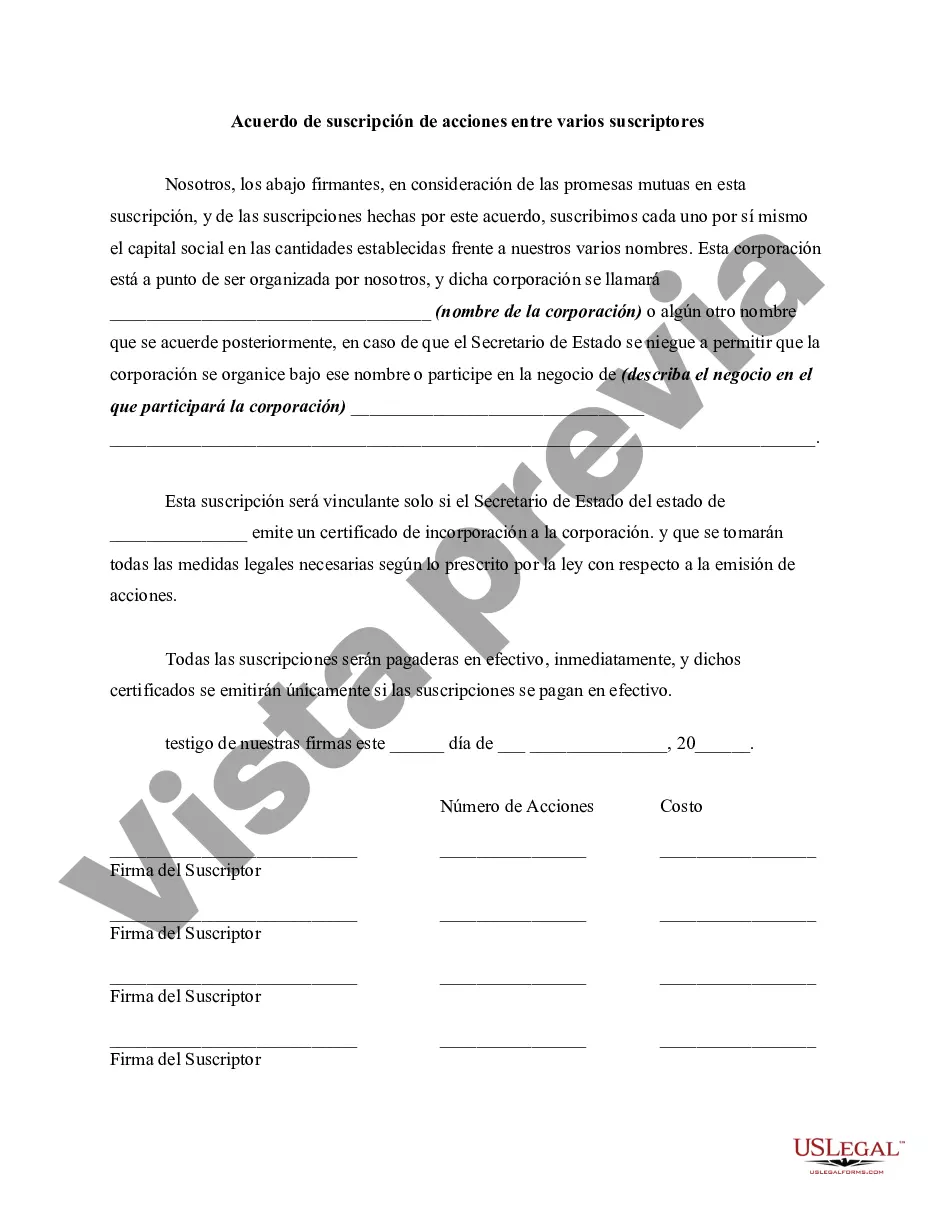

A stock subscription is an agreement to purchase, at a stated price, a stated number of shares of stock of a corporation which is to be formed. Unless some restriction appears in the enabling statute or in the articles or certificate of incorporation, any natural person, and any corporation with the appropriate power, may be a subscriber to corporate stock. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Harris Texas Stock Subscription Agreement is a legal document that outlines the terms and conditions for purchasing stocks among several subscribers in Harris County, Texas. This agreement is a crucial component of any stock transaction as it establishes the rights, obligations, and responsibilities of the subscribers involved. It serves as a binding contract between the subscribers and the issuing company. There are various types of Harris Texas Stock Subscription Agreements among several subscribers, including: 1. Common Stock Subscription Agreement: This type of agreement is used when subscribers intend to purchase common stocks. Common stocks represent ownership in a corporation and entitle shareholders to vote on company matters and receive dividends. 2. Preferred Stock Subscription Agreement: Preferred stock subscription agreements are used when subscribers desire to purchase preferred stocks. Preferred stocks offer shareholders priority in dividend distribution and have different rights than common stocks, such as receiving a fixed dividend before common shareholders. 3. Restricted Stock Subscription Agreement: This agreement is utilized when subscribers wish to acquire restricted stocks. Restricted stocks have certain limitations imposed by the issuing company, such as a restriction on transferability or a lock-up period. 4. Convertible Stock Subscription Agreement: This type of agreement enables subscribers to purchase convertible stocks, which can be converted into a different class of stock at a later date. It provides flexibility to subscribers in terms of investment options. 5. Employee Stock Subscription Agreement: Employee stock subscription agreements are specific to employees who wish to subscribe to company stocks as part of their compensation package. These agreements often outline vesting schedules and other terms specific to employees. 6. Private Stock Subscription Agreement: Private stock subscription agreements are applicable when subscribers acquire stocks from a private company that is not publicly traded. These agreements usually contain additional clauses to protect the interests of both parties. In each type of Harris Texas Stock Subscription Agreement, key provisions include the number of shares subscribed, the purchase price per share, payment terms, representations and warranties made by the subscribers, conditions for stock issuance, and dispute resolution mechanisms. Comprehensively, the Harris Texas Stock Subscription Agreement among subscribers is a comprehensive legal instrument that ensures a transparent and organized process for purchasing stocks in Harris County, Texas. It safeguards the rights of subscribers and the issuing company, providing a framework for a mutually beneficial stock transaction.The Harris Texas Stock Subscription Agreement is a legal document that outlines the terms and conditions for purchasing stocks among several subscribers in Harris County, Texas. This agreement is a crucial component of any stock transaction as it establishes the rights, obligations, and responsibilities of the subscribers involved. It serves as a binding contract between the subscribers and the issuing company. There are various types of Harris Texas Stock Subscription Agreements among several subscribers, including: 1. Common Stock Subscription Agreement: This type of agreement is used when subscribers intend to purchase common stocks. Common stocks represent ownership in a corporation and entitle shareholders to vote on company matters and receive dividends. 2. Preferred Stock Subscription Agreement: Preferred stock subscription agreements are used when subscribers desire to purchase preferred stocks. Preferred stocks offer shareholders priority in dividend distribution and have different rights than common stocks, such as receiving a fixed dividend before common shareholders. 3. Restricted Stock Subscription Agreement: This agreement is utilized when subscribers wish to acquire restricted stocks. Restricted stocks have certain limitations imposed by the issuing company, such as a restriction on transferability or a lock-up period. 4. Convertible Stock Subscription Agreement: This type of agreement enables subscribers to purchase convertible stocks, which can be converted into a different class of stock at a later date. It provides flexibility to subscribers in terms of investment options. 5. Employee Stock Subscription Agreement: Employee stock subscription agreements are specific to employees who wish to subscribe to company stocks as part of their compensation package. These agreements often outline vesting schedules and other terms specific to employees. 6. Private Stock Subscription Agreement: Private stock subscription agreements are applicable when subscribers acquire stocks from a private company that is not publicly traded. These agreements usually contain additional clauses to protect the interests of both parties. In each type of Harris Texas Stock Subscription Agreement, key provisions include the number of shares subscribed, the purchase price per share, payment terms, representations and warranties made by the subscribers, conditions for stock issuance, and dispute resolution mechanisms. Comprehensively, the Harris Texas Stock Subscription Agreement among subscribers is a comprehensive legal instrument that ensures a transparent and organized process for purchasing stocks in Harris County, Texas. It safeguards the rights of subscribers and the issuing company, providing a framework for a mutually beneficial stock transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.