As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Cook Illinois is a reputable organization providing transportation services in Illinois. The Cook Illinois Report of Independent Accountants after Audit of Financial Statements is a comprehensive document that evaluates and communicates the financial standing and performance of the company. This report provides valuable insights and assurance to stakeholders, such as investors, creditors, and regulators, regarding the accuracy and integrity of Cook Illinois' financial statements. The independent accountants who conduct the audit thoroughly examine the financial records, reporting practices, internal controls, and compliance with accounting principles and standards. Multiple types of Cook Illinois reports may be generated depending on the specific focus of the audit: 1. Cook Illinois Report of Independent Accountants — Financial Statements: This type of report provides an opinion on the fairness and presentation of Cook Illinois' financial statements, including the balance sheet, income statement, cash flow statement, and statement of changes in equity. The independent accountants express their professional judgment on whether the financial statements fairly represent Cook Illinois' financial position, results of operations, and cash flows. 2. Cook Illinois Report of Independent Accountants — Compliance: In this type of report, the independent accountants assess Cook Illinois' compliance with applicable laws, regulations, and contractual obligations. They evaluate whether Cook Illinois has complied with legal and regulatory requirements and consistently implemented any specific requirements from external stakeholders, such as government agencies or granters. 3. Cook Illinois Report of Independent Accountants — Internal Controls: This report focuses on assessing the effectiveness and reliability of Cook Illinois' internal controls system. The independent accountants evaluate the design and implementation of internal controls to ensure the accuracy, safeguarding, and management of Cook Illinois' assets and financial reporting. They determine whether any significant weaknesses or deficiencies exist and provide recommendations for improvement. 4. Cook Illinois Report of Independent Accountants — Audit Findings and Recommendations: This type of report consolidates the audit findings and recommendations identified by the independent accountants. It presents a detailed analysis of any issues or deficiencies discovered during the audit process, along with suggestions for remediation and enhancements. The report aims to assist Cook Illinois in addressing identified areas of improvement and ensuring the continued reliability and transparency of its financial reporting. Overall, the Cook Illinois Report of Independent Accountants after Audit of Financial Statements serves as a critical tool for stakeholders to assess the financial health, compliance, and internal control strengths of Cook Illinois. It enhances transparency, reliability, and confidence in the organization's financial reporting, helping to maintain trust among investors, creditors, and other interested parties.Cook Illinois is a reputable organization providing transportation services in Illinois. The Cook Illinois Report of Independent Accountants after Audit of Financial Statements is a comprehensive document that evaluates and communicates the financial standing and performance of the company. This report provides valuable insights and assurance to stakeholders, such as investors, creditors, and regulators, regarding the accuracy and integrity of Cook Illinois' financial statements. The independent accountants who conduct the audit thoroughly examine the financial records, reporting practices, internal controls, and compliance with accounting principles and standards. Multiple types of Cook Illinois reports may be generated depending on the specific focus of the audit: 1. Cook Illinois Report of Independent Accountants — Financial Statements: This type of report provides an opinion on the fairness and presentation of Cook Illinois' financial statements, including the balance sheet, income statement, cash flow statement, and statement of changes in equity. The independent accountants express their professional judgment on whether the financial statements fairly represent Cook Illinois' financial position, results of operations, and cash flows. 2. Cook Illinois Report of Independent Accountants — Compliance: In this type of report, the independent accountants assess Cook Illinois' compliance with applicable laws, regulations, and contractual obligations. They evaluate whether Cook Illinois has complied with legal and regulatory requirements and consistently implemented any specific requirements from external stakeholders, such as government agencies or granters. 3. Cook Illinois Report of Independent Accountants — Internal Controls: This report focuses on assessing the effectiveness and reliability of Cook Illinois' internal controls system. The independent accountants evaluate the design and implementation of internal controls to ensure the accuracy, safeguarding, and management of Cook Illinois' assets and financial reporting. They determine whether any significant weaknesses or deficiencies exist and provide recommendations for improvement. 4. Cook Illinois Report of Independent Accountants — Audit Findings and Recommendations: This type of report consolidates the audit findings and recommendations identified by the independent accountants. It presents a detailed analysis of any issues or deficiencies discovered during the audit process, along with suggestions for remediation and enhancements. The report aims to assist Cook Illinois in addressing identified areas of improvement and ensuring the continued reliability and transparency of its financial reporting. Overall, the Cook Illinois Report of Independent Accountants after Audit of Financial Statements serves as a critical tool for stakeholders to assess the financial health, compliance, and internal control strengths of Cook Illinois. It enhances transparency, reliability, and confidence in the organization's financial reporting, helping to maintain trust among investors, creditors, and other interested parties.

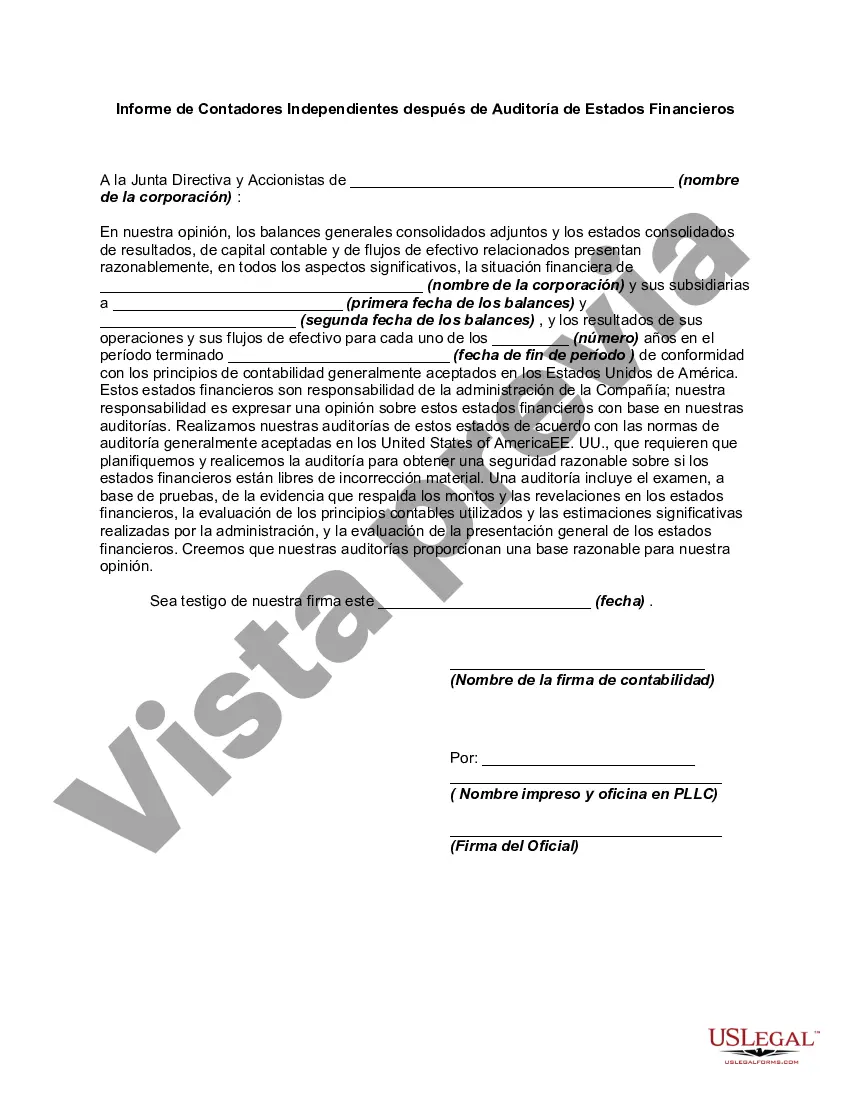

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.