A stock subscription is an agreement to purchase, at a stated price, a stated number of shares of stock of a corporation which is to be formed. Unless some restriction appears in the enabling statute or in the articles or certificate of incorporation, any natural person, and any corporation with the appropriate power, may be a subscriber to corporate stock. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

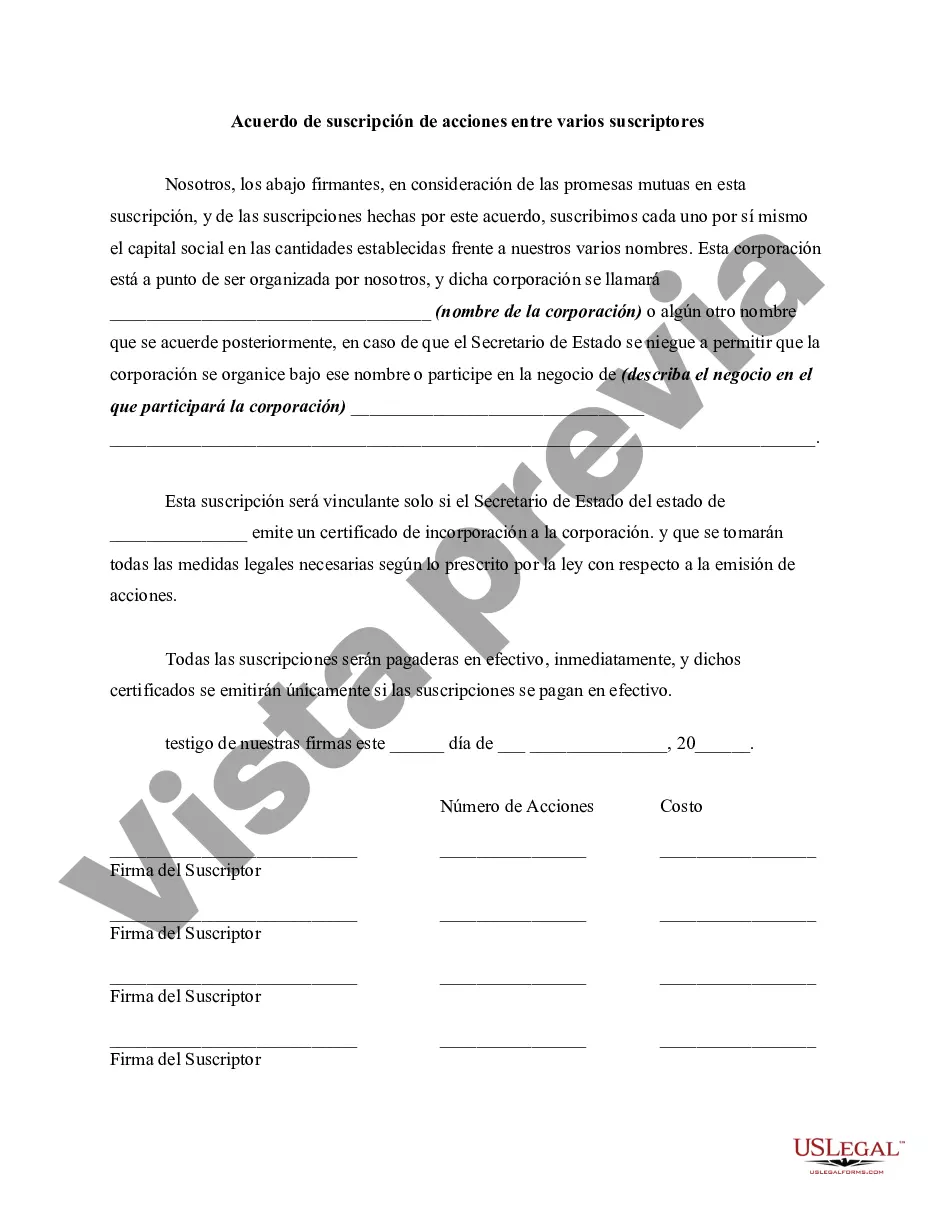

Miami-Dade Florida Stock Subscription Agreement Among Several Subscribers is a legal document that outlines the terms and conditions for the purchase of stocks by multiple investors in Miami-Dade County, Florida. This agreement serves as a binding contract between the subscribers and the company issuing the stocks. The purpose of this agreement is to establish the rights, obligations, and responsibilities of the subscribers in relation to their investment in the company. It covers essential details such as the number of shares being subscribed, the price per share, and the payment terms. There are different types of Miami-Dade Florida Stock Subscription Agreement Among Several Subscribers, depending on the specific details and requirements of each situation. Some of these types may include: 1. Common Stock Subscription Agreement: This type of agreement applies when subscribers are purchasing common stocks, which provide them with voting rights and potential dividends. It outlines the terms and conditions specific to the purchase of common shares. 2. Preferred Stock Subscription Agreement: This type of agreement applies when subscribers are purchasing preferred stocks, which typically offer higher dividends but may not have voting rights. It includes provisions relevant to the purchase and ownership of preferred shares. 3. Convertible Stock Subscription Agreement: This type of agreement applies when subscribers are purchasing convertible stocks, which can be converted into another class of securities (such as common or preferred shares) at a later date. It specifies the conversion terms and conditions, enabling subscribers to explore potential opportunities for capital appreciation. Regardless of the type, all Miami-Dade Florida Stock Subscription Agreements Among Several Subscribers should include standard provisions such as representations and warranties, restrictions on transfer, dispute resolution mechanisms, and governing law clauses. These provisions help protect the interests of both the subscribers and the issuing company and ensure compliance with relevant legal requirements. It is important for all parties involved to carefully review and understand the terms of the agreement before signing. Seeking professional legal advice is recommended to ensure compliance with applicable laws and to address any specific concerns or circumstances related to the stock subscription transaction.Miami-Dade Florida Stock Subscription Agreement Among Several Subscribers is a legal document that outlines the terms and conditions for the purchase of stocks by multiple investors in Miami-Dade County, Florida. This agreement serves as a binding contract between the subscribers and the company issuing the stocks. The purpose of this agreement is to establish the rights, obligations, and responsibilities of the subscribers in relation to their investment in the company. It covers essential details such as the number of shares being subscribed, the price per share, and the payment terms. There are different types of Miami-Dade Florida Stock Subscription Agreement Among Several Subscribers, depending on the specific details and requirements of each situation. Some of these types may include: 1. Common Stock Subscription Agreement: This type of agreement applies when subscribers are purchasing common stocks, which provide them with voting rights and potential dividends. It outlines the terms and conditions specific to the purchase of common shares. 2. Preferred Stock Subscription Agreement: This type of agreement applies when subscribers are purchasing preferred stocks, which typically offer higher dividends but may not have voting rights. It includes provisions relevant to the purchase and ownership of preferred shares. 3. Convertible Stock Subscription Agreement: This type of agreement applies when subscribers are purchasing convertible stocks, which can be converted into another class of securities (such as common or preferred shares) at a later date. It specifies the conversion terms and conditions, enabling subscribers to explore potential opportunities for capital appreciation. Regardless of the type, all Miami-Dade Florida Stock Subscription Agreements Among Several Subscribers should include standard provisions such as representations and warranties, restrictions on transfer, dispute resolution mechanisms, and governing law clauses. These provisions help protect the interests of both the subscribers and the issuing company and ensure compliance with relevant legal requirements. It is important for all parties involved to carefully review and understand the terms of the agreement before signing. Seeking professional legal advice is recommended to ensure compliance with applicable laws and to address any specific concerns or circumstances related to the stock subscription transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.