As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Cuyahoga Ohio is a county located in the state of Ohio, United States. It is the second most populous county in the state and is home to the city of Cleveland. Cuyahoga County plays a significant role in Ohio's economy, housing numerous businesses, industries, and educational institutions. When it comes to financial matters, the Cuyahoga Ohio Report of Independent Accountants after Audit of Financial Statements holds crucial information. This report is prepared by independent accountants who conduct a thorough examination of the county's financial records, ensuring transparency and accuracy in financial reporting. The report assesses the county's financial condition, performance, and compliance with relevant laws and regulations. The Cuyahoga Ohio Report of Independent Accountants after Audit of Financial Statements follows a standardized format to present its findings. It includes a letter of transmittal, management's discussion and analysis (MDA), financial statements, and the report of independent accountants. The letter of transmittal outlines the purpose and scope of the audit, the responsibilities of the auditor and management, and provides an overview of the report. It may also include the auditor's opinion on the fairness and reliability of the financial statements. The MDA section provides a narrative overview of the county's financial performance, significant events, and key financial indicators. It assists readers in understanding the financial statements, highlighting trends, and identifying potential areas of concern. The financial statements presented consist of the balance sheet, income statement, statement of cash flows, and notes to the financial statements. These statements provide a comprehensive snapshot of the county's financial position, revenues, expenses, and cash flows. Additionally, the notes to the financial statements provide additional information and disclosures required by accounting standards. Finally, the report of the independent accountants includes their opinion on the financial statements. Depending on the findings, the report may state that the financial statements present a true and fair view of the county's financial position and performance in all material respects. In some cases, the report may also identify any material weaknesses or instances of non-compliance that need attention. It is worth mentioning that there are different types of Cuyahoga Ohio Reports of Independent Accountants after Audit of Financial Statements based on the purpose and scope of the audit. These may include the annual audit report, interim audit report, or special purpose audit report, each serving a specific need or requirement of the county. In conclusion, the Cuyahoga Ohio Report of Independent Accountants after Audit of Financial Statements is a comprehensive document that evaluates the financial health of Cuyahoga County. It is an essential tool for transparency, accountability, and informed decision-making, containing valuable insights for stakeholders, government officials, investors, and the public.Cuyahoga Ohio is a county located in the state of Ohio, United States. It is the second most populous county in the state and is home to the city of Cleveland. Cuyahoga County plays a significant role in Ohio's economy, housing numerous businesses, industries, and educational institutions. When it comes to financial matters, the Cuyahoga Ohio Report of Independent Accountants after Audit of Financial Statements holds crucial information. This report is prepared by independent accountants who conduct a thorough examination of the county's financial records, ensuring transparency and accuracy in financial reporting. The report assesses the county's financial condition, performance, and compliance with relevant laws and regulations. The Cuyahoga Ohio Report of Independent Accountants after Audit of Financial Statements follows a standardized format to present its findings. It includes a letter of transmittal, management's discussion and analysis (MDA), financial statements, and the report of independent accountants. The letter of transmittal outlines the purpose and scope of the audit, the responsibilities of the auditor and management, and provides an overview of the report. It may also include the auditor's opinion on the fairness and reliability of the financial statements. The MDA section provides a narrative overview of the county's financial performance, significant events, and key financial indicators. It assists readers in understanding the financial statements, highlighting trends, and identifying potential areas of concern. The financial statements presented consist of the balance sheet, income statement, statement of cash flows, and notes to the financial statements. These statements provide a comprehensive snapshot of the county's financial position, revenues, expenses, and cash flows. Additionally, the notes to the financial statements provide additional information and disclosures required by accounting standards. Finally, the report of the independent accountants includes their opinion on the financial statements. Depending on the findings, the report may state that the financial statements present a true and fair view of the county's financial position and performance in all material respects. In some cases, the report may also identify any material weaknesses or instances of non-compliance that need attention. It is worth mentioning that there are different types of Cuyahoga Ohio Reports of Independent Accountants after Audit of Financial Statements based on the purpose and scope of the audit. These may include the annual audit report, interim audit report, or special purpose audit report, each serving a specific need or requirement of the county. In conclusion, the Cuyahoga Ohio Report of Independent Accountants after Audit of Financial Statements is a comprehensive document that evaluates the financial health of Cuyahoga County. It is an essential tool for transparency, accountability, and informed decision-making, containing valuable insights for stakeholders, government officials, investors, and the public.

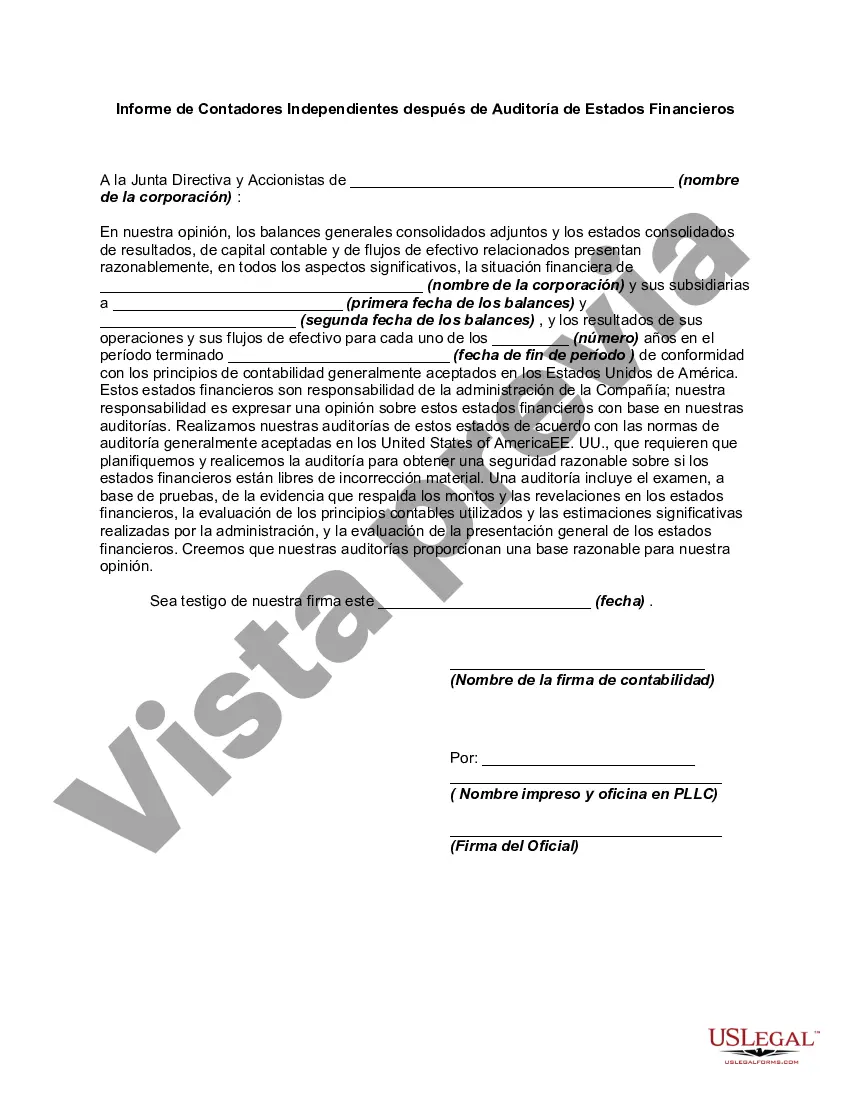

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.