As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Title: Understanding the Chicago Illinois Report of Independent Accountants after Audit of Financial Statements Introduction: The Chicago Illinois Report of Independent Accountants after Audit of Financial Statements serves as a critical document that provides valuable insights into the financial health and transparency of businesses operating in the state. This report is an essential tool for investors, stakeholders, and regulatory bodies, ensuring accountability and accurate representation of a company's financial position. In this article, we will delve into the details of this report, its significance, and different types of Chicago Illinois reports that can be encountered. 1. Purpose of the Chicago Illinois Report of Independent Accountants: The primary purpose of the Chicago Illinois Report of Independent Accountants after Audit of Financial Statements is to offer assurance to the users of financial statements. It evaluates the fairness, accuracy, and compliance of the financial statements with Generally Accepted Accounting Principles (GAAP) and other relevant regulatory frameworks. These reports provide an independent opinion and enhance the reliability of financial information. 2. Key Components of the Chicago Illinois Report: The Chicago Illinois Report of Independent Accountants after Audit of Financial Statements generally consists of the following sections: a. Introductory Paragraph: This section outlines the responsibilities of both the company's management and the independent auditor undertaking the audit. It also highlights the reporting framework used. b. Management's Responsibility Section: Here, the report describes the management's overall responsibilities in preparing and presenting the financial statements. It emphasizes the fair presentation of financial information, internal control systems, and material misstatement prevention. c. Auditor's Responsibility Section: This part provides an overview of the independent auditor's responsibilities, highlighting the adherence to professional standards, conducting the audit, assessing internal controls, and expressing an unbiased opinion. d. Opinion Section: Perhaps the most critical part, this section details the auditor's opinion on the fairness of the financial statements. Based on the audit findings, the auditor may express an unqualified opinion, qualified opinion, adverse opinion, or disclaimer of opinion. e. Other Required Statements: Depending on the specific requirements or circumstances, additional statements may be included in the report. These could cover matters such as going concern, consistency, and supplementary information. 3. Types of Chicago Illinois Reports of Independent Accountants after Audit of Financial Statements: While the general structure of the report remains consistent, the opinions expressed within the report can vary, affecting the perception of a company's financial health. The differing types of reports include: a. Unqualified Opinion: Also known as a clean opinion, this type of report indicates the financial statements fairly represent the company's financial position and comply with relevant accounting principles. b. Qualified Opinion: A qualified opinion suggests that there may be limitations or reservations in the presentation of financial information, typically due to material misstatements, restrictions on audit procedures, or inadequate disclosure. c. Adverse Opinion: An adverse opinion implies that the financial statements do not fairly represent the company's financial position or fail to comply with accounting principles. This opinion raises significant concerns about the company's financial health. d. Disclaimer of Opinion: A disclaimer of opinion occurs when the auditor is unable to express an opinion due to insufficient evidence, lack of independence, or other significant limitations. Such a report generally calls for immediate attention and further investigation. Conclusion: The Chicago Illinois Report of Independent Accountants after Audit of Financial Statements is an essential document that provides credibility, transparency, and reliability in evaluating a company's financial position. These reports aid investors, stakeholders, and regulatory bodies in making informed decisions. Understanding the various types of reports and their implications is crucial for interpreting the financial health of businesses operating in Chicago, Illinois.Title: Understanding the Chicago Illinois Report of Independent Accountants after Audit of Financial Statements Introduction: The Chicago Illinois Report of Independent Accountants after Audit of Financial Statements serves as a critical document that provides valuable insights into the financial health and transparency of businesses operating in the state. This report is an essential tool for investors, stakeholders, and regulatory bodies, ensuring accountability and accurate representation of a company's financial position. In this article, we will delve into the details of this report, its significance, and different types of Chicago Illinois reports that can be encountered. 1. Purpose of the Chicago Illinois Report of Independent Accountants: The primary purpose of the Chicago Illinois Report of Independent Accountants after Audit of Financial Statements is to offer assurance to the users of financial statements. It evaluates the fairness, accuracy, and compliance of the financial statements with Generally Accepted Accounting Principles (GAAP) and other relevant regulatory frameworks. These reports provide an independent opinion and enhance the reliability of financial information. 2. Key Components of the Chicago Illinois Report: The Chicago Illinois Report of Independent Accountants after Audit of Financial Statements generally consists of the following sections: a. Introductory Paragraph: This section outlines the responsibilities of both the company's management and the independent auditor undertaking the audit. It also highlights the reporting framework used. b. Management's Responsibility Section: Here, the report describes the management's overall responsibilities in preparing and presenting the financial statements. It emphasizes the fair presentation of financial information, internal control systems, and material misstatement prevention. c. Auditor's Responsibility Section: This part provides an overview of the independent auditor's responsibilities, highlighting the adherence to professional standards, conducting the audit, assessing internal controls, and expressing an unbiased opinion. d. Opinion Section: Perhaps the most critical part, this section details the auditor's opinion on the fairness of the financial statements. Based on the audit findings, the auditor may express an unqualified opinion, qualified opinion, adverse opinion, or disclaimer of opinion. e. Other Required Statements: Depending on the specific requirements or circumstances, additional statements may be included in the report. These could cover matters such as going concern, consistency, and supplementary information. 3. Types of Chicago Illinois Reports of Independent Accountants after Audit of Financial Statements: While the general structure of the report remains consistent, the opinions expressed within the report can vary, affecting the perception of a company's financial health. The differing types of reports include: a. Unqualified Opinion: Also known as a clean opinion, this type of report indicates the financial statements fairly represent the company's financial position and comply with relevant accounting principles. b. Qualified Opinion: A qualified opinion suggests that there may be limitations or reservations in the presentation of financial information, typically due to material misstatements, restrictions on audit procedures, or inadequate disclosure. c. Adverse Opinion: An adverse opinion implies that the financial statements do not fairly represent the company's financial position or fail to comply with accounting principles. This opinion raises significant concerns about the company's financial health. d. Disclaimer of Opinion: A disclaimer of opinion occurs when the auditor is unable to express an opinion due to insufficient evidence, lack of independence, or other significant limitations. Such a report generally calls for immediate attention and further investigation. Conclusion: The Chicago Illinois Report of Independent Accountants after Audit of Financial Statements is an essential document that provides credibility, transparency, and reliability in evaluating a company's financial position. These reports aid investors, stakeholders, and regulatory bodies in making informed decisions. Understanding the various types of reports and their implications is crucial for interpreting the financial health of businesses operating in Chicago, Illinois.

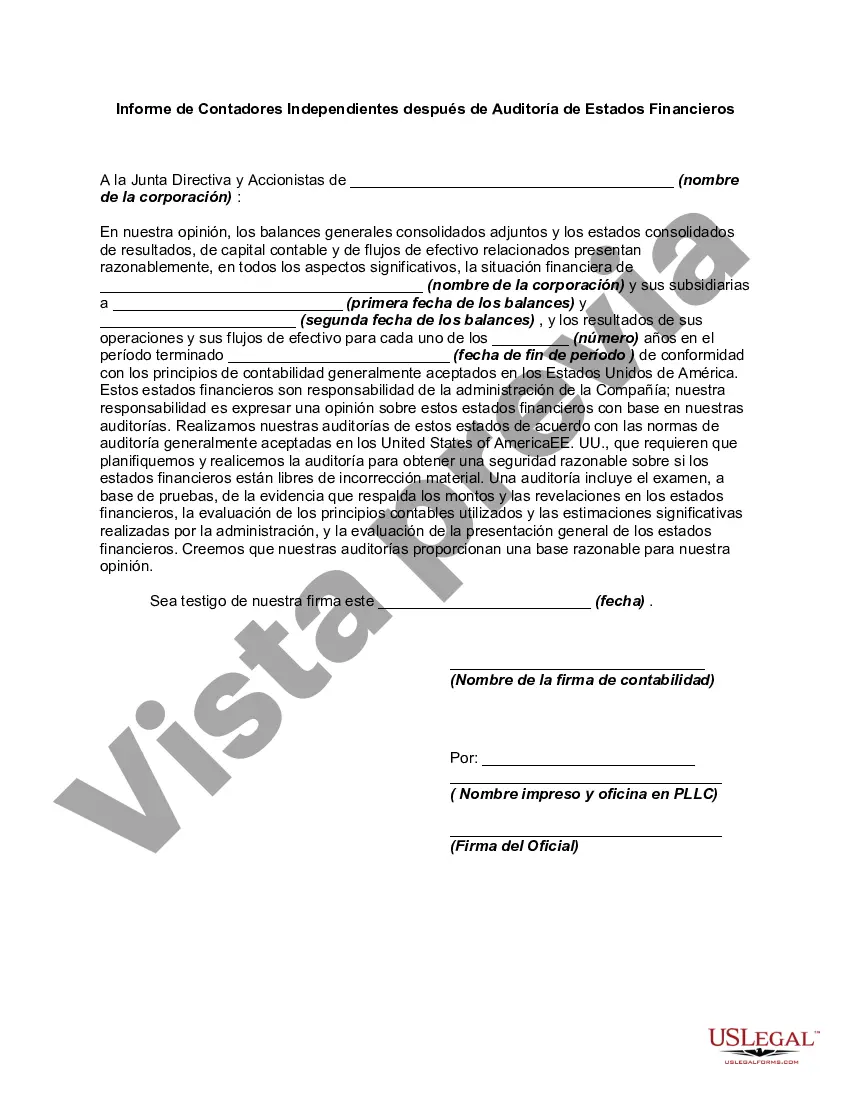

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.