As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Franklin Ohio Report of Independent Accountants after Audit of Financial Statements The Franklin Ohio Report of Independent Accountants after Audit of Financial Statements is a crucial document that provides an in-depth analysis and evaluation of the financial records and statements of the city of Franklin, Ohio. This report is prepared annually and serves as a critical tool for assessing the city's financial health, transparency, and compliance with accounting standards. The purpose of the report is to provide an objective and independent assessment of the financial statements, including the balance sheet, income statement, cash flow statement, and notes to the financial statements. It is prepared by a team of highly qualified and professional independent accountants who are licensed and experienced in conducting audits for governmental entities. The report includes a comprehensive review of the city's accounting policies, internal controls, and financial management practices. The independent accountants carefully examine financial transactions, records, and supporting documents to ensure accuracy, completeness, and compliance with relevant laws, regulations, and accounting principles. The key areas covered in the report generally include an analysis of revenue and expenditure trends, examination of significant assets and liabilities, evaluation of cash management practices, review of budgetary controls and variances, assessment of debt levels and repayment capabilities, and identification of potential financial risks. Additionally, the report highlights any material findings and discrepancies discovered during the audit. It may include recommendations for improvement, addressing areas of concern, and ensuring adherence to best practices. These findings can encompass issues related to internal controls, financial misstatements, unusual transactions, or noncompliance with accounting standards. Different types or variations of the Franklin Ohio Report of Independent Accountants after Audit of Financial Statements may exist depending on the specific financial aspects being audited. For instance, variations could include focused reports solely examining areas such as pension funds, grants, or funds related to specific projects. In conclusion, the Franklin Ohio Report of Independent Accountants after Audit of Financial Statements is a vital document that provides a comprehensive analysis of the financial performance, transparency, and compliance of the city of Franklin, Ohio. It serves as a valuable tool for city officials, stakeholders, and residents to assess the fiscal health and accountability of the municipality.Franklin Ohio Report of Independent Accountants after Audit of Financial Statements The Franklin Ohio Report of Independent Accountants after Audit of Financial Statements is a crucial document that provides an in-depth analysis and evaluation of the financial records and statements of the city of Franklin, Ohio. This report is prepared annually and serves as a critical tool for assessing the city's financial health, transparency, and compliance with accounting standards. The purpose of the report is to provide an objective and independent assessment of the financial statements, including the balance sheet, income statement, cash flow statement, and notes to the financial statements. It is prepared by a team of highly qualified and professional independent accountants who are licensed and experienced in conducting audits for governmental entities. The report includes a comprehensive review of the city's accounting policies, internal controls, and financial management practices. The independent accountants carefully examine financial transactions, records, and supporting documents to ensure accuracy, completeness, and compliance with relevant laws, regulations, and accounting principles. The key areas covered in the report generally include an analysis of revenue and expenditure trends, examination of significant assets and liabilities, evaluation of cash management practices, review of budgetary controls and variances, assessment of debt levels and repayment capabilities, and identification of potential financial risks. Additionally, the report highlights any material findings and discrepancies discovered during the audit. It may include recommendations for improvement, addressing areas of concern, and ensuring adherence to best practices. These findings can encompass issues related to internal controls, financial misstatements, unusual transactions, or noncompliance with accounting standards. Different types or variations of the Franklin Ohio Report of Independent Accountants after Audit of Financial Statements may exist depending on the specific financial aspects being audited. For instance, variations could include focused reports solely examining areas such as pension funds, grants, or funds related to specific projects. In conclusion, the Franklin Ohio Report of Independent Accountants after Audit of Financial Statements is a vital document that provides a comprehensive analysis of the financial performance, transparency, and compliance of the city of Franklin, Ohio. It serves as a valuable tool for city officials, stakeholders, and residents to assess the fiscal health and accountability of the municipality.

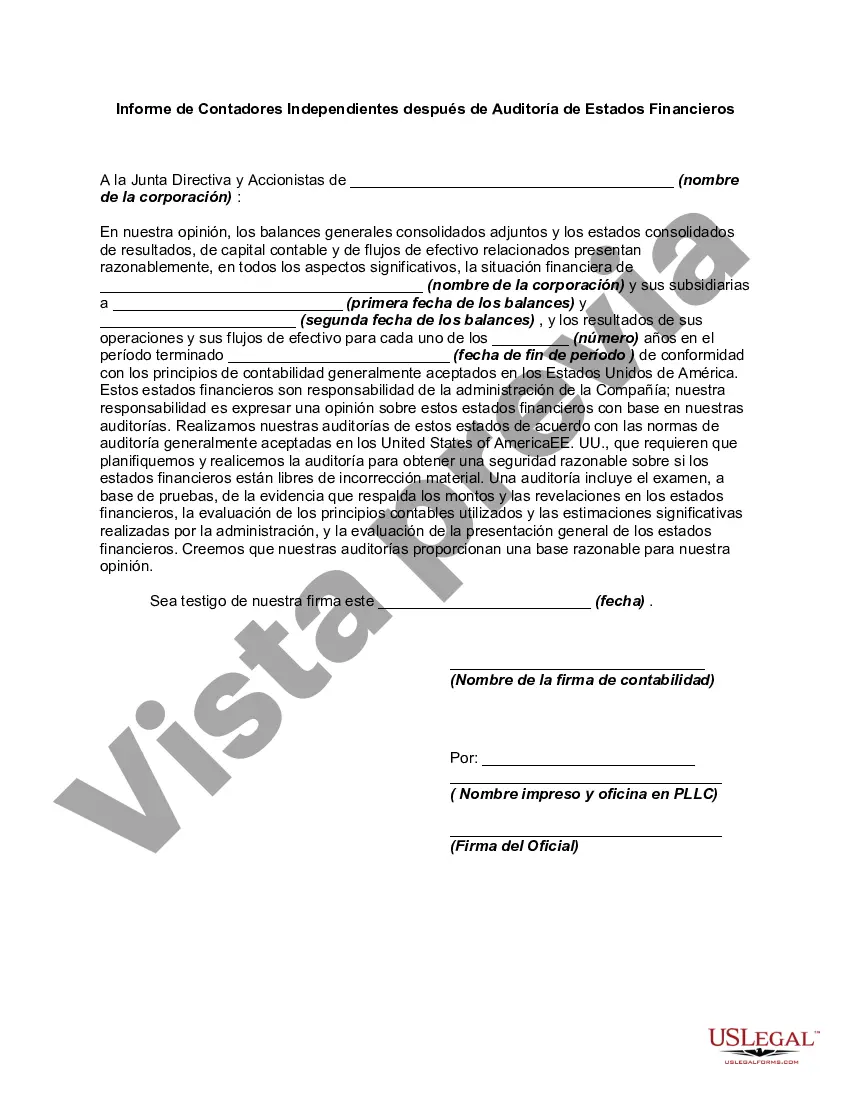

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.