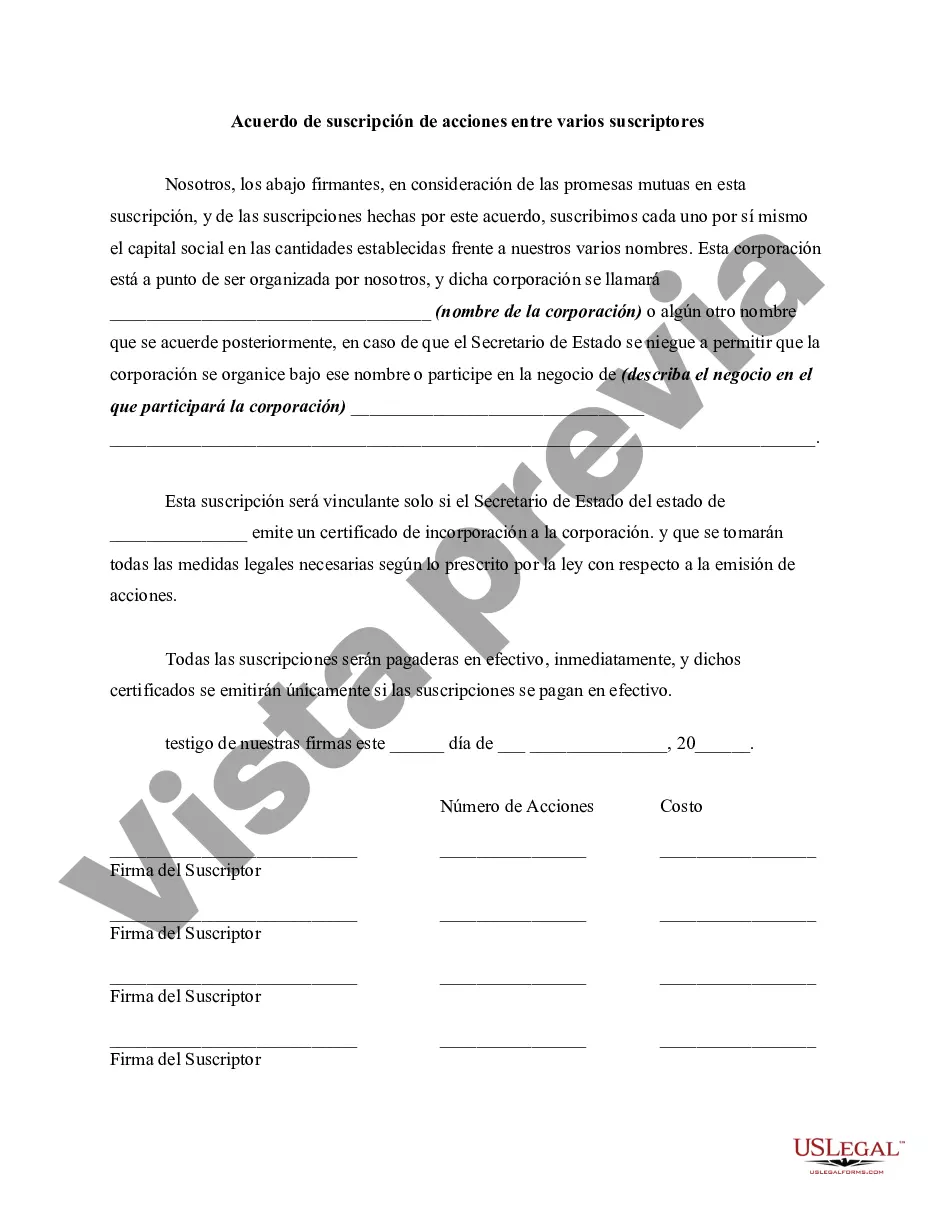

A stock subscription is an agreement to purchase, at a stated price, a stated number of shares of stock of a corporation which is to be formed. Unless some restriction appears in the enabling statute or in the articles or certificate of incorporation, any natural person, and any corporation with the appropriate power, may be a subscriber to corporate stock. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Fairfax Virginia Stock Subscription Agreement Among Several Subscribers is a legally binding document that outlines the terms and conditions agreed upon by multiple individuals or entities subscribing to the stock of a company based in Fairfax, Virginia. This agreement serves as the contract between the company issuing the stock (the issuer) and the subscribers (investors or stockholders). It is designed to protect the rights and interests of both parties involved in the stock subscription process. The agreement will typically include the following key elements: 1. Parties Involved: The agreement will clearly state the names and contact information of all subscribing parties, including the issuer and the subscribers. 2. Subscription Details: The agreement will outline the number of shares or amount of stock being subscribed by each subscriber. It will also specify the price per share or the total subscription amount. 3. Payment Terms: The agreement will define the payment terms and conditions, including the modes of payment and the schedule for payment. It may also cover any provisions for installment payments, if applicable. 4. Representations and Warranties: Both the issuer and the subscribers will provide certain representations and warranties to ensure the accuracy of information provided. This may include confirming eligibility to purchase and hold the stock, compliance with applicable laws, and verifying the availability of funds for subscription. 5. Securities Laws Compliance: The agreement will address compliance with relevant federal and state securities laws, including disclosure requirements, exemptions, and potential restrictions on the transferability of the subscribed stock. 6. Terms and Conditions: The agreement will include various terms and conditions, such as restrictions on transfer, confidentiality, dispute resolution mechanisms, and termination provisions. It may also outline any rights or privileges granted to the subscribers, such as voting rights or dividend entitlements. Different types of Fairfax Virginia Stock Subscription Agreements Among Several Subscribers may exist based on the specific circumstances or needs of the issuing company. For example: 1. Primary Offering: This type of agreement is used when a company offers its shares publicly for the first time, allowing new investors to subscribe to the stock. 2. Secondary Offering: In a secondary offering, existing shareholders or the company itself may offer additional shares to raise capital. The agreement will govern the terms for such subscriptions by both existing and new subscribers. 3. Private Placement Agreement: This type of agreement is used when the issuer restricts the offering of its stock to a select group of accredited investors, often with exemptions from certain securities laws requirements. In summary, a Fairfax Virginia Stock Subscription Agreement Among Several Subscribers is a critical document that facilitates the subscription of shares by multiple investors in a company based in Fairfax, Virginia. The agreement provides the necessary legal framework and protects the interests of all parties involved, ensuring a transparent and efficient stock subscription process.Fairfax Virginia Stock Subscription Agreement Among Several Subscribers is a legally binding document that outlines the terms and conditions agreed upon by multiple individuals or entities subscribing to the stock of a company based in Fairfax, Virginia. This agreement serves as the contract between the company issuing the stock (the issuer) and the subscribers (investors or stockholders). It is designed to protect the rights and interests of both parties involved in the stock subscription process. The agreement will typically include the following key elements: 1. Parties Involved: The agreement will clearly state the names and contact information of all subscribing parties, including the issuer and the subscribers. 2. Subscription Details: The agreement will outline the number of shares or amount of stock being subscribed by each subscriber. It will also specify the price per share or the total subscription amount. 3. Payment Terms: The agreement will define the payment terms and conditions, including the modes of payment and the schedule for payment. It may also cover any provisions for installment payments, if applicable. 4. Representations and Warranties: Both the issuer and the subscribers will provide certain representations and warranties to ensure the accuracy of information provided. This may include confirming eligibility to purchase and hold the stock, compliance with applicable laws, and verifying the availability of funds for subscription. 5. Securities Laws Compliance: The agreement will address compliance with relevant federal and state securities laws, including disclosure requirements, exemptions, and potential restrictions on the transferability of the subscribed stock. 6. Terms and Conditions: The agreement will include various terms and conditions, such as restrictions on transfer, confidentiality, dispute resolution mechanisms, and termination provisions. It may also outline any rights or privileges granted to the subscribers, such as voting rights or dividend entitlements. Different types of Fairfax Virginia Stock Subscription Agreements Among Several Subscribers may exist based on the specific circumstances or needs of the issuing company. For example: 1. Primary Offering: This type of agreement is used when a company offers its shares publicly for the first time, allowing new investors to subscribe to the stock. 2. Secondary Offering: In a secondary offering, existing shareholders or the company itself may offer additional shares to raise capital. The agreement will govern the terms for such subscriptions by both existing and new subscribers. 3. Private Placement Agreement: This type of agreement is used when the issuer restricts the offering of its stock to a select group of accredited investors, often with exemptions from certain securities laws requirements. In summary, a Fairfax Virginia Stock Subscription Agreement Among Several Subscribers is a critical document that facilitates the subscription of shares by multiple investors in a company based in Fairfax, Virginia. The agreement provides the necessary legal framework and protects the interests of all parties involved, ensuring a transparent and efficient stock subscription process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.